The selling operations in the last sessions are normal after the upward journey, in which the pair moved, amid expectations that US interest rates will be raised sooner than previously expected. The pair may maintain its gains as investors await the US government's monthly jobs report due on Friday. The improvement in the results of the figures for the details of the report includes the change in the number of non-farm jobs, the unemployment rate and the average hourly wage. They will increase the strength of the US dollar against the rest of the other major currencies.

A survey showed that growth in China's manufacturing activity slowed in June as export demand weakened and producers struggled with supply bottlenecks. According to the results, the monthly PMI issued by the National Statistics Agency and an industry group fell to 50.9 from 51.0 in May on a 100-point scale where numbers above the 50 level show an increase in activity.

Procedures for new export orders, production and producer prices fell.

Commenting on the numbers, Julian Evans-Pritchard and Sheena Yu of Capital Economics said in a report: "The latest surveys indicate that growth has slowed this month." Supply shortages continued to dampen production in the manufacturing sector. Factory production and consumer spending in China have rebounded to levels above pre-epidemic levels, but export demand is uneven as governments battle the novel coronavirus outbreak. Accordingly, economist Zhang Liqun said in a statement issued by the China Federation of Logistics and Purchasing, along with the PMI reading, that companies "still expect to be cautious."

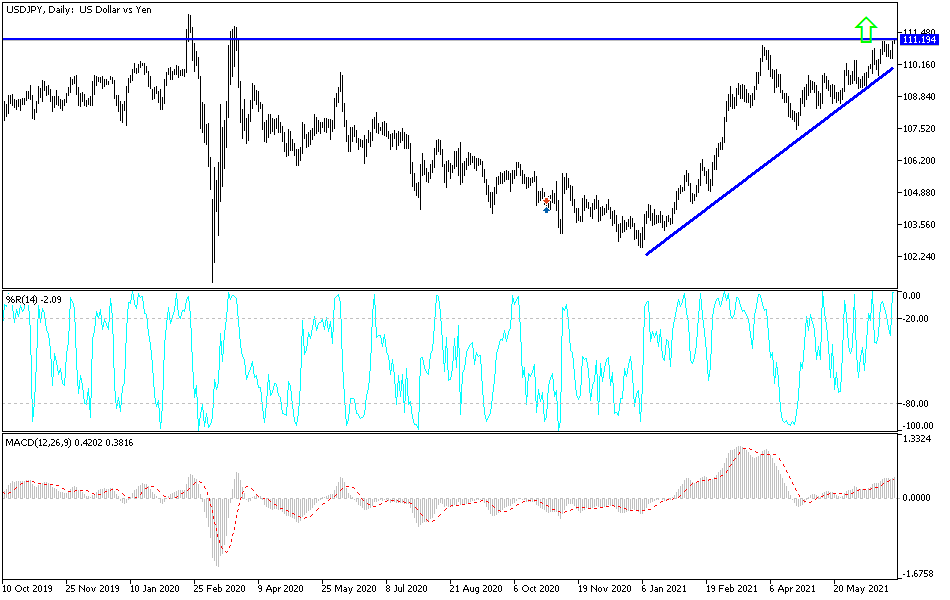

According to the technical analysis of the pair: The stability of the USD/JPY currency pair is above the 110.00 psychological resistance. The general trend of the pair will remain bullish, and the current movement is normal. The US dollar is still supported by the expectation of raising the US interest rate and improves the results of the economic data that confirm this. In addition, the Japanese yen was exposed to some pressures from the economic situation in the country due to the epidemic and fears of a sporting event that might increase the suffering. It must be considered that the pair's move above the resistance 111.20 pushes the technical indicators to oversold levels. This means that the US jobs report tomorrow may give the pair the opportunity for profit-taking selling operations. The closest targets for the bulls are currently 111.40, 112.00 and 112.65, respectively. There will be no opportunity for the bears to control the performance without breaching the support 109.75, otherwise the general trend will remain bullish.

The US dollar will be affected today by the announcement of the number of weekly jobless claims and the ISM manufacturing PMI reading.