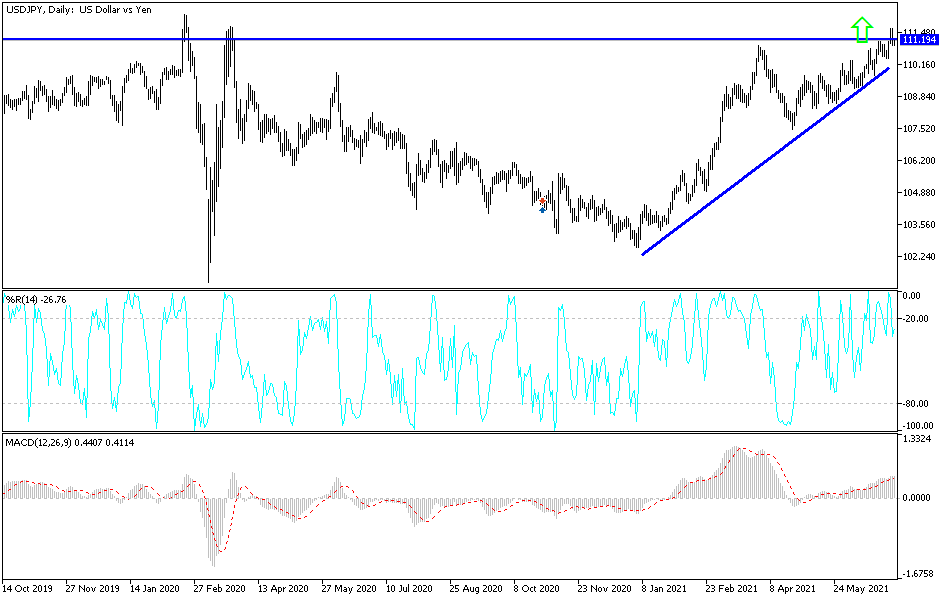

After consecutive bullish jumps for the USD/JPY currency pair, it pushed it towards the resistance level 111.66, its highest since March 2020. I mentioned a lot that the pair is ready to sell profits as soon as possible if it gains some momentum. Expectations of a US interest rate hike subsided slightly after the US jobs numbers were announced. This allowed profit-taking selling to reach the 110.95 level, before the pair settled around the resistance 111.10 at the time of writing the analysis. The rapid rebound is due to the maintenance of pressure on the Japanese yen against the rest of the other major currencies.

Tokyo reported 518 new cases of the coronavirus on Sunday, the 15th consecutive day that infections have increased from the levels of the previous week. New cases on Saturday, reached 716, the highest in more than five weeks. For his part, former Prime Minister Shinzo Abe, who lobbied for access to the Olympics, has criticized those who oppose the games, calling them "anti-Japanese". "The success of the Olympics carries historical meaning for Japan," Abe was quoted by the Mainichi newspaper as saying. Abe blamed calls to cancel the Olympics on people "who have been criticized for espousing anti-Japanese views".

Japanese media have reported several possible scenarios, including: no fans at all; No fans at the opening ceremony on July 23; restrictions on fans at night events; Reduced limit in all places to 5000.

In contrast, US President Joe Biden said he is concerned about the needless loss of life due to COVID-19 as unvaccinated people contract and transmit the coronavirus during the July 4 holiday. Speaking to reporters Friday, Biden emphasized that for most Americans who are vaccinated, the weekend is worth celebrating. "This year is different from the Fourth of July last year, and it will be better next year," he said.

Biden said he was concerned about those who had yet to get a single dose. "I am concerned that people who have not been vaccinated have the ability to pick up the variant and spread the variant to other people who have not been vaccinated," he stated. “I'm worried. Lives will be lost.”

The WHO chief said the world is going through a "very dangerous period" of the COVID-19 pandemic, noting that the most contagious delta variant has been identified in nearly 100 countries. In a press briefing on Friday, Tedros Adhanom Ghebreyesus said that the Corona Delta variant, which was first found in India, continues to evolve and mutate, and has become the predominant COVID-19 virus in many countries. “I have already urged leaders around the world to ensure that by this time next year, 70% of all people in every country will be vaccinated,” he stated, adding that this would effectively end the acute phase of the pandemic.

According to the technical analysis of the pair: The general trend of the USD/JPY currency pair is still bullish as long as it is stable above the psychological resistance 110.00. It should be taken into consideration that the pair crossed the resistance 111.20, which will move the technical indicators to strong overbought levels. We may see limited moves for the currency pair today amid the US holiday and investors' aversion to risk after the impact of the latest US jobs numbers have passed. The most appropriate selling levels for the pair are currently 111.55 and 112.20, respectively.

On the daily time frame, there will be a break of the current general bullish trend in case the pair moves towards the support level 109.75, otherwise the trend will remain bullish.