The recent strong gains of the US dollar stem with full force from expectations that the US central bank will tighten monetary policy and that it may be the first among the major global central banks to raise historically low interest rates, which the COVID-19 epidemic was the main reason for their collapse.

“The bears on the dollar, surfing a wave of easy Fed policy, are running out,” says Kit Juckes, Societe Generale Currency Analyst. If the United States can escape the clutches of the zero rate limit, it will earn itself a much stronger dollar.” That conclusion took place in the middle of the year of research and strategy review of the currency markets and comes at an important turning point for the US dollar, which is entering the second half of the year after being the best performing currency in the G10.

Dollar strength was ignited by the June Federal Policy Review in which FOMC members provided the timing when they expected the first interest rate to appear. The move boosted US and dollar yields and led the Société Générale to say the dollar could be lower now. Accordingly, analyst Jukes says: “The FOMC meeting in June shifted the market focus from the Fed tapering off asset purchases, to when it would start raising interest rates. Short-term yields rose and the dollar rose with them.”

While Juckes and his team have a more constructive view of the US dollar, some patience may be required as a more concerted push for a stronger dollar will take some time to materialize. Accordingly, the analyst stated, “But in the new timing of the Fed, it will still be two years before the rate hike is triggered and there will be a lot of twists in the tale before then. We are more confident that the Fed has boosted the volatility of the forex market.” "But the bears on the dollar, surfing a wave of easy Fed policy, are running out of time," he adds.

If US data remains strong, inflation isn't declining quickly, and other markets don't react so violently that the Fed gives pause for thought, it's hard to see why the Fed shouldn't go ahead with tapering, as debate continues over when to start Interest rate hike cycle.

“If that happens, it is likely that the dollar has already broken through the lows during this cycle,” he adds.

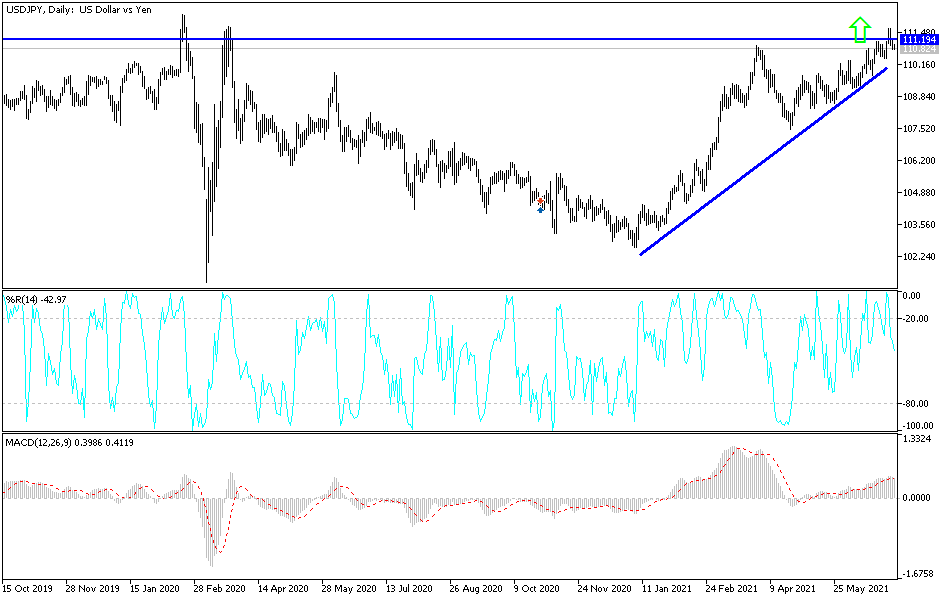

According to the technical analysis of the pair: Despite the recent performance, the bears will not have strength without moving the USD/JPY currency pair below the 109.75 support level so far, the opportunity to rise is still valid. The currency pair will be affected by the results of the upcoming US economic data to confirm the proximity When or not to raise US interest rates. Currently the closest targets for the bulls are 111.20 and 112.00, respectively. The last level pushes the technical indicators to strong overbought levels. The currency pair will be affected today by the announcement of the ISM PMI for the services sector and the extent to which investors take risks or not.