This contributed to the bullish rebound of the USD/JPY currency pair to the resistance level of 110.60 and to settle around the level of 110.52 at the beginning of this important week's trading amid an upward trend.

The Asian situation in the spread of the Corona virus irritates investors in appetite for risk. In addition to Japan, China recorded 32 new confirmed cases of the Corona virus. Of these, 27 are believed to have been obtained from abroad. No deaths were reported. The National Health Commission said six cases believed to have come from abroad were on China's southwestern border with Myanmar. In general, the death toll in China reached 4,636 out of a total of 9,229 confirmed cases.

The top US infectious disease expert said USA is in an "unnecessary predicament" of rising COVID-19 cases due to unvaccinated Americans and the virulent delta variant. "We're going in the wrong direction," Dr. Anthony Fauci added, describing himself as "very frustrated."

Nearly 163 million people, or 49% of the eligible U.S. population, have been vaccinated, according to CDC data.

The preliminary Markit manufacturing PMI for July exceeded expectations at 62 with a reading of 63.1 while the services PMI missed expectations at 64.8 with a reading of 59.8. In the same week, initial jobless claims came in the US on July 16th, below expectations at 350K, with 419K claims, and continuing claims came in higher than expected, reaching 3.236 million versus expectations of 3.1 million. June building permits also missed expectations while new homes outperformed.

From Japan, imports for June exceeded the expected change (YoY) by 29% with a record of 32.7%. Exports in the same period also outperformed expectations by 46.2% with a rate of 48.6% year-on-year. However, the merchandise trade balance for this period has missed expectations. Prior to that, it was announced that the previous Japanese National CPI for Food and Energy for June exceeded the expected change (annualized) by -0.5% with -0.2% while the previous CPI for Fresh Food matched expectations at 0.2%. On the other hand, the general CPI beat expectations by -0.1% with 0.2% YoY.

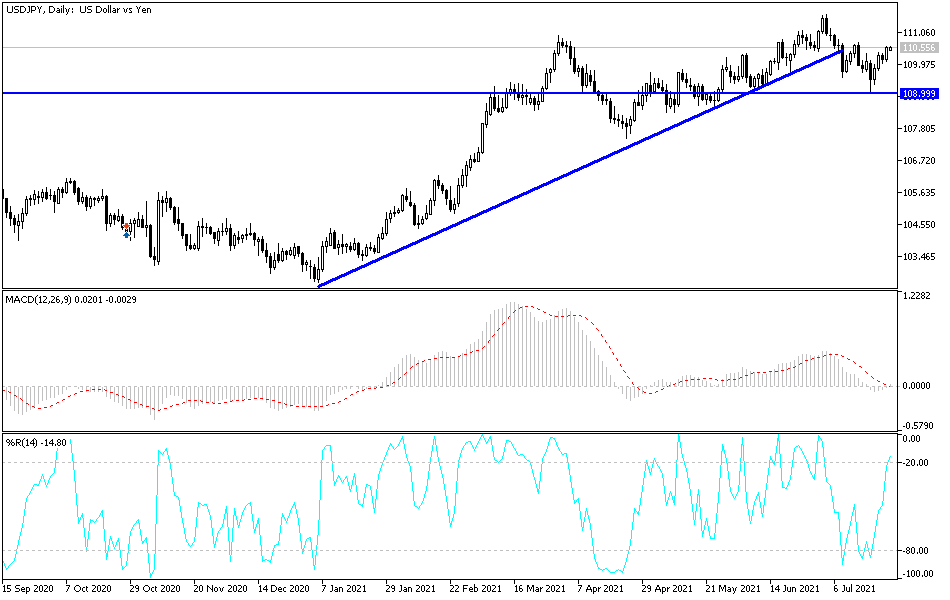

According to the technical analysis of the USD/JPY: In the near term and according to the performance of the hourly chart, it appears that the USD/JPY currency pair is trading within the formation of a descending channel. This shows a slight short-term momentum in the market sentiment. Accordingly, the bulls will look to extend the latest rebound towards 110.40 or higher to 110.82. On the other hand, the bears will target short-term profits at 109.83 or lower at 109.42.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp bullish channel. This indicates a strong long-term bullish momentum in the market sentiment. Accordingly, the bulls will look to ride the current rally towards the resistance 111.60 or higher to the resistance 113.53. On the other hand, the bears will target long-term profits at around the 108.49 support or lower at the 106.48 support.

As for the economic calendar data today: From Japan, the reading of the Manufacturing PMI and the Consumer Price Index will be announced from the Bank of Japan.