EUR/USD

The euro fell throughout last week, breaking down below the previous week’s lows before bouncing a bit too close right around the 1.18 level. Nonetheless, this is a market that looks as if it is slightly lower, and I think we are eventually going to go looking towards 1.16 underneath. That does not necessarily mean that we will get there right away, but the general attitude of the euro is lower, although this is probably more about the greenback than anything else. It is worth noting that the 200-week EMA is down at the 1.16 level which is my longer-term target. I suspect that we may get a little bit of a bounce to kick off the week, but that will be sold into.

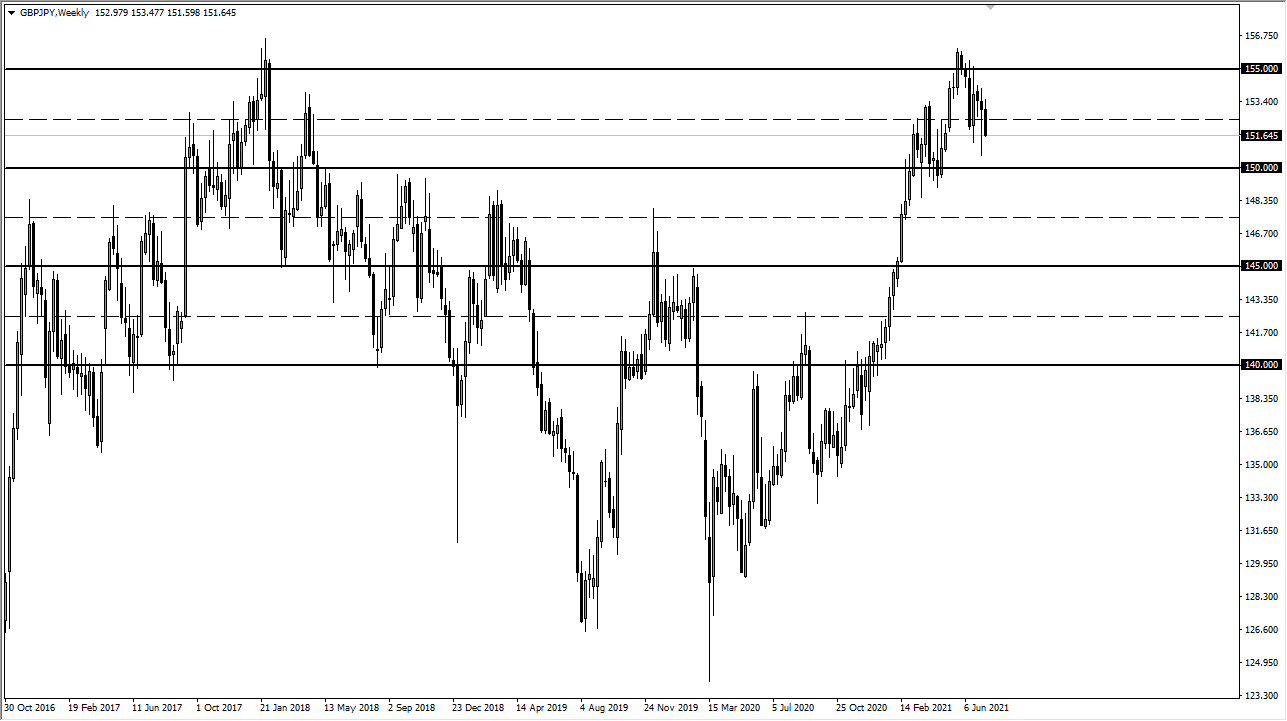

GBP/JPY

The British pound fell rather hard against the Japanese yen during the week, closing towards the bottom of the overall range. At this point, it certainly looks as if the market is going to continue struggling, and I think that it is probably only a matter of time before we go reaching towards the ¥150 level. This is a very ugly candlestick, and I think it is only a matter of time before the sellers take over on any short-term rally.

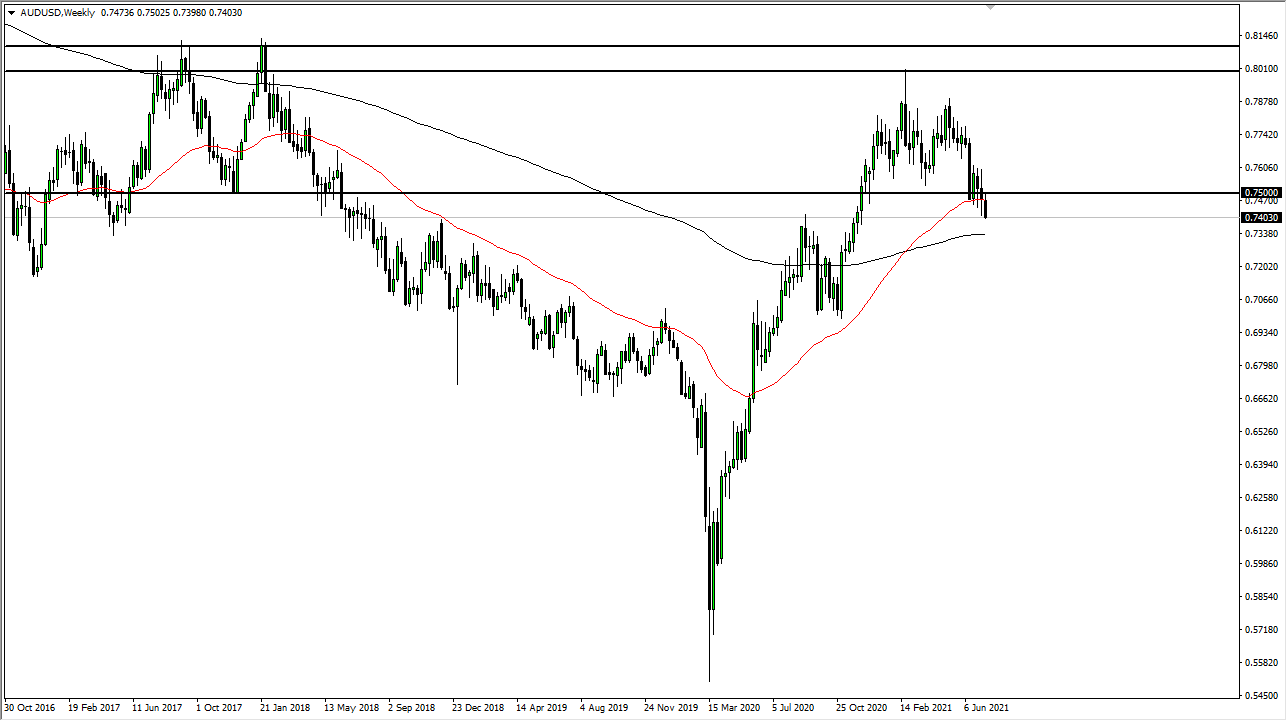

AUD/USD

The Australian dollar initially tried to rally during the week but found the 0.75 level above the be far too resistive to continue going higher. Now that we have rolled back over, it is worth noting that we are closing at the very bottom of the range and that of course is a very negative sign. I believe that as we break through the 0.74 handle, the downward pressure will continue to accelerate, thereby sending the market towards the 0.70 level over the longer term. This week though, I believe that rallies will continue to be sold into unless we get some type of significant breakdown.

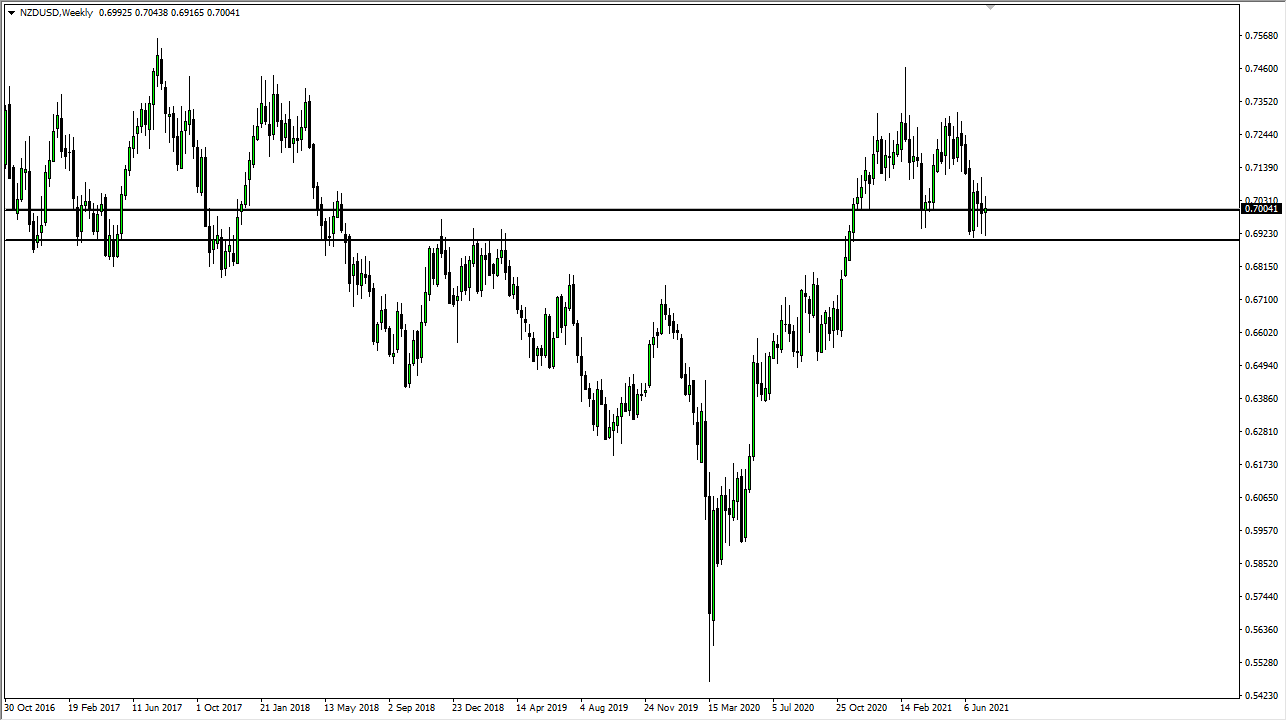

NZD/USD

The New Zealand dollar was all over the place during last week as we continue to hear a lot of questions as to whether or not the global economy is going to grow. We also have to pay attention to the fact that New Zealand has cut back on some buying of bonds. Nonetheless, the “fear trade” looks as if it is ready to take off, so if we break down below the 0.69 level, I feel that the New Zealand dollar probably will drop rather hard. If you need to see anything along the lines of confirmation, simply look at its cousin, the Australian dollar.