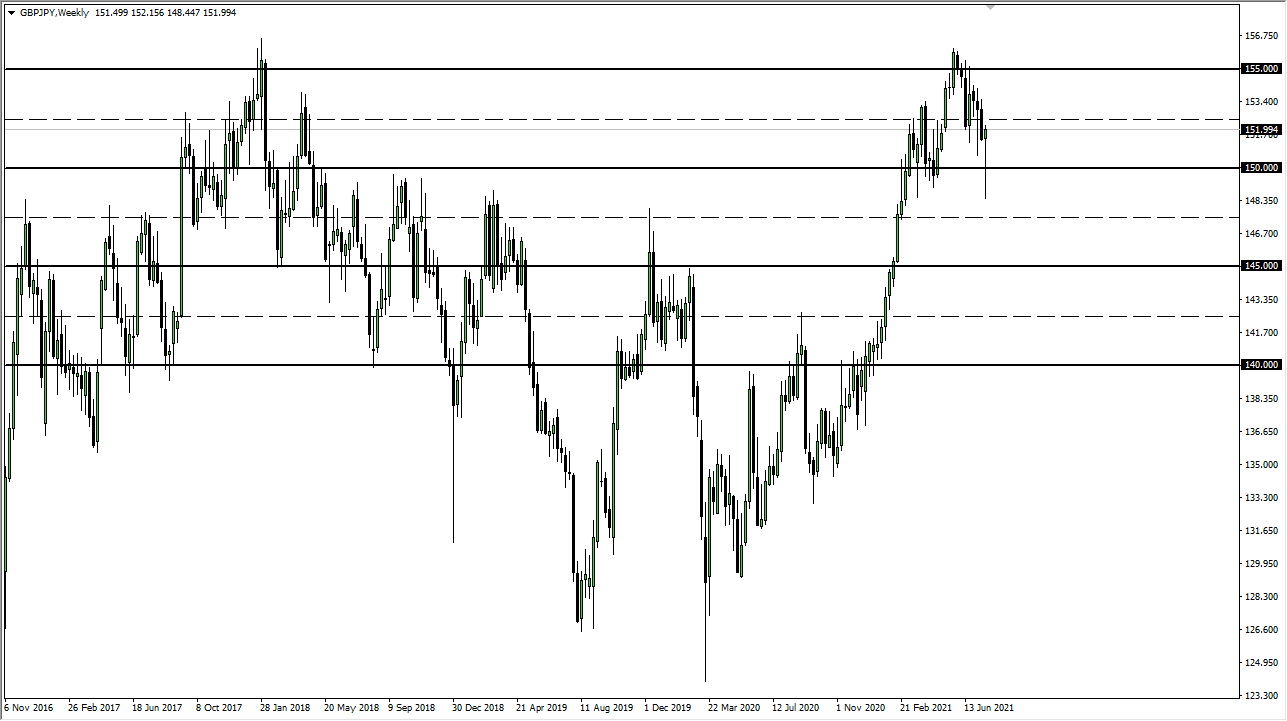

GBP/JPY

The British pound had a major turnaround during the course of last week, initially plunging much lower than anticipated, only to turn around and show massive amounts of strength. At this point, it looks as if this is going to continue to be a “buy on the dips” type of situation. The ¥150 level looks to be a “line in the sand”, so as long as we stay above there, I think that buyers will probably continue to try to push this market higher. If we break above the ¥152.50 level, that is also a very bullish sign.

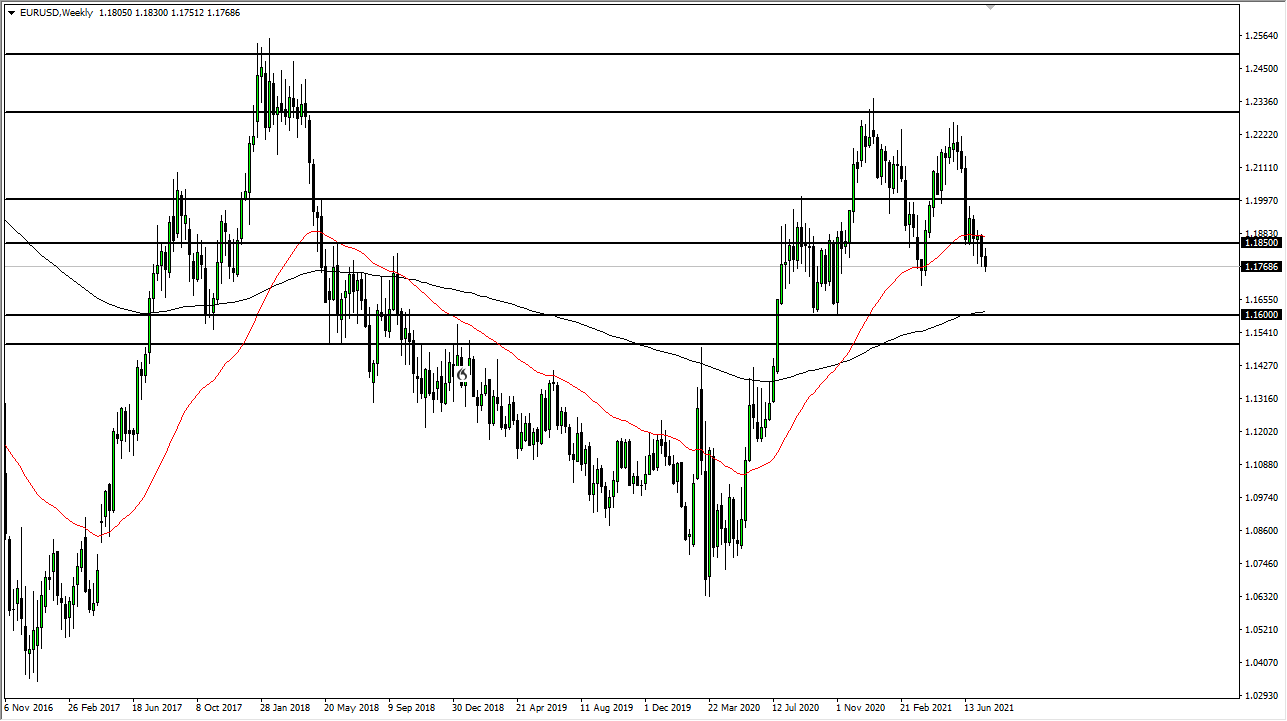

EUR/USD

The euro initially tried to rally during the week but then gave back the gains as we continue to slide lower. At this point, the market has the 1.17 level underneath as support, but if we get that out, we are very likely we go looking towards 1.16 level underneath there. The 200-week EMA is currently sitting at the 1.16 level, which could offer a lot of support. If we turn around nda break above the 1.1850 level, then it is likely that the market would go much higher. At this point, the market is very likely to be very noisy, but I think rallies will probably be faded during this week.

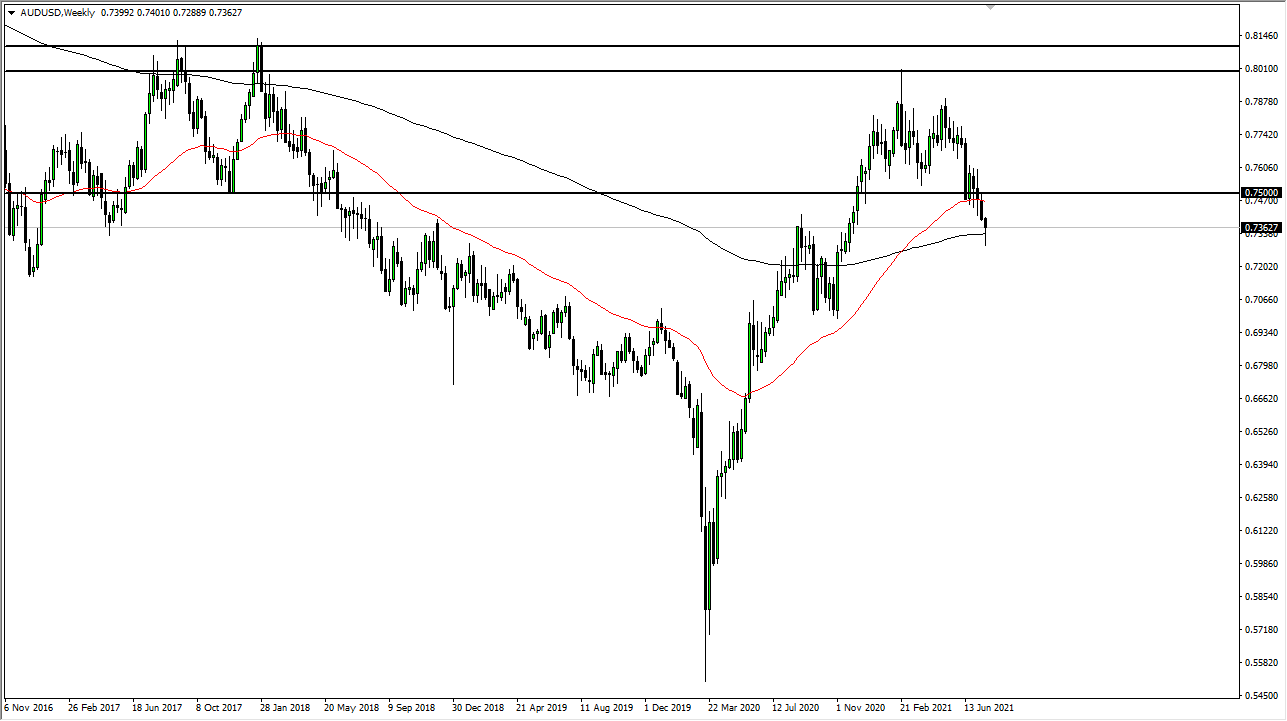

AUD/USD

The Australian dollar fell fairly significantly during the week, slicing below the 200-week EMA. Ultimately, this is a market that is going to continue to be very sensitive to risk, but you should keep in mind that the Australian dollar might be a bit of a laggard in comparison to other currencies due to the fact that Australia continues to lock itself down. As long as the authorities in Australia are willing to kill their own economy, there is no point in trying to fight what it is they are trying to do. If we were to break above the 0.75 handle, that would be impressive.

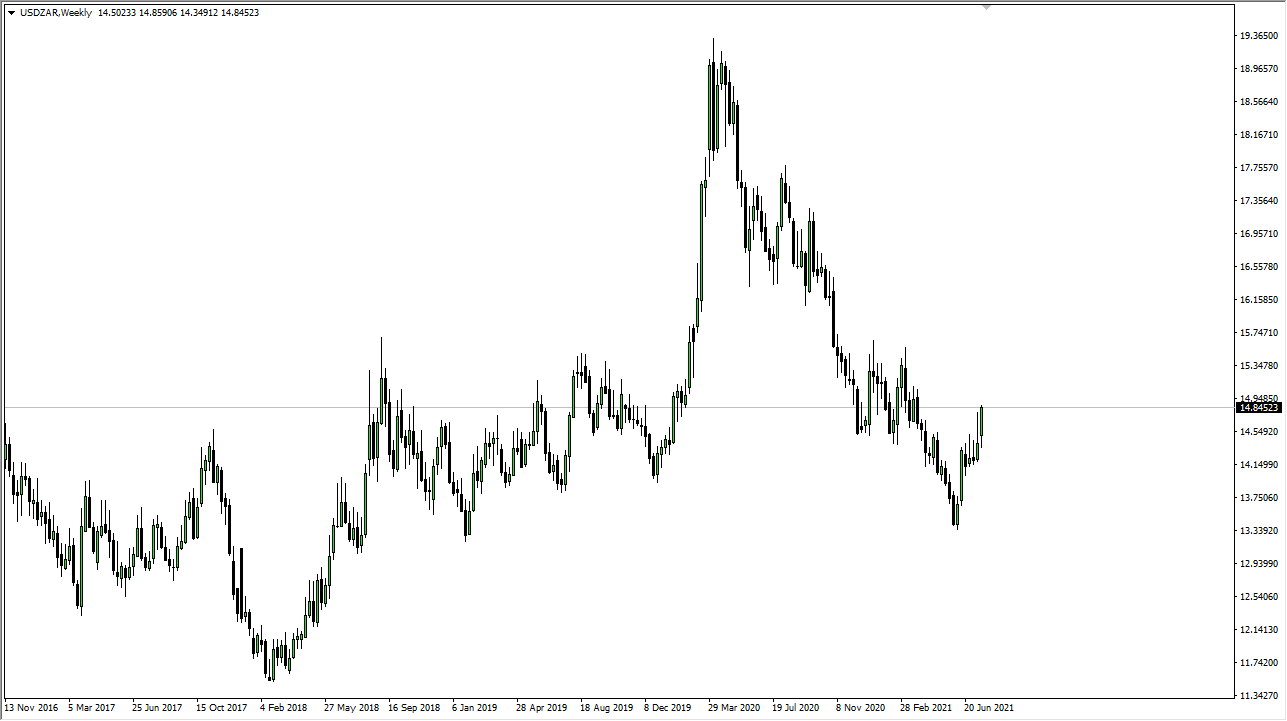

USD/ZAR

The US dollar gapped higher to kick off the week, pulled back, and then turned around to rally again. This makes sense considering that we continue to see a lot of problems in South Africa, and the US dollar has been strengthening in general. The South African rand is going to be a bit of an outlier because it will be moving based upon political unrest. At this point, I have no interest in trying to short this pair until that gets resolved.