GBP/USD

The British pound fell during a large portion of the week, but as you can see, we have bounced from the 1.37 handle. That being said, the candlestick for the week was a hammer, but preceded by an inverted hammer, suggesting that the market is still trying to figure out what to do going forward. If we break down below the 1.37 handle, then it is likely that we could go looking towards the 1.35 handle. On the other hand, if we can take out the 1.40 level, then it is likely that we could go looking towards 1.42 handle. From a longer-term standpoint, the 1.42 level is a very crucial as resistance, so it is going to be very interesting to see how this plays out.

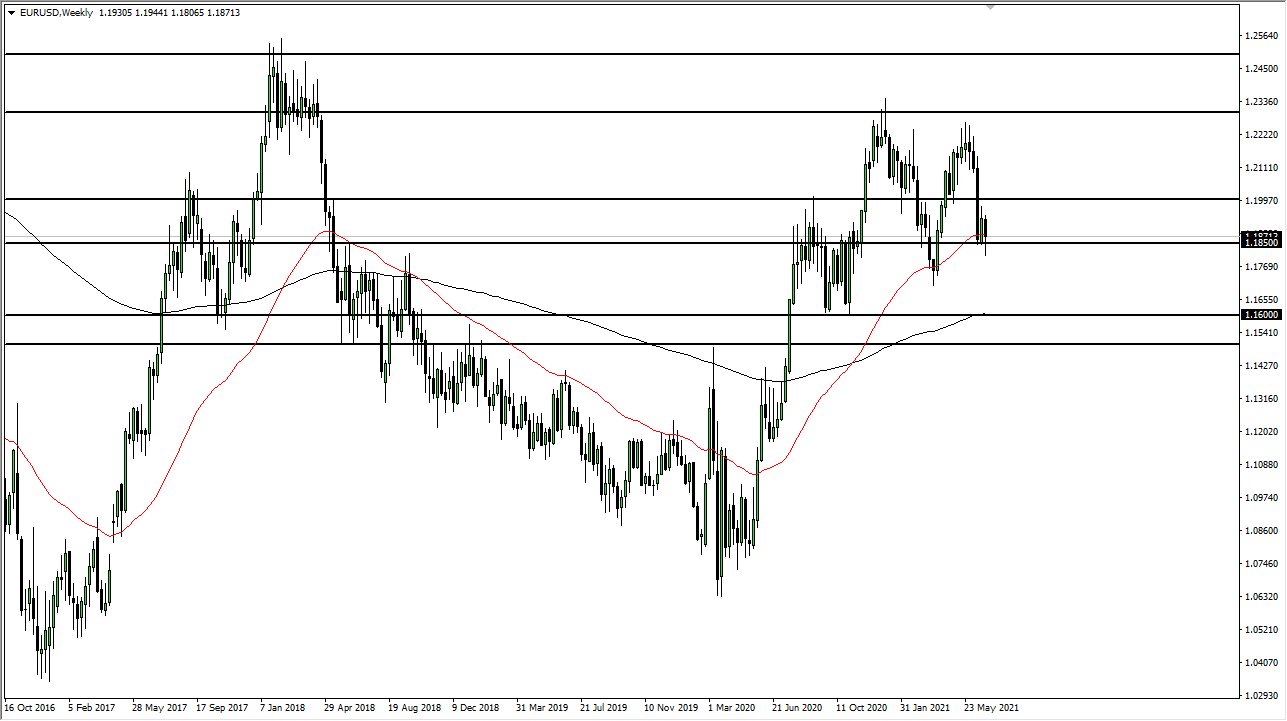

EUR/USD

The euro has broken down during the course of the week to pierce the 1.1850 level, but then turned around to form a bit of a hammer. That being said, there is a lot of noise in general and downward pressure as of late, so I think we are going to end up going back and forth, which suggests that the market is going to be very choppy to say the least. If we break down below the weekly candlestick, then it is likely that we will go looking towards the 1.17 handle, just as breaking to the upside could be an attempt to get to the 1.20 handle.

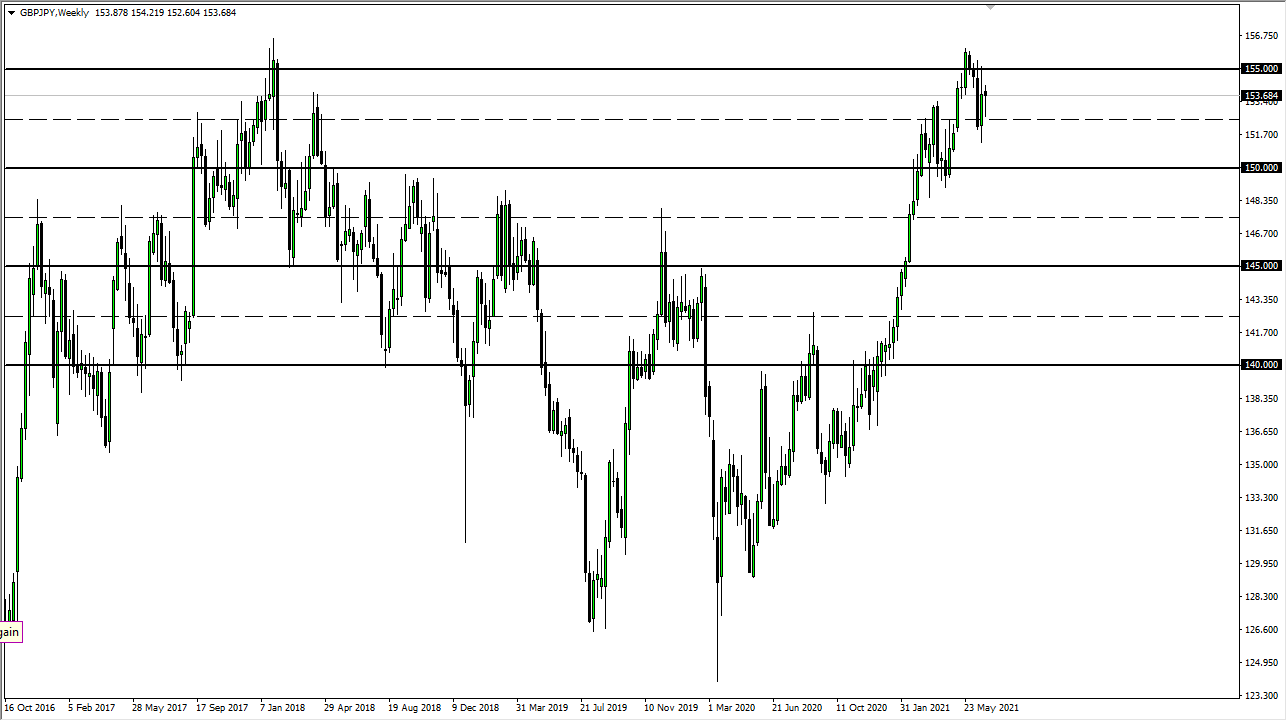

GBP/JPY

The British pound initially pulled back during the week to reach down towards the ¥152.50 level. However, we have turned around to show signs of strength and form a bit of a hammer. At this point, the market is likely to see a lot of noisy behavior and resistance at the ¥155 level. It is because of this that I think the market is going to continue to be very noisy and tight, perhaps bouncing around between the low of the week and of ¥155 level, which has been important more than once.

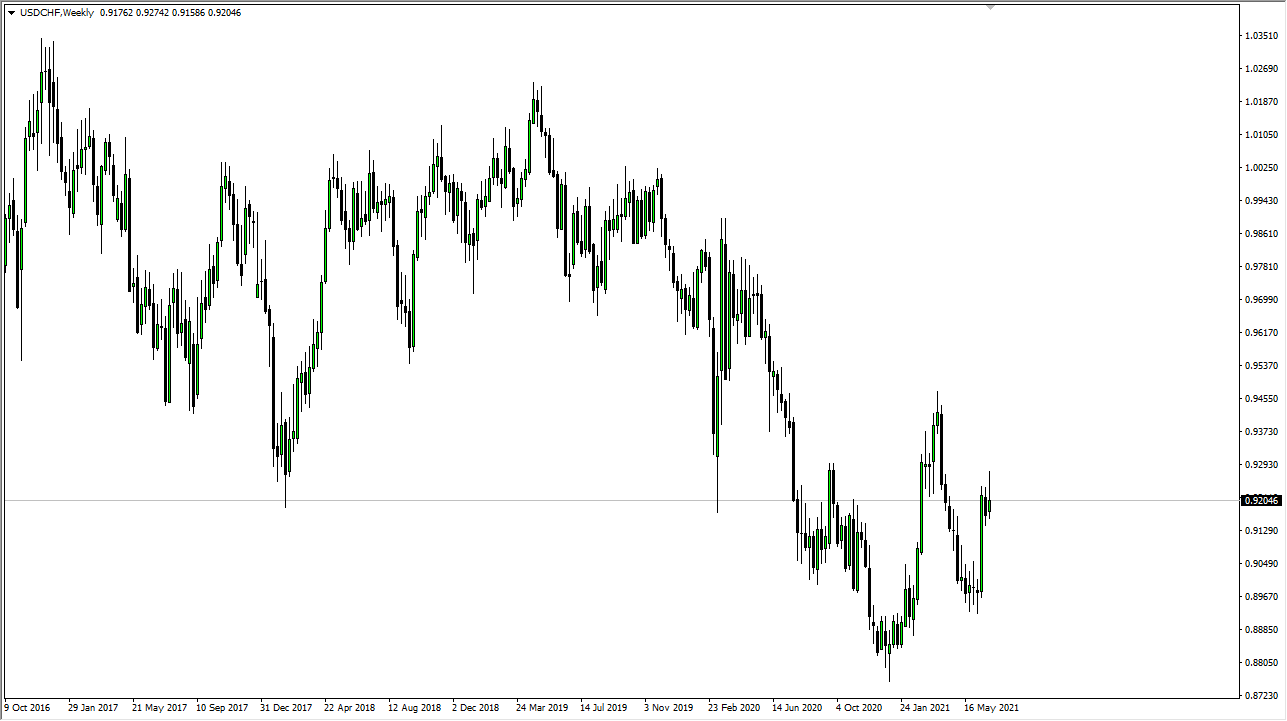

USD/CHF

The US dollar rallied a bit during the week to break towards the 0.93 handle, only to turn around and form a bit of a shooting star. The shooting star is a very negative candlestick, but we still have a massive bullish candlestick from a couple of weeks ago that has influence on this market. I think we are going to see a lot of noisy trading and volatility, as well as choppy trading.