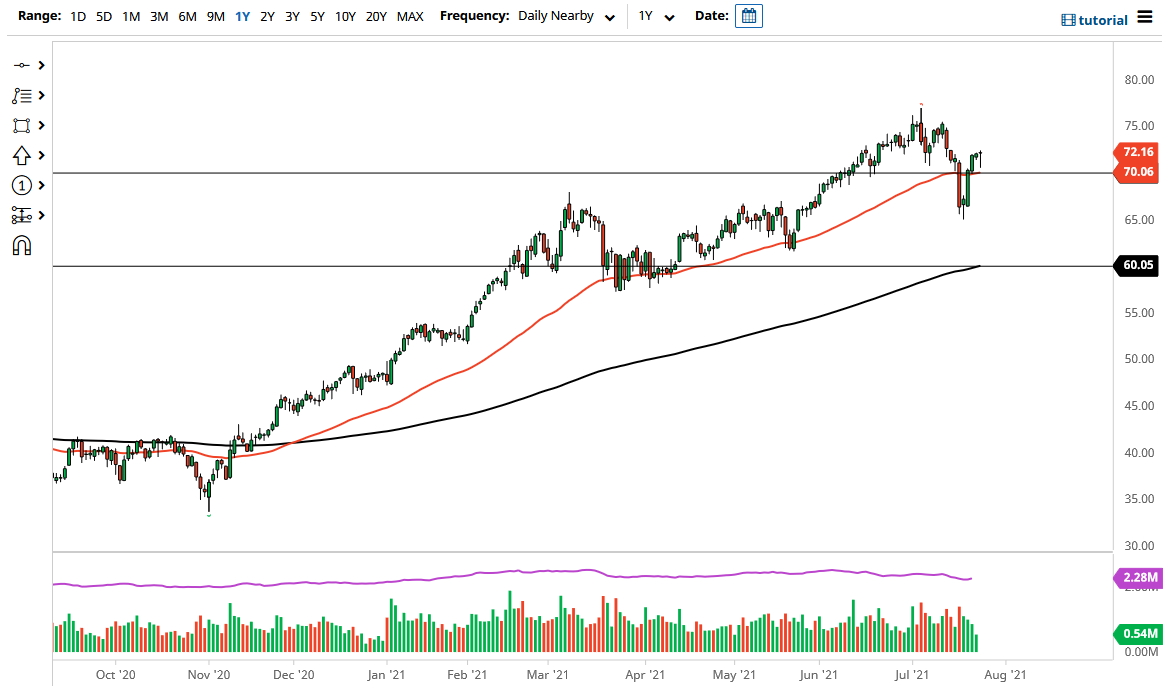

The West Texas Intermediate Crude Oil market fell a bit during the trading session on Monday, reaching towards the $70 level. The $70 level is a large, round, psychologically significant figure that a lot of traders will pay close attention to, and it is worth acknowledging the fact that we bounced from a potential breakdown point. The 50-day EMA also sits there, so it makes sense that we would see a certain amount of support and attention there. With that being the case, I think we are looking at a scenario in which value hunters will continue to come into this market and take advantage of cheaper oil.

If we were to turn around and break down below the $70 level, then it could have the market looking towards the $65 level underneath which is where we bounced from. I think it is going to be very noisy, but the fact that we could not continue to go lower suggests that the buyers are almost certainly going to come back into the market and take advantage of any opportunity to pick up oil. If we can reach towards the $75 level, then I would see a significant amount of resistance, but if we can break above there, then it allows crude oil to go looking towards the $80 level.

I do think that we will continue to see a lot of noisy trading, as people are trying to figure out what is going on with the potential reopening trade. Inflation is also another issue that people will have to pay attention to, as it could drive down the value of the greenback. If the greenback starts to lose strength, that also means that there will be less of those greenbacks needed in order to pick up a barrel of oil. Ultimately, I think this is a market that will eventually try to figure out where it wants to go longer term, and as things stand right now, you have to be bullish in general until the narrative changes. That does not mean that it will be easy, but clearly this is a market that wants to go much higher over the longer term.