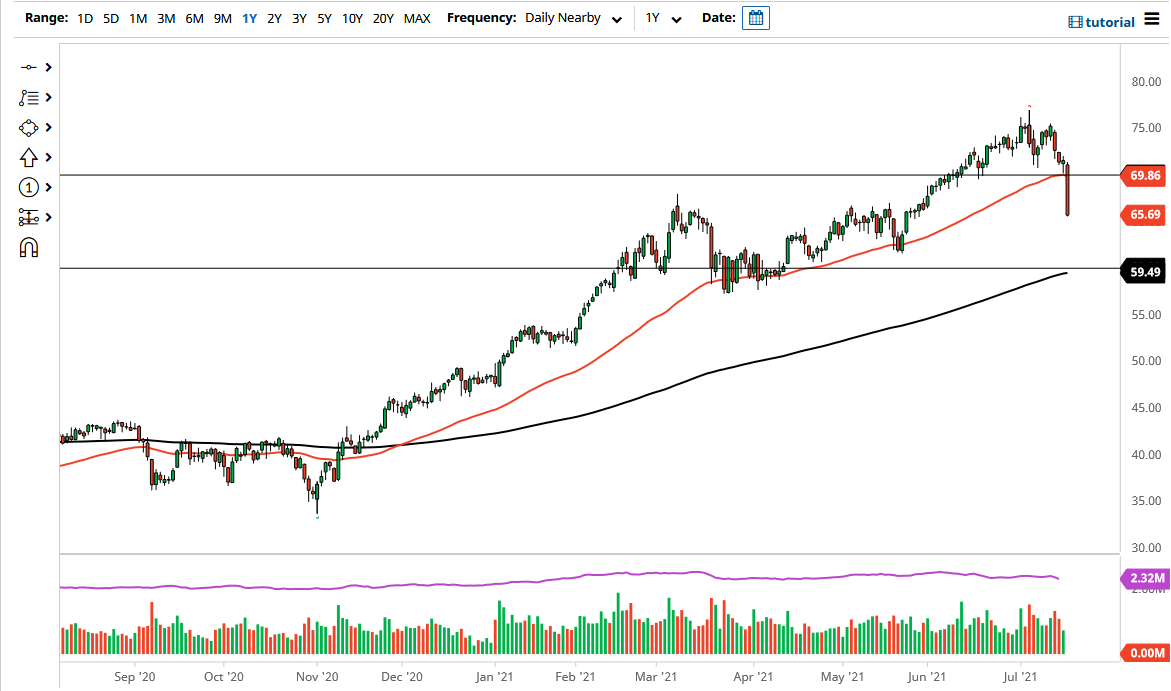

The West Texas Intermediate Crude Oil market broke down significantly during the trading session on Monday as OPEC+ came to an agreement to increase crude oil production. The 400,000 additional barrels per day will increase by the same amount at the beginning of each month, and as a result, the oil market completely collapsed almost immediately during the trading session. The market broke below the $70 level rather quickly, right along with the 50-day EMA.

Towards the end of the day, the market was threatening the $65 level, losing 8% for the session, one of the worst losses the market has seen in the last couple of years. The $65 level underneath would offer a little bit of support, but I think this is a market that will continue to drift lower, and a break below the bottom of the candlestick for the trading session almost certainly will get more selling going. There was a point recently where bullish options in the crude oil markets outnumbered bearish ones 20 to 1, so the market was completely on the wrong side. Whether or not the supply becomes a major issue over the longer term is a completely different argument, but nonetheless, we obviously have had a huge shot across the bow during the trading session.

As far as buying is concerned, at the very least we need to see some type of stability over the course of a couple of days in order to get long. It is very unlikely that we will suddenly turn around and rally significantly, so I think we need to take a breath and wait for a buying opportunity. We clearly cannot be buyers at this point because that would simply be gambling. What am hoping to see is a couple of hammers or simply quiet trading before rallying, but I also would recognize that a move above the $70 level rather rapidly would also show an extreme amount of bullish pressure. Ultimately, this is a market that I think will be very noisy, but I believe that the market probably has further downside more than anything else at this juncture. If the US dollar continues to rally significantly like it has during the trading session, that will also weigh upon the idea of crude oil rallying. Finally, we also have to worry about the possibility of further lockdowns driving down demand.