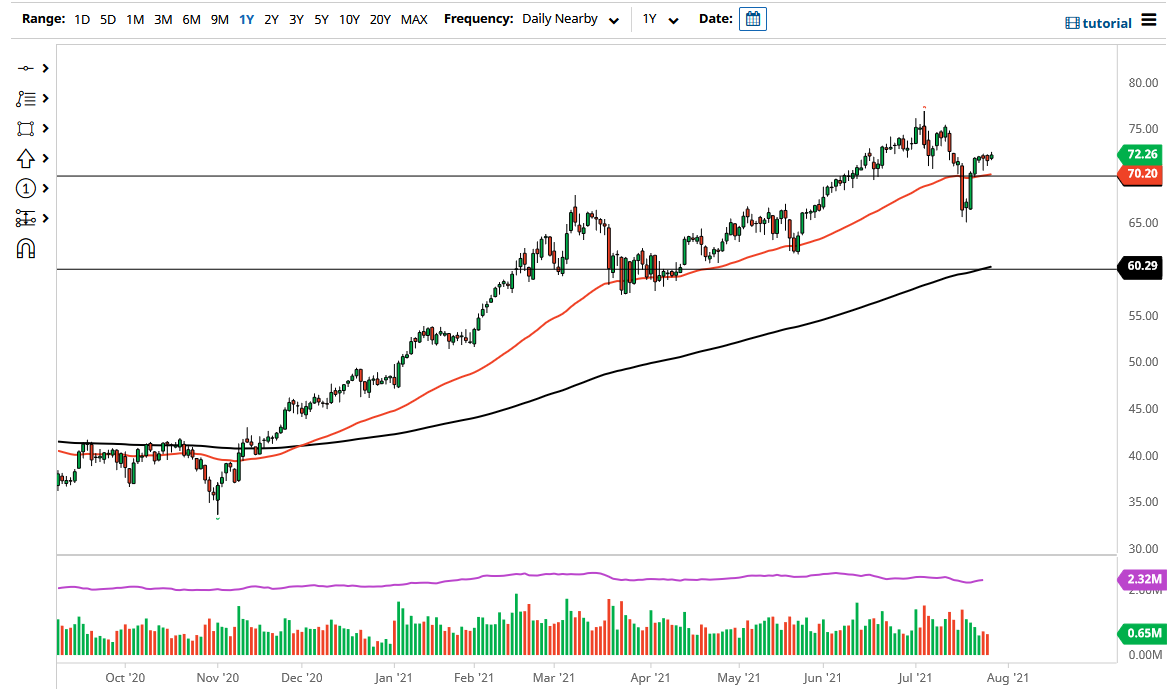

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Wednesday as we continue to hear a lot of noise in general. The $72.50 level just above offers a little bit of resistance, but I do think it is only a matter of time before we could go looking towards the $75 level. To the downside, the $70 level should be a significant amount of support as well, especially as the 50-day EMA is sitting right there as well and it makes sense that we could see plenty of buyers.

If we were to break down below the $70 level, it is likely that the market could go looking towards the $65 level. The $65 level is where we had bounced from previously, and at this point we are trying to determine whether or not that was a short-term bounce that will be sold into, or if it is the beginning of the overall move to the upside. It should be noted that the US dollar has a bit of an influence on this market as well, as the crude oil markets are based in those very same greenbacks.

When you look at this chart, you can see that there is a lot of resistance just above near the $75 level, so we should be paying close attention to that level, because if we can break above there it would be a very good sign to say the least. Ultimately, this is a market that I think will find one reason or another to go higher, but as we can see, it is taking its time to take off. I think at this point we are worried about the Delta variant slowing down the overall economic growth situation, and if that is going to be the case, then it makes sense that we would see a bit of hesitation for crude oil traders to suggest that there will be more demand. The most recent inventory figures out of the United States have shown a bit of a drop in the amount of crude oil in storage, suggesting that perhaps we will continue to struggle to meet demand.