OPEC+ is currently in the third day of negotiations for the production numbers, as the UAE does not wish to extend cuts as much as some of the other members. This has put oil markets “on hold” for the time being, but it should also be noted that Monday was part of the extended Independence Day holiday in the United States, thereby taking some of the volume off the market anyway.

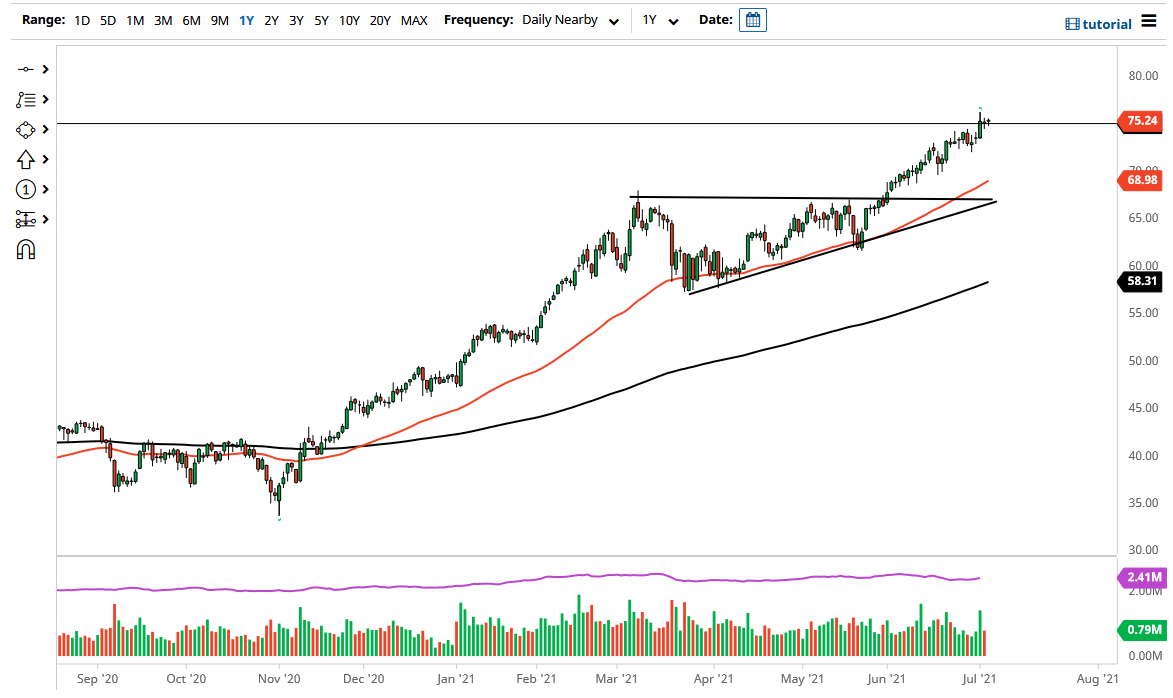

The $75 level offers a significant amount of psychological importance, so I think it makes sense that we are simply sitting here. If we can break above the Thursday candlestick though, that would open up the possibility of the WTI market reaching towards the $77.50 level, which is the measured move from the ascending triangle underneath that we had broken out of a few weeks back. That all ties together quite nicely, and there is quite a bit of significant psychology involved in that as well.

It looks as if the market will continue to find plenty of buyers on dips, though, and if we do reach down towards the $70 level, there should be a nice confluence with the 50-day EMA as well. In other words, I do not have any interest in shorting the crude oil market right now, and I think that it is only a matter of time before we would continue to go higher. As long as we continue to see the reopening trade come into play, crude oil will continue to be attractive. After all, as we continue to see economies reopen, there will be much more demand and therefore higher prices.

The currency markets will have their say, and if the US dollar strengthens rather significantly that could put a little bit of weight upon the market, but I do not necessarily think it will keep it from rising, unless there is some type of major spike in the greenback. As things stand right now, I think that you have plenty of support at $72.50, $70, and then possibly even the 50-day EMA. With this being the case, I am a buyer of dips and have no interest whatsoever in trying to short this market anytime soon.