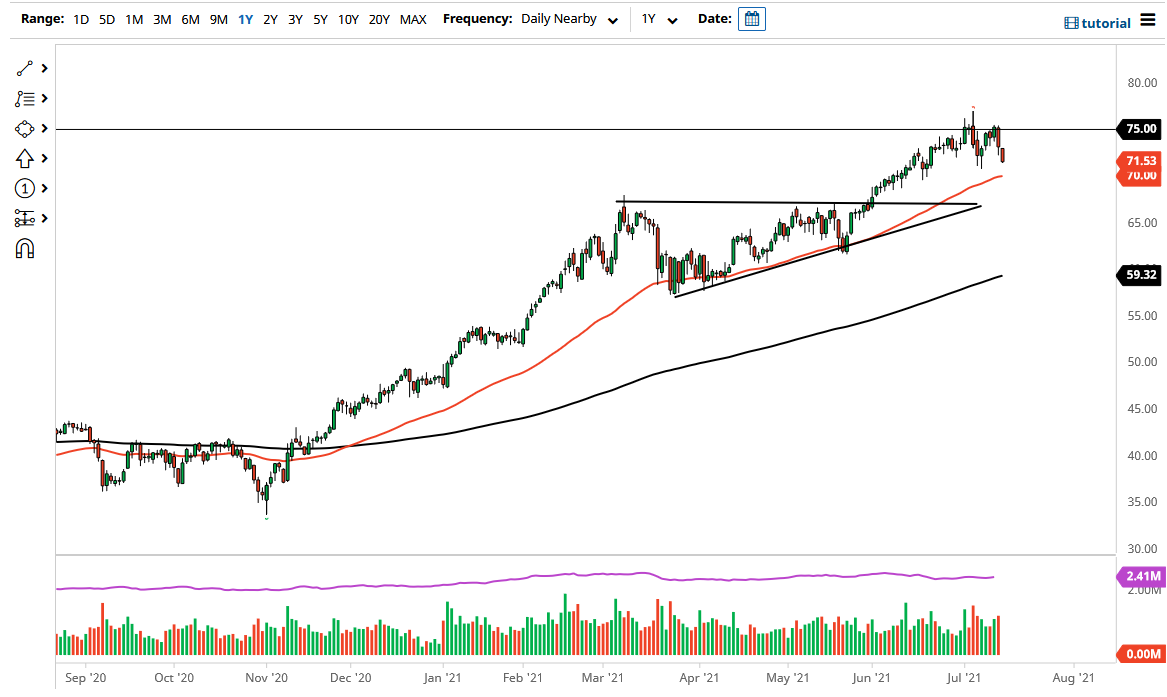

That should suggest that we should have further downward pressure, especially as OPEC+ cannot seem to get it together as far as some type of agreement. The market is still very much in an uptrend so I would not start shorting quite yet.

The 50 day EMA currently sits at roughly $70, so that will more than likely offer a hard floor in the market, at least for the short term. With that being the case, the market is likely to see a lot of buying pressure in that area, and therefore if we see some type of bounce on Friday it might be a signal that we can start to go long again. However, if the OPEC+ members cannot get it all together as far as some type of progression on a deal is concerned, that will almost certainly be negative for crude oil initially, but then people will start to talk about whether or not the members would start to flood the market with crude oil, as some of them rely solely on crude oil sales to bring money into the country.

A breakdown below the 50 day EMA opens up the possibility of a move down to the $67.50 level, which is the top of an ascending triangle. The ascending triangle should offer a significant floor, and at this point time we were to break down below there, that could be a complete longer-term trend change. To the upside, the $75 level could be a target for the bullish traders, assuming that we get some type of finalization when it comes to any type of agreement. Breaking through the $75 level would of course be a very bullish sign, but in the meantime, I think we are simply better off waiting on the sidelines in order to wait for the market to show its true intentions, and then simply follow along. At this point, it is all being driven by headlines and rumors, so it is very difficult to get overly excited one way or the other.