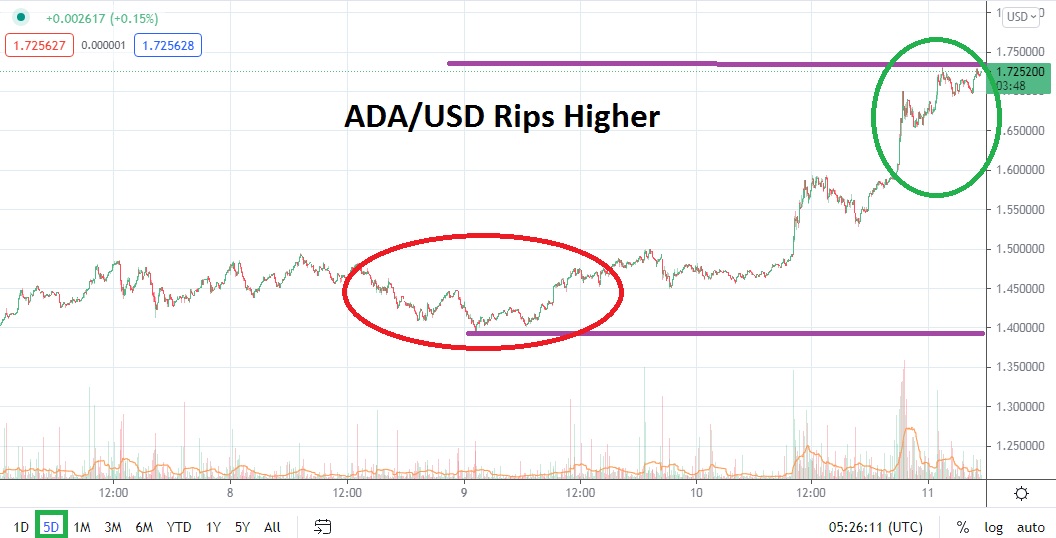

If speculators thought that explosive moves higher within the world of cryptocurrency had disappeared, ADA/USD served as a reminder yesterday that many things are still possible. Cardano was trading in a rather polite and vibrant bullish trend already, and circulating near the 1.450000 level when it started to incrementally rise on Tuesday. Essentially when the 1.500000 mark was broken higher, it appears trading volumes began to climb.

As time went by yesterday and the incremental move upwards continued, ADA/USD then traversed the 1.600000 level which appears to have set off alarm bells among many speculators. Trading volumes increased further and a jump from 1.610000 to 1.680000 happened quickly. As of this morning, ADA/USD has maintained its higher range and is trading near the 1.740000 level.

The current price of Cardano has the cryptocurrency within sight of early June price levels. Yes, three-month charts will have to be looked at in order to properly gauge the next technical resistance junctures that ADA/USD could likely face. On the 5th of June, the cryptocurrency was trading near the 1.777000 mark. On the third of June, ADA/USD was trading near the 1.888000 level. However, before traders trip over themselves running towards their trading terminals to place a wager on Cardano, they should remember this is a frequently volatile and dangerous asset.

For the time being, the upwards momentum cannot be doubted, but this doesn’t mean reversals lower will not happen. On the 19th of July, ADA/USD was trading within sight of the 1.020000 level. The 73% plus percentage gain since then should not be lost in translation. ADA/USD can move in a streaky manner and, technically, the journey higher since the 4th of August has seen Cardano go from a value of 1.320000 to where it stands at this time. Meaning that over half of the gains made in the past four weeks actually happened in the last week of trading.

Speculators who believe they want to buy ADA/USD based on the upwards momentum may be making a logical wager. If early June resistance is toppled near term and the 1.770000 to 1.800000 junctures begin to be flirted with, there is reason to suspect that additional bullish moves could ensue. Traders are advised not to get overly ambitious and at a minimum use escalating stop loss ratios to secure profits if and when reversals lower occur. There is the ever present danger ADA/USD could turn negative in the short term, so traders should make sure there risk management is secure.

Cardano Short-Term Outlook:

Current Resistance: 1.751800

Current Support: 1.699000

High Target: 1.857000

Low Target: 1.611000