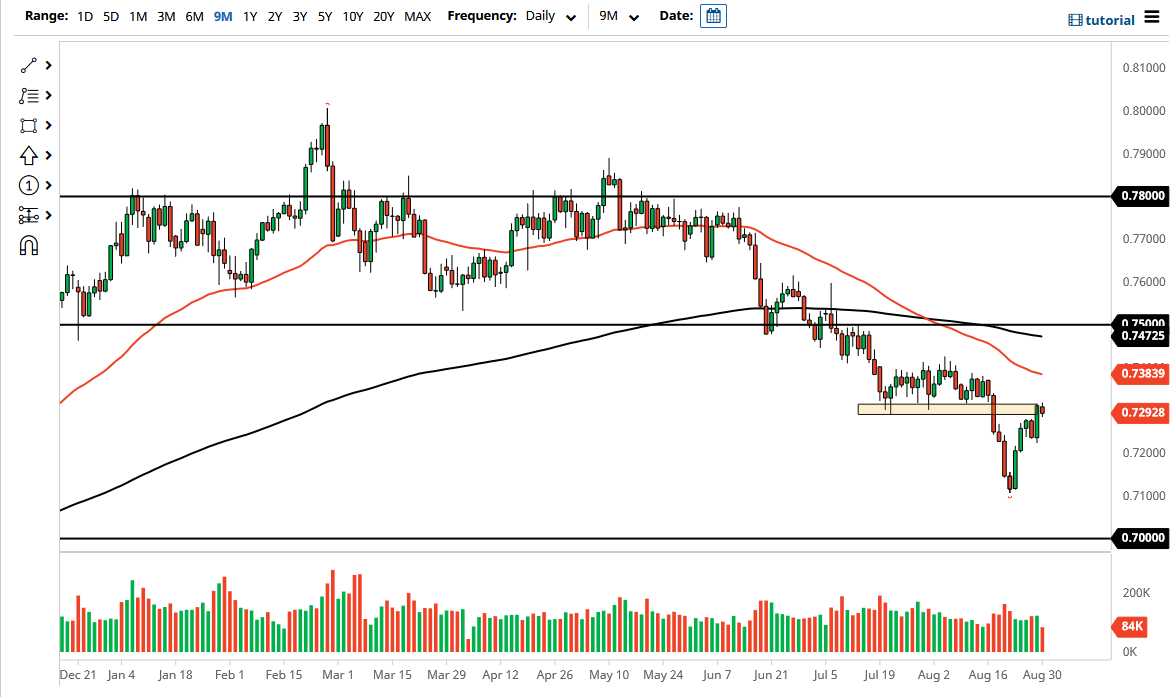

The Australian dollar initially tried to take out the 0.73 level above, but then gave back the gains as this has been an area of significant interest more than once. After all, the 0.73 level has been a massive support level multiple times over the last couple of months, and now looks as if it is going to offer quite a bit of selling pressure. If we break down below the bottom of the candlestick, then we could go looking towards the 0.7250 level, which is the bottom of the candlestick from the trading session on Friday. If we break down below there, then the Aussie will almost certainly break down drastically from here.

On that breakdown, the market would go looking towards the 0.71 handle, and then possibly the 0.70 level underneath, which has been my longer-term target for a while, but I am the first to admit that the last couple of sessions have really thrown everything for a loop. After all, this will have caught a lot of people off guard, but at this point I think that the buying pressure may have subsided. After all, there is a significant amount of resistance not only at the 0.73 level but extends all the way to the 0.74 level. The 50-day EMA sits just above there and is drifting lower, possibly offering quite a bit of pressure as well.

The size of the candlestick is not much to get excited about, but it is where it sat that catches my attention more than anything else. That being said, now we will have to pay attention to the Australian GDP figures which will be released on Tuesday, going into Wednesday morning. The GDP number has a lot to do with what the Reserve Bank of Australia will do, and that obviously has a lot to do with where the Aussie goes. The US dollar could get a bit of a boost if we have some type of “risk off event”, which also works against the Aussie. Pay attention to the commodity markets, because if they start to roll over, then it is likely that this pair will drop as well. Copper markets are paramount, but so are gold markets. Keep an eye on the US Dollar Index to get an idea in general.