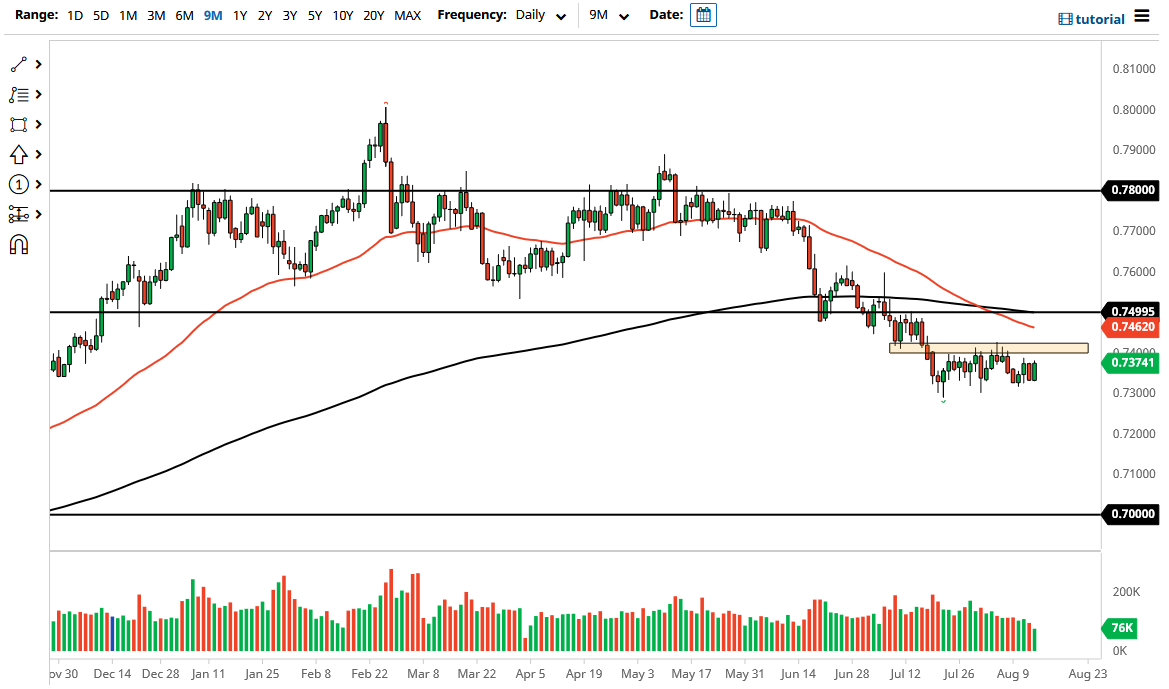

The Australian dollar rallied a bit on Friday as we continue to bounce around between the 0.73 level underneath and the 0.74 level above. Because of this, the market is likely to continue to be very noisy, as we continue to focus on multiple things, not the least of which will be the US 10-year yields, which is a major driver of the US dollar in general, so if the yields start to spike again, that could be very good for the greenback.

However, the Australian dollar also has the biggest problem facing a right now being the Australian government itself. After all, Canberra is now locked down right along with Melbourne and Sydney, which suggests that perhaps we are going to continue to see the Australian economy struggle a bit. Beyond that, we also have the Chinese economy struggling, where Australia sends most of its exports when it comes to the idea of commodities and hard assets. As the global economy slows down, desire for commodities could be an issue. Yes, I understand that the “reopening trade” and inflation are the big narratives right now, but the data are starting to turn and that is something that you will have to pay close attention to.

At this point, if we were to break down below the 0.73 level, it opens up a move lower. At that point it would suggest that we could go towards the 0.70 level, an area that I think we had been contemplating previously. On the other hand, if we break above the 0.74 level, I do not necessarily think that is a buying opportunity quite yet. I would like to see this market break above the 0.75 level, because at least then you are getting above the 200-day EMA. We recently had that “death cross” in that general vicinity, so that is something that you need to pay close attention to as well, as longer-term traders do tend to give it a bit of notice. In general, this is a market that I like fading overall, but I also recognize that we are currently in consolidation more than anything else. With this being the quietest time a year that is not a huge surprise, so please keep that in mind.