Bullish View

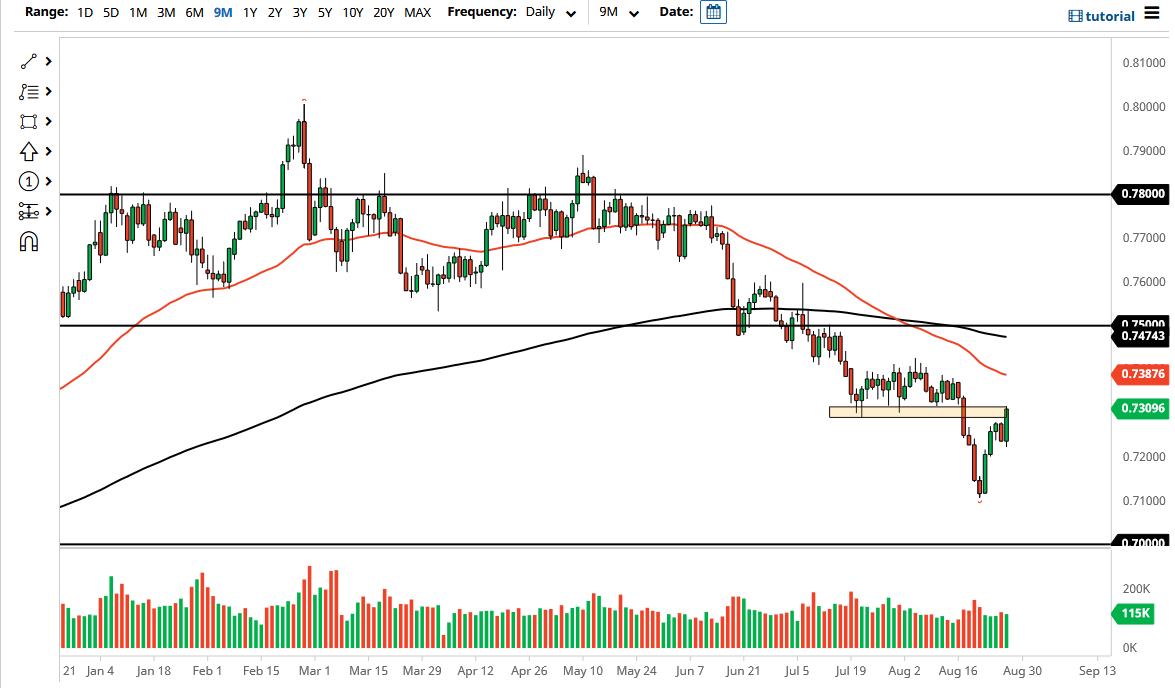

Buy the AUD/USD and add a take-profit at 0.7400.

Add a stop-loss at 0.7200.

Timeline: 1-2 days.

Bearish View

Sell the AUD/USD and a take-profit at 0.7150.

Add a stop-loss at 0.7350.

The AUD/USD price maintained the bullish trend in early trading after the statement by Jerome Powell on US monetary policy. The pair rose to 0.7315, which was higher than last week’s low of 0.7100.

Australia COVID Cases and Dovish Fed

The Australian dollar rose slightly against the US dollar as the market continued to focus on the statement by Powell at the Jackson Hole Symposium.

In the statement, he joined other central bank governors in hinting that the bank will start tapering its purchases later this year. This will happen if the Delta variant of the pandemic fails to have a major negative impact on the economy.

He also hinted that the central bank was not considering hiking interest rates any time soon. This was in line with the previous statements by the Fed that it will start hiking in late 2023.

The statement by Jerome Powell was viewed as being bearish for the US dollar. Indeed, the US Dollar Index (DXY) declined by about 0.30% as he spoke. At the same time, stocks, as measured by key indices like the Dow Jones and S&P 500, continued their bullish trend.

The AUD/USD is rising even as the Australian COVID situation worsened. In the past few days, the number of daily additions has been rising. For example, on Sunday, the country confirmed more than 1,100 new cases, which was substantially higher than the moving average of about 974.

The next key catalysts for the AUD/USD will be the latest pending home sales numbers from the United States. Analysts expect the number to show that the number of pending home sales increased in July. Recently, data showed that the number of housing starts, building permits, new, and existing home sales did well in July.

AUD/USD Analysis

The four-hour chart shows that the AUD/USD rose sharply on Friday as Jerome Powell talked. The pair rose to 0.7315, which was the highest level on 17th August. The pair has formed what looks like an inverted head and shoulders pattern. In price action, this is usually a bullish view.

The pair has also moved above the 25-day and 15-day moving averages while the Relative Strength Index (RSI) has been in an upward trend. Therefore, the pair will likely maintain a bullish trend as bulls target the next key resistance at 0.7400.