Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered prior to 5pm Tokyo time Friday.

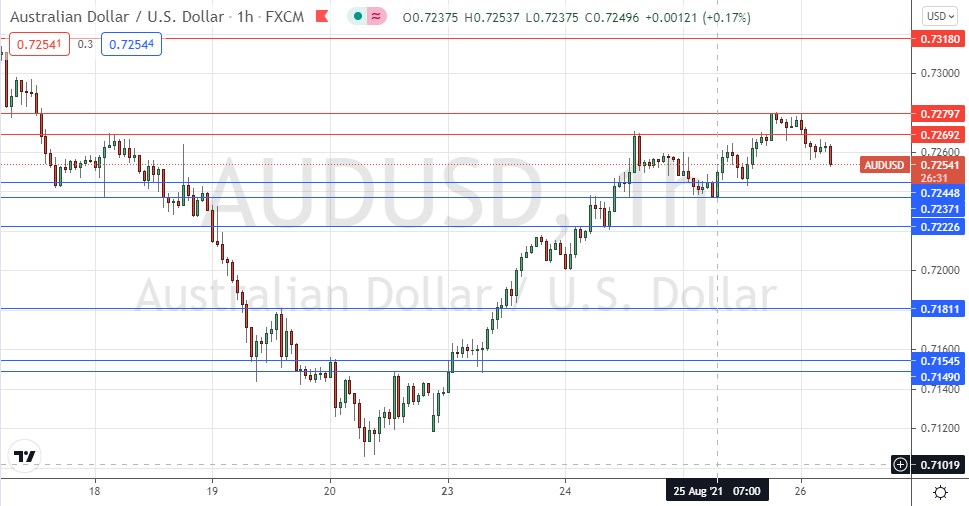

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7269 or 0.7280.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7245, 0.7237, 0.7222, or 0.7181.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that the most likely opportunity here would probably be a potential short trade from a bearish reversal off the 0.7244 / 0.7250 area. However, in the unlikely event that the price will get established above the 0.7269 level, that would be a very bullish sign.

I was wrong about 0.7250, but the resistance at 0.7269 which I highlighted did firmly cap the high of the day.

The technical picture remains relatively bullish as we have seen the price continue to rise, but we are seeing a significant bearish retracement at present and the presentation of resistance levels. It is nothing for medium- to long-term bulls to get too worried about though.

The price direction is hard to predict as there are few clues from the action, and today is the big day of this week in the Forex market, when some news from the Jackson Hole Symposium will probably produce this week’s major market movement. At the time of writing, we do not yet know what that news will be.

The best I can say is that the support level at 0.7244 could be strong, and the resistance at 0.7280 also looks firm, so scalping reversals off these levels and hoping they run into enough profit to turn into a swing trade will probably be the best approach to trading this currency pair today, at least until Jackson Hole produces some momentum or at least bigger swings beyond these levels.

Concerning the USD, there will be a release of preliminary GDP data at 1:30pm London time, while the Jackson Hole Symposium will be taking place all day. There is nothing of high importance scheduled today regarding the AUD.