Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken before 5pm Tokyo time Wednesday.

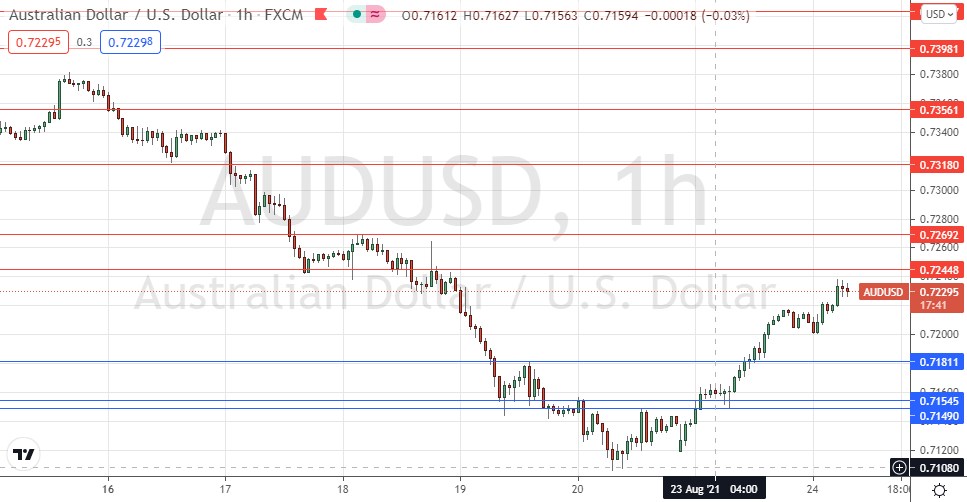

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7245, 0.7269, or 0.7318.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7181, 0.7155, or 0.7149.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

This currency pair has been falling hard over recent weeks to multi-month lows. We have seen a perfect bearish storm here, with the USD stronger than almost every other major global currency and advancing to long-term highs itself, while the AUD has recently been a very weak currency due partly to Australia’s delayed exposure to the coronavirus which has caused economically damaging prolonged lockdowns.

This bearish trend peaked last week but this week is seeing a strong bullish rebound with a wave that looks more impulsive than reactive, so this could be a very early and tentative sign of a trend change. It is notable that while the AUD had been the weakest currency, yesterday it was the strongest. However, it is too early to say whether the bearish trend is over so traders should be very wary of making that call.

The most likely opportunity here will probably be a potential short trade from a bearish reversal off the 0.7244 / 0.7250 area, which could be a strongly resistant area due to the confluence with this psychological quarter-number.

I think it is unlikely that the price will be able to rise by much today, even if it does not fall significantly. However, in the unlikely event that the price will get established above the 0.7269 level, that would be a very bullish sign.

There is nothing of high importance scheduled today concerning either the AUD or the USD.