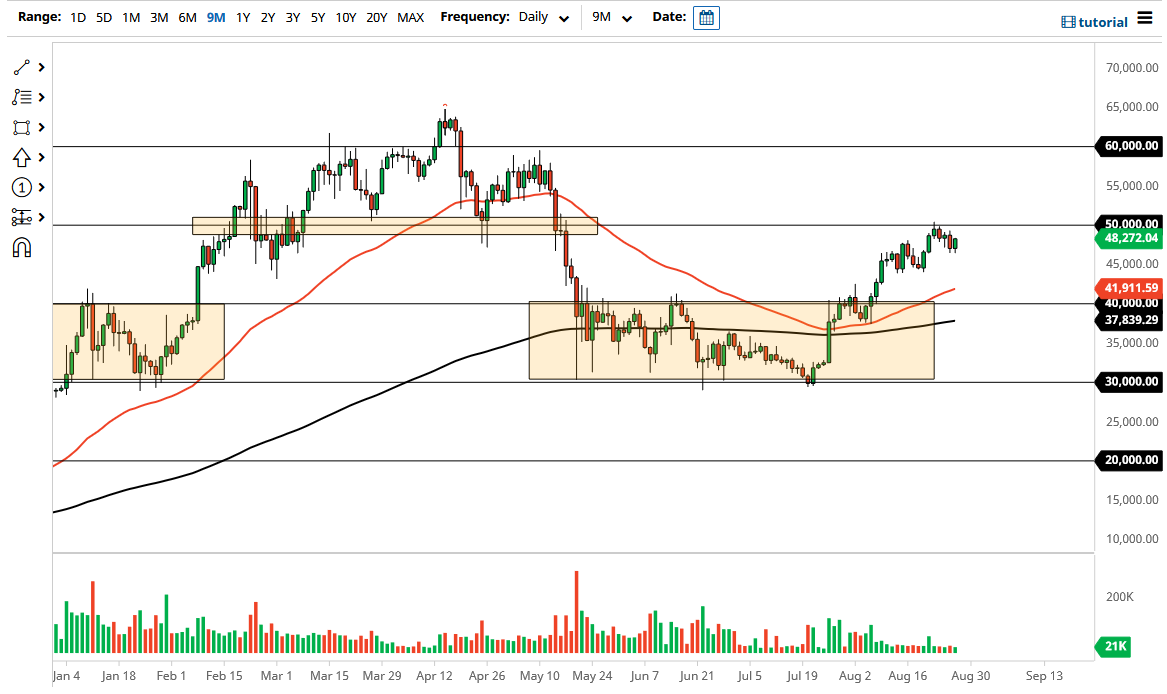

The Bitcoin market rallied a bit on Friday as we continue to build up a little bit of momentum in order to spring through the $50,000 level. That is a large, round, psychologically significant figure, and at this point it is likely that we will continue to fight in this general vicinity. If we were to break above the $50,000 level on a daily close, then I think it will allow for the market to go much higher, perhaps reaching towards the $55,000 level initially, and then the $60,000 level above.

In general, this is a market that I think continues to find plenty of buyers underneath, especially near the $45,000 level. The $45,000 level also has the 50-day EMA approaching it quite rapidly, so I think that could also offer a certain amount of support as well. In general, I think that any time we pull back it is going to be an opportunity to get long, unless we break down below that 50-day EMA, because then we could go down towards the $40,000 level underneath. The $40,000 level is a large, round, psychologically significant figure and the top of the consolidation area that we had been in for quite some time. If we do break down below there, that obviously would change a lot.

For what it is worth, the US dollar got hammered during the trading session on Friday, so that has helped Bitcoin rally a bit. It looks as if we have formed a couple of bullish flags, so there should be plenty of momentum going forward. To add to that, we are certain to see the alt coins do quite well also, meaning that people are willing to jump out on the risk spectrum, so with that being the case it will be interesting to see how this plays out.

When I look at this chart, it is obvious that Bitcoin continues to find buyers on dips, and I do not think that will change anytime soon. We had a large accumulation phase just above the $30,000 level, and that has become the new “floor in the market” overall. I find it almost impossible to imagine we will break down through there anytime soon.