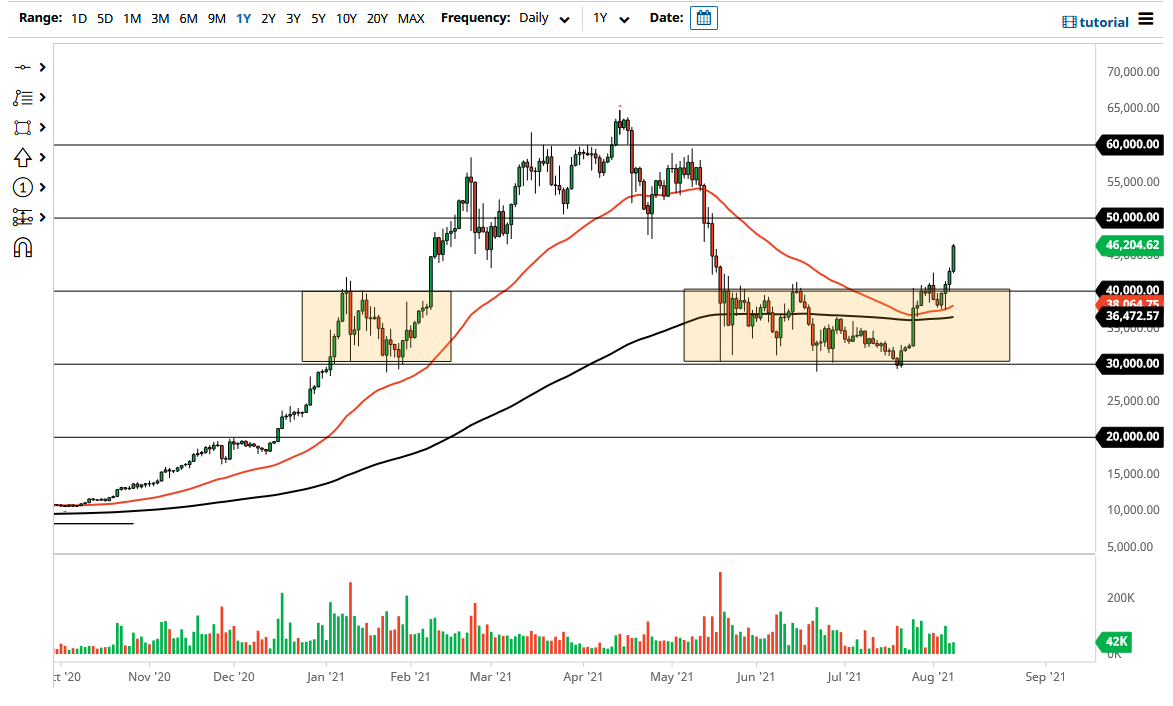

It appears that Bitcoin traders believe that the US Congress will not do anything to stymie the DeFi part of the crypto currency markets, which had been feared over the weekend. As you can see, the market gained quite significantly during the trading session, adding 8% to the value of the digital currency. The market has crossed the 45,000 level, which is an area that a lot of people would pay close attention to, as it has a certain amount of psychological importance attached to it.

That being said, the market is likely to continue to see buyers jumping in and trying to reach towards the $50,000 level, as it is a major support level from the past and a major psychologically important level that will attract a lot of headlines. Nonetheless, I do not necessarily think that we are simply going to slice through that area, and I do think that given enough time we should see a little bit of a pullback into this market. The biggest problem that you have with the Bitcoin market is that it tends to be very erratic as it is mainly driven by retail traders, meaning that it is suspect to massive moves.

To the downside, the $40,000 level should be a significant amount of support, as it is a large, round, psychologically significant figure, and an area where we had seen a bit of a bullish flag print. Therefore, it is likely that we will also pay close attention to the 50-day EMA which is curling higher and getting ready to reach towards the $40,000 level. At this point, I think we will continue to see a lot of volatility and choppiness, but that is nothing new for this market. Bitcoin will continue to pay close attention to inflationary expectations, because inflation has been a driver of Bitcoin to go higher for quite some time, so I think it does make sense that we would see attention paid to the 10-year note. That interest rate is something that a lot of people will be paying close attention to as well, thereby driving whether or not there will be attempts to protect wealth via Bitcoin and many other assets.