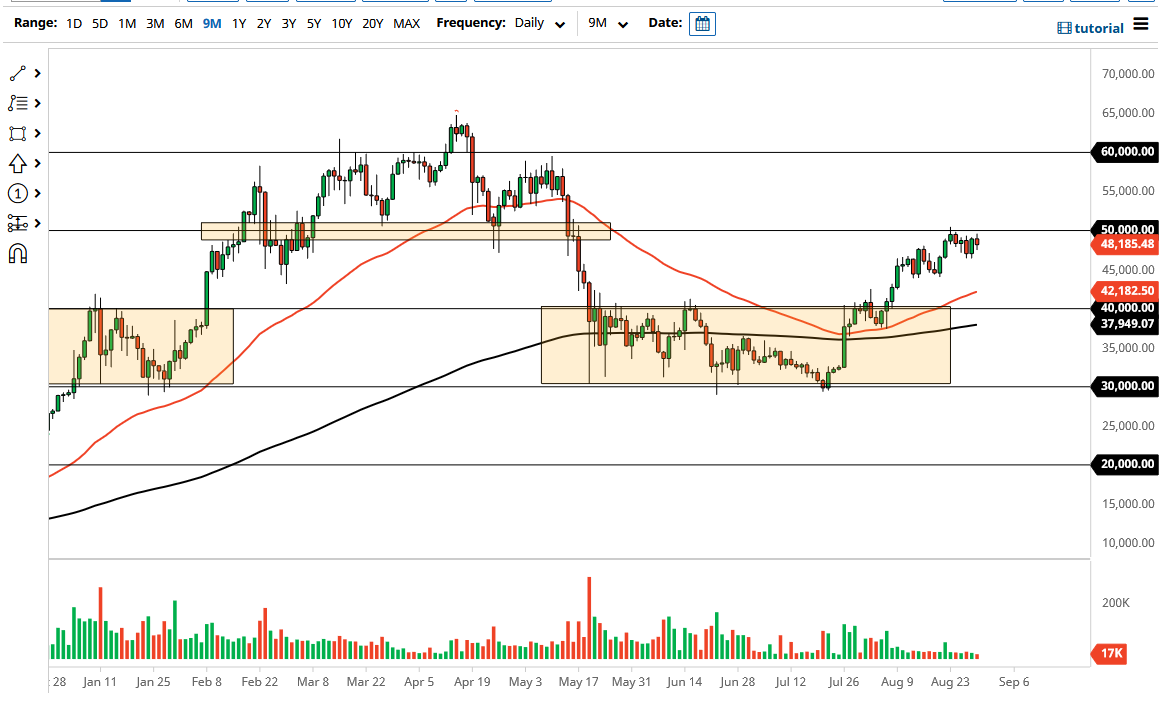

Bitcoin markets fluctuated on Monday as traders came back from a relatively quiet weekend. The $50 level above is a large, round, psychologically significant figure, and with that being the case it is likely that we would see a lot of selling pressure at that point. In fact, the $50,000 level has held for six sessions in a row, despite the fact that we slammed directly into that area.

That being said, if we were to break above the $50,000 level, then it is possible that we could go looking towards the $55,000 level. The $55,000 level has been short-term support in the past, but the $50,000 level being a major support previously is what the market seems to be focusing on as far as “market memory” is concerned. That does not mean that we cannot break above it, just that it might take a little bit more effort than some of you believe. However, if we were to break above that $50,000 level, then I think we will start to see a little bit of a push to the upside.

Looking at this chart, the 50-day EMA underneath has started to swing above the $42,000 level, and the 50-day EMA is an indicator that quite often causes a significant amount of noise in the Bitcoin market. As it is sloping higher, it does suggest that there will be plenty of “buyers of dips” going forward, so it makes sense that simply taking your time and picking up value as it presents itself is probably going to be the best thing going forward.

I do believe that eventually we will break out to the upside, but the $50,000 level has caused enough noise that I think it might take a while to get above there. Having said that, the market is probably going to continue to be very choppy and volatile more than anything else, so understand that you do have a certain amount of time before putting the entire position out there. Nonetheless, this continues to be a market that I think will go higher as the central bank liquidity measures continue to provide a positive catalyst for the crypto community.