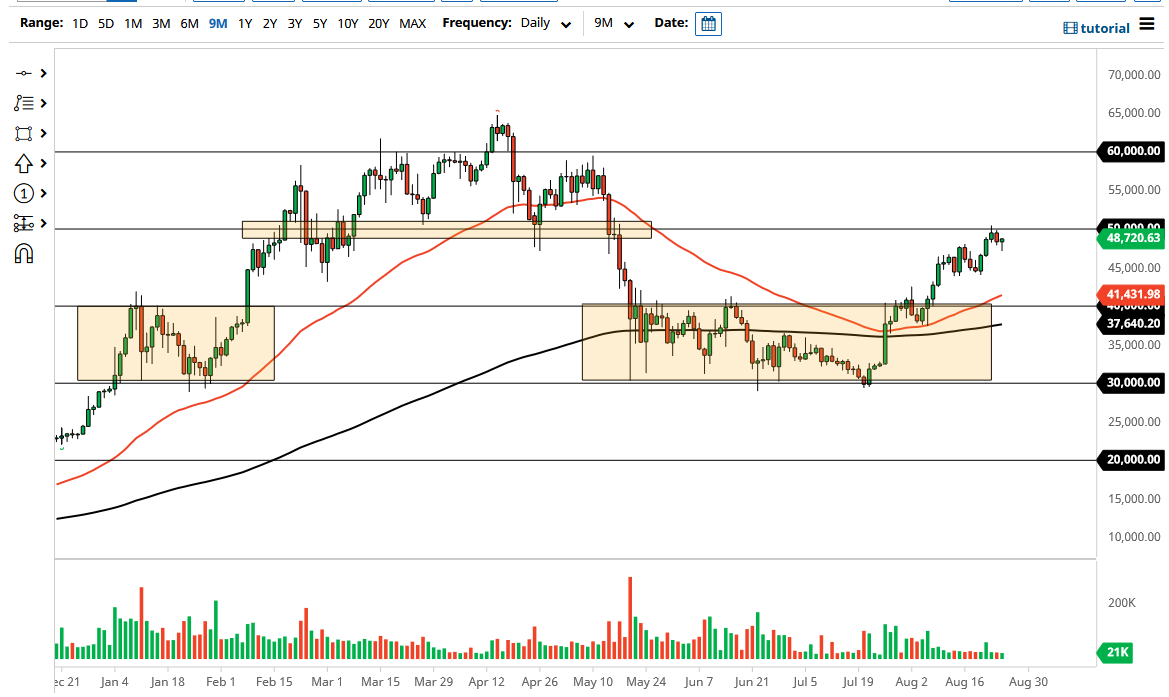

The Bitcoin market initially drifted a little bit lower on Wednesday but found a little bit of buying pressure underneath to form a hammer. The hammer is just below a major resistance barrier in the form of the $50,000 level, which is an area that I think would attract a lot of attention due to the fact that it has been important more than once. Furthermore, media and retail traders love the idea of trading on big figures like this.

If we can break above the $50,000 level, it would allow the market to continue reaching higher, and there is a certain amount of “FOMO” that comes into play every time we kick past one of these big figures. The “fear of missing out” trade certainly could come into play, as retail traders jump upon the move higher. In this scenario, the market is likely to go looking towards the $55,000 level, and eventually the $60,000 level, which has been important previously. Beyond that, the market tends to move in $10,000 increments anyway, so that makes a nice target.

On the other hand, if we were to break down below the hammer that formed during the trading session on Wednesday, it is possible that we could go back towards the 45,000 level, an area where we have seen quite a bit of support over the last couple of weeks. Because of this, the market is likely to see this as an area where a lot of value hunting could come back into the picture. The $45,000 level has been important recently, but in the big picture it is only a minor speed bump along the road to bigger levels.

On some type of breakdown, there is even more support down at the $40,000 level, where the 50-day EMA has recently broken through, and we had broken above the top of the consolidation range previously. The Bitcoin market remains a bit of a “buy on the dip” scenario for most traders. This will be especially true if the US dollar gets hammered, but it is worth noting that the Bitcoin market has moved in the opposite direction of the US Dollar Index as of late, so that does not necessarily hold up all the time.