Bullish View

Buy the BTC/USD and add a take-profit at 50,000.

Add a stop-loss at 43,000.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 44,500 and a take-profit at 44,000.

Add a stop-loss at 48,000.

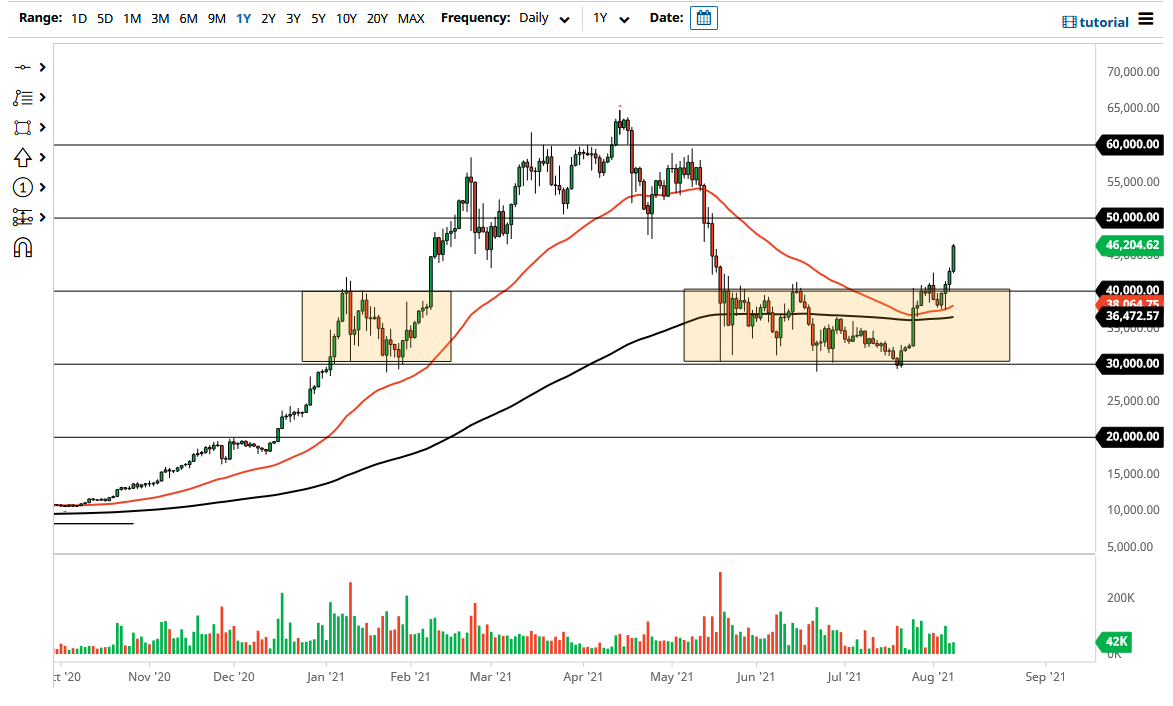

The BTC/USD price soared to the highest level since May as sentiment in the industry improved. The Bitcoin price is trading at $45,956, which was slightly below Monday’s high of $46,788.

Bitcoin Bounces Back

The BTC/USD pair has been in a strong bullish momentum after it crashed below 30,000 in July. Since then, the pair has jumped by more than 16,000 points, pushing its total market capitalization to more than $864 billion. At its lowest level in July, Bitcoin was valued at less than $600 billion. In total, the market cap of all digital coins has jumped to more than $1.86 trillion.

The main headline for Bitcoin prices was the fact that the Senate rejected a compromise amendment to the $1 trillion infrastructure bill. The amendment would have clarified the meaning of the term broker to include exchanges like Coinbase and Binance.

At the same time, the bill would have excluded key participants in the industry like miners, stakers and developers. Therefore, since Senator Richard Shelby voted against it, the original definition will remain. The Senate wanted to redefine the term broker in a bid to raise about $28 billion to fund infrastructure.

The BTC/USD pair has also rallied because of the rising volume as investors come back to the industry. Recent data shows that the volume of Bitcoin and other cryptocurrencies has jumped recently. That is a positive thing because it signals that there is renewed interest among market participants. The leading drivers of this push are institutional investors who don’t want to be left behind the new bull run. Some of the biggest holders of Bitcoin like MicroStrategy, Tesla and SpaceX have maintained their holdings.

The next key catalyst will be the latest Coinbase Global earnings. The company is set to publish its earnings later today. Analysts expect that the firm made $2.3 billion in the second quarter.

BTC/USD Technical Analysis

The BTC/USD pair rose to a high of 46,788, which was the highest level since May. On the four-hour chart, the price was above the important support at 41,265, which was the highest level on June 14. On the four-hour chart, the price has moved above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the overbought level. Therefore, the next key level to watch will be 50,000.