The CAC Index rallied significantly during the trading session on Friday as we continue to see luxury goods do quite well due to the rich becoming richer during the pandemic. Remember, the Parisian index is essentially Airbus and luxury goods. With that being the case, we will continue to go much higher, and I think we will see a lot of interest in this marketplace. Ultimately, this is a market that I think will continue to be a “buy on the dips” type of scenario, and it certainly looks as if Paris is ready to reach towards 7000.

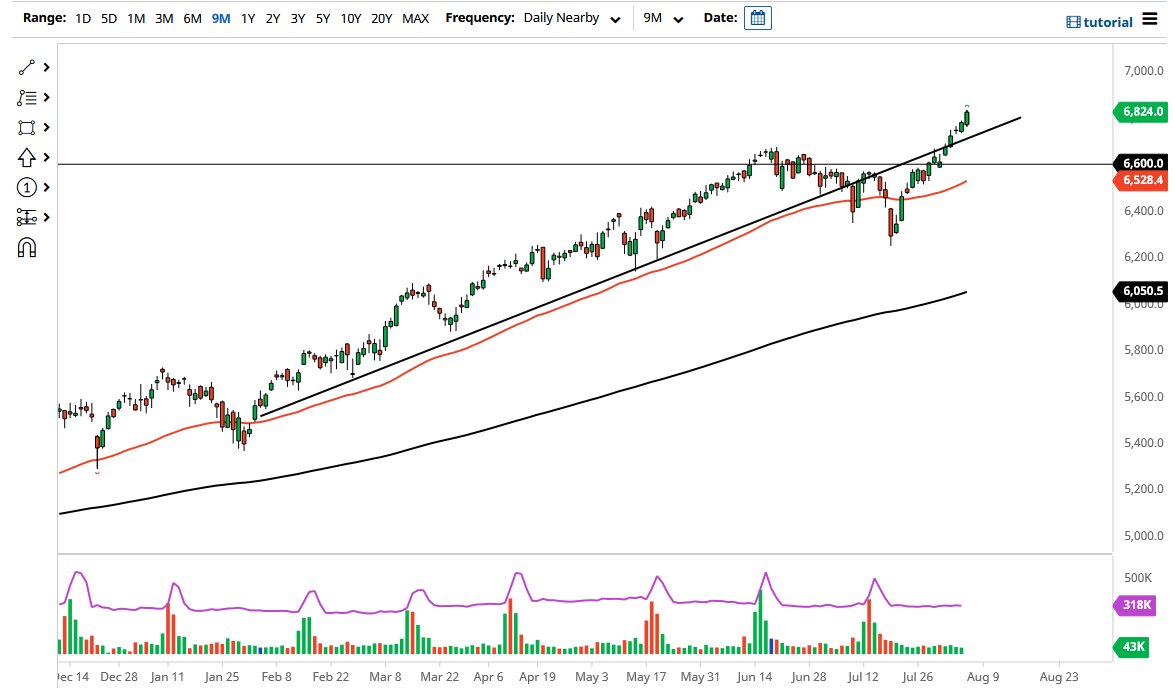

The CAC is the second largest index in the European Union, and that will have an influence on minor indices underneath. With that being the case, I think the market is likely to see a lot of interest, as the last couple of weeks have essentially been on fire. I think given enough time, if we do get a pullback, the previous uptrend line that I have marked on the chart and the 6600 level both could offer plenty of support. The 50-day EMA is down at the 6528 and rising quite quickly.

I have no interest whatsoever in trying to short this market, and if it did break down significantly then I might be looking to short other indices such as the IBEX in Spain, which has underperformed the bigger players such as Germany and France. That will probably continue to be the case, as the larger indices continue to attract a lot of flow based upon the reopening trade. Furthermore, some of the smaller indices do not have the exporting power that the big indices do, so that is another thing to keep in mind.

Another thing that is helping the situation here in the CAC is that the EUR/USD has broken down rather significantly, making those exports out of France cheaper for consumers around the world and bolstering the demand for French goods such as wine, luxury goods and possibly even aircraft. Ultimately, this is a market that cannot be shorted as long as we are well above the 50-day EMA. The 7000 level will almost certainly cause a certain amount of resistance, and you could make an argument for being a little bit overbought, but given enough time, the value hunters come back.