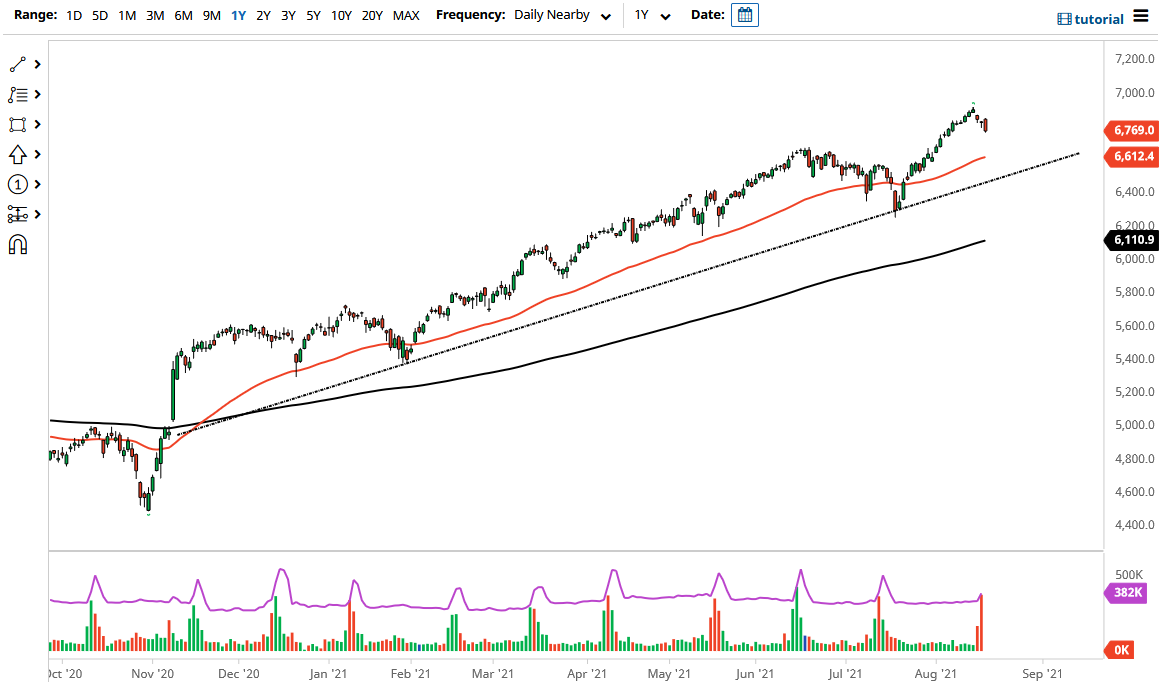

The Parisian index has formed a nasty looking candlestick during the trading session on Wednesday as we gapped higher, and then fell straightaway to form a bearish and coughing candle. This is typically a very negative sign, and it almost always sends the market lower. That being said, I think if we pull back from here it is very possible, that we could go looking towards the €6700 level, followed by the 50 day EMA which sits just underneath.

Underneath the 50 day EMA, there is also the uptrend line that continues to cause a lot of support, so it is not until we break through all of this that I would be concerned about the overall attitude of the market and at this point I think it would be a matter of buying dips as they offer a bit of value. The market should find plenty of buyers underneath in order to keep this market afloat, as the indices continue to be supported by central banks around the world, including the ECB.

If we were to break down below the 6400 level, which would clear both the 50 day EMA and the uptrend line, then I think the CAC could go lower, perhaps reaching towards the 200 day EMA currently sitting at the 6100 level. All things being equal, that would be a very negative turn of events and at that point I can probably be short of this market as there is plenty of negativity in the market. Remember that the CAC is highly sensitive to risk appetite as most of the index is made up of luxury type exports, so obviously you need a good export market to get things going for a longer-term move.

If we were to turn around and rally from here, the market could go looking towards the 6900 level, which is a large, round, psychologically significant figure in of course the most recent all-time high. Because of this, I think that if we break above there then it is likely that the market goes looking towards the €7000 level, as the large, round, psychological aspect of the figure makes it a nice target. Pay close attention to indices around the world, as they do tend to move in the same general direction. Ultimately, the CAC will move right along with the DAX and the FTSE as an example.