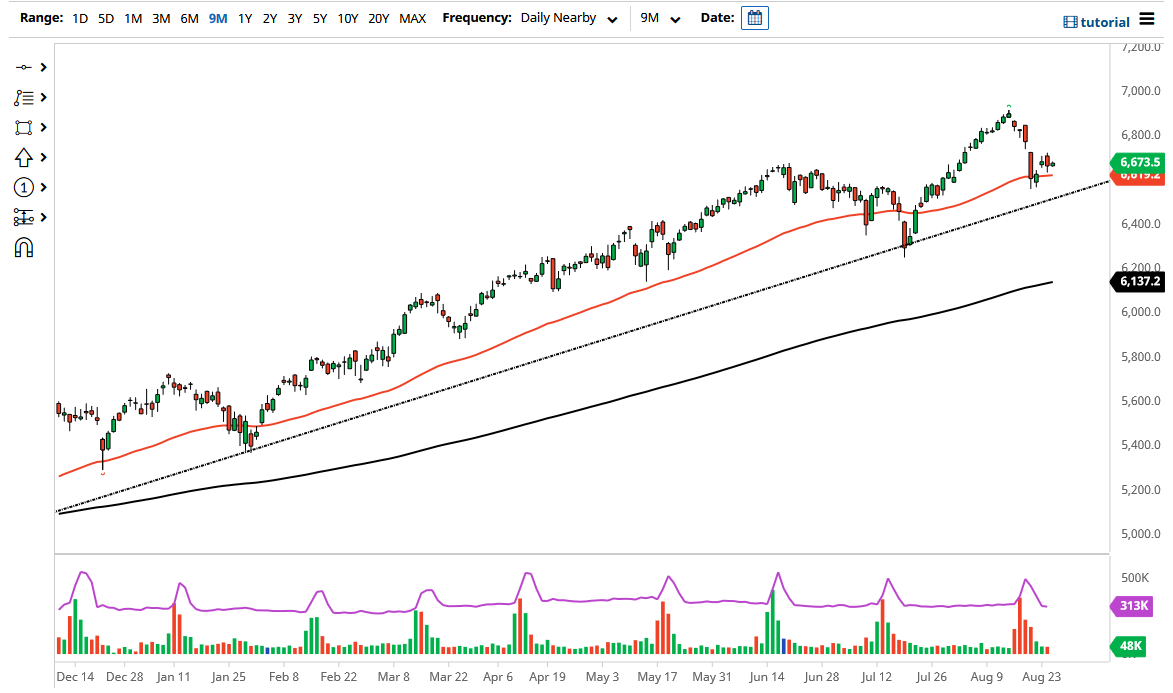

The CAC Index did very little on Wednesday as we sit right around the 6700 level, and perhaps even more importantly, the 50-day EMA. The 50-day EMA has been supportive more than once, and as a result it is likely that the traders around the world will continue to look at the 50-day EMA as a potential buying opportunity, right along with the uptrend line that sits just below it. In that scenario, I think it is much easier to simply buy dips going forward, but then again, that is the way that most markets behave.

Keep in mind that the Parisian index is highly sensitive to luxury goods, meaning that it has a lot to do with whether or not people are buying non-essential items. At this point, we have had a nice little pullback, but whether or not it has been enough to satiate the markets is a completely different question. I am waiting to see some type of impulsive candlestick that I can take advantage of, and most certainly will as the market will go looking towards the 7000 level given enough time. The 7000 level is a large, round, psychologically significant figure that a lot of people will stand up and take notice of and could offer just a bit of selling pressure.

The market breaking down below the uptrend line could open up the possibility of a move down to the 6300 level, and then possibly even the 200-day EMA after that. Unlike most indices, I do not have an issue whatsoever in trying to short the CAC, but that is only because it is so highly levered to a handful of luxury goods, perhaps with the exception of Airbus. With this being the case, the market is likely to continue to see buyers on dips regardless, because central banks around the world will do everything they can to liquefy markets and essentially make it so that you have to buy stocks in order to get any type of return. At this juncture, the market is likely to see a lot of value hunting given enough time, and I need to see some type of impulsivity in the short term in order to get long again. Then I would anticipate that we could kick off the next leg higher.