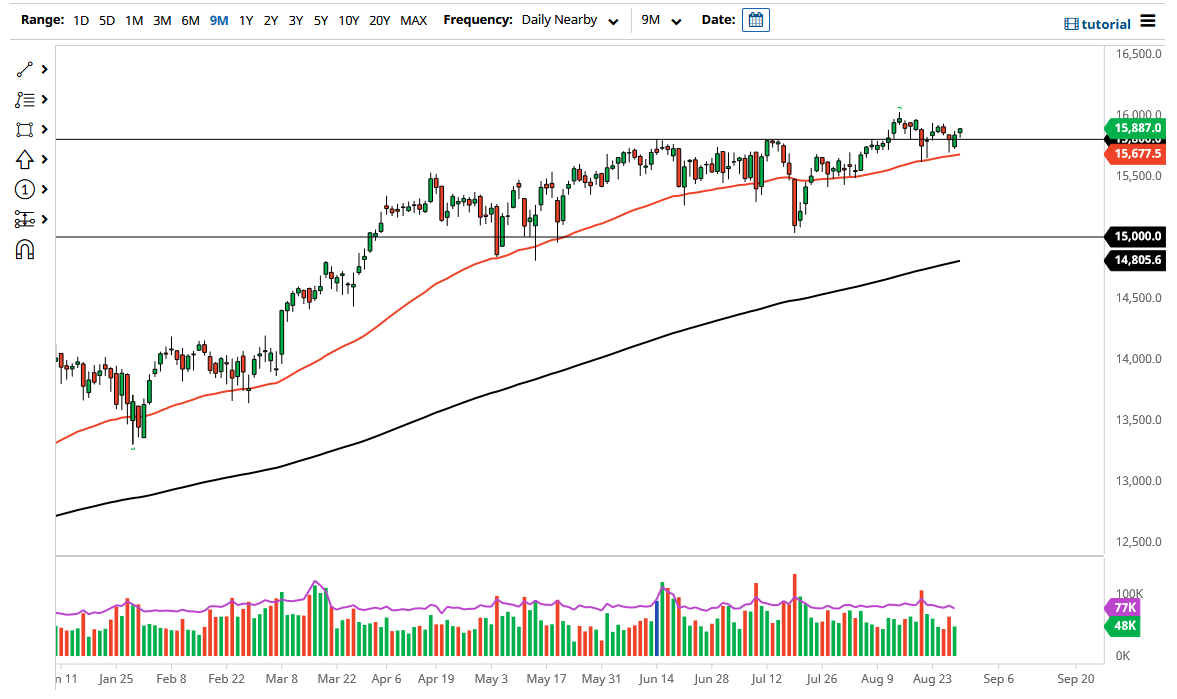

The DAX Index gapped higher just a bit on Monday to show signs of strength, but at the end of the day we had to pull back and test the 15,800 level yet again. The 50-day EMA underneath continues to offer significant support at the 15,675 level. The market has been in a bullish run for quite some time, and I think that we are simply trying to build up some type of base to continue going higher. The market has been very choppy for some time, as we are waiting to see whether or not we can continue to go higher.

Keep in mind that the German index is highly levered to the reopening trade mainly due to the fact that German companies are such a major exporters of industrial products. As long as we stay above the 50-day EMA, I think short-term traders will continue to pick up these dips, so it is only a matter of time before we get to the 16,000 level. If we can break above the 16,000 level, it is very likely that the market could go looking towards the 16,250 level, and then possibly even the 16,500 level. The DAX tends to be very highly correlated to risk appetite and industrial growth around the world.

When you look at this chart, you will notice that although we have been slightly choppy and to the upside, it has been rather quiet for some time. With that in mind, it makes a lot of sense that we would see an initial burst, and then go much higher. The market has been very quiet, but that can only last so long. Ultimately, I do think that we are building up enough pressure to go higher. On the other hand, if we were to break down below the 50-day EMA, then the 15,500 level would be supportive, as well as the 15,000 level underneath there. The 15,000 level underneath would be a significant support level based upon longer-term trading, and I think what we are seeing here is a market that continues to be a “buy on the dips” type of opportunity, but after that we will go much higher.