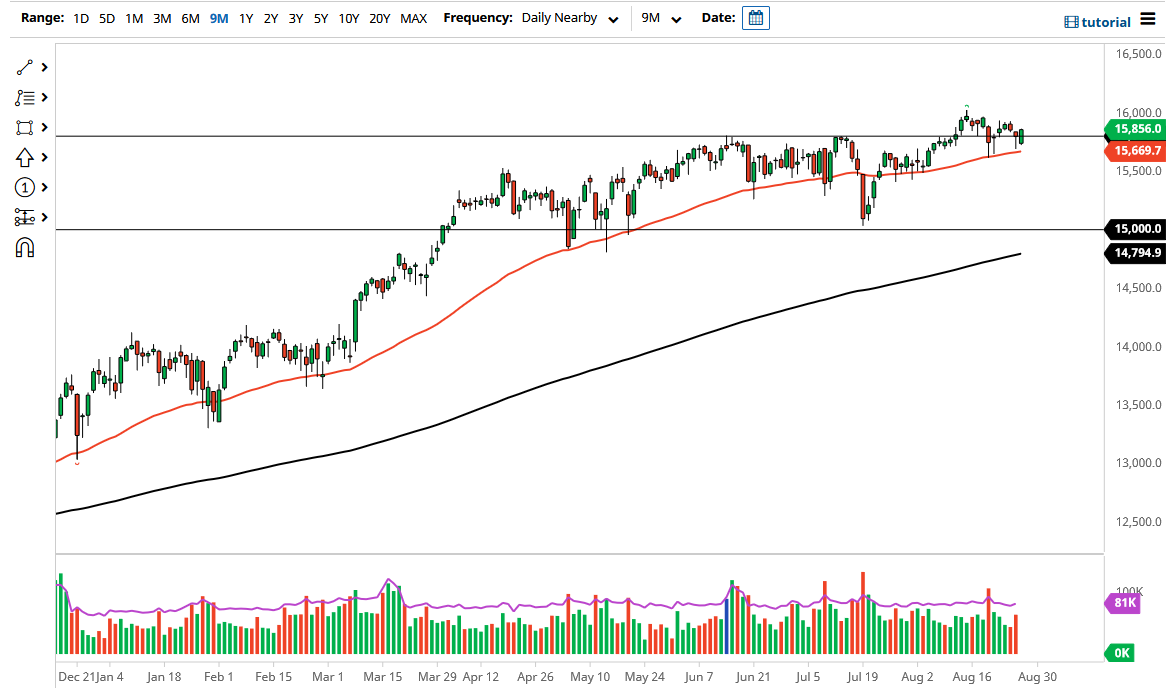

The DAX Index rallied a bit on Friday as we continue to see strength, but ultimately, we are simply trying to figure out whether or not we are going to finally launch. This is a market that should continue to see plenty of buyers, as the DAX is the “blue-chip index” for the entire continent. Pullbacks should be supported at the 50-day EMA at the very least, and I think when we are looking at this chart, we should be thinking about buying only. If we break out above the highs of the trading session on Friday, then I think we will go pressing the 16,000 level. The 16,000 level is an area where we would see psychological resistance, and the fact that we formed a bit of a shooting star in that area does not hurt the cause either.

Looking at this chart, I think that we will continue to see a lot of noisy behavior, but it does not take a lot of imagination to draw a symmetrical triangle currently, and that typically means that we are winding up for some type of bigger move. If that is going to be the case, then I think we look at a scenario where the market not only reaches about 16,000, but based upon the measured move could be looking at a move towards the 16,250 level.

To the downside, if we were to break down below the 50-day EMA, then it is likely we will go looking towards the 15,500 level, which is a large, round, psychologically significant area that a lot of people will be paying close attention to. If we break down below there, then the market is likely to see a lot of downward momentum to reach towards the 15,000 handle. The 15,000 handle currently looks as if the 200-day EMA is racing towards it and will end up being the bottom of the overall consolidation area, so I think at this point we are looking at the 15,000 level as the “floor in the market.” Anything below there would be disastrous for the DAX. I do not think we will get there anytime soon, and it is obvious that the market favors the upside.