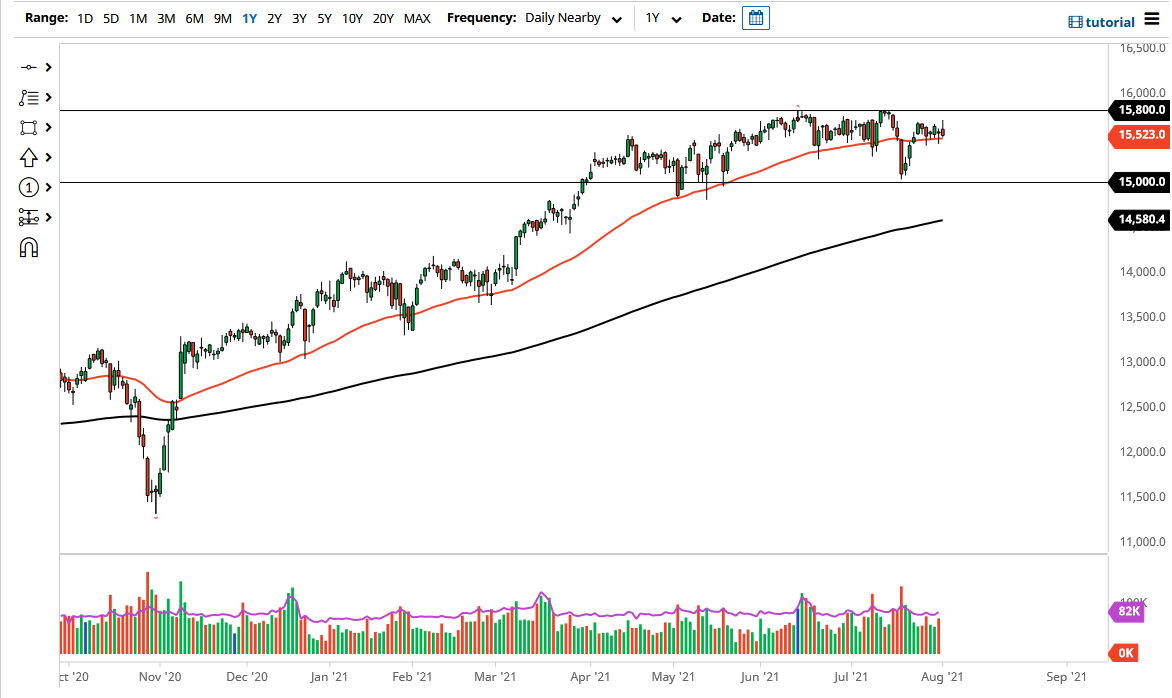

The DAX Index initially tried to rally during the trading session on Monday but gave back the gains to turn around and fall rather hard. After doing so, the market then slammed into the 50-day EMA underneath, which is sitting at the 15,505 level. Breaking down below that level would more than likely open up a possibility for even more selling, perhaps reaching down to the 15,000 level.

Keep in mind that this market is finding this general vicinity as a consolidation area, with the 15,000 level underneath being support, and then the 15,800 level above offering resistance. With this being the case, I think it is clear that we have a roughly 800-point range that the market continues to respect. After all, we have been in this range for several months now, and as we begin August, it does make sense that the markets may be quiet as it is historically a very lackluster time of year and a lot of big traders are away for holiday.

That being said, if we were to break down below the 15,000 level, then it is likely that we could go looking towards the 200-day EMA which is currently sitting at the 14,580 handle. That is an area that is going to be paid close attention to due to the fact that it is a largely followed longer-term technical indicator. Breaking down below that would then look at a move much lower, as it would be a complete turnaround of the uptrend. On the other hand, if we were to break above the 15,800 level, then it is likely that we would challenge the 16,000 level. Breaking above the 16,000 level would be a continuation of the longer-term uptrend, opening up the possibility of even bigger moves over the longer term.

At this juncture, I believe the DAX will continue to follow right along with the global reopening trade, which right now has a lot of concern attached to it. Remember, Germany is a major exporter of industrial components and machinery, so if the rest of the world picks up, then the DAX will be one of the major beneficiaries. If we continue to see a lot of concern out there though, it is more than likely that this index will struggle.