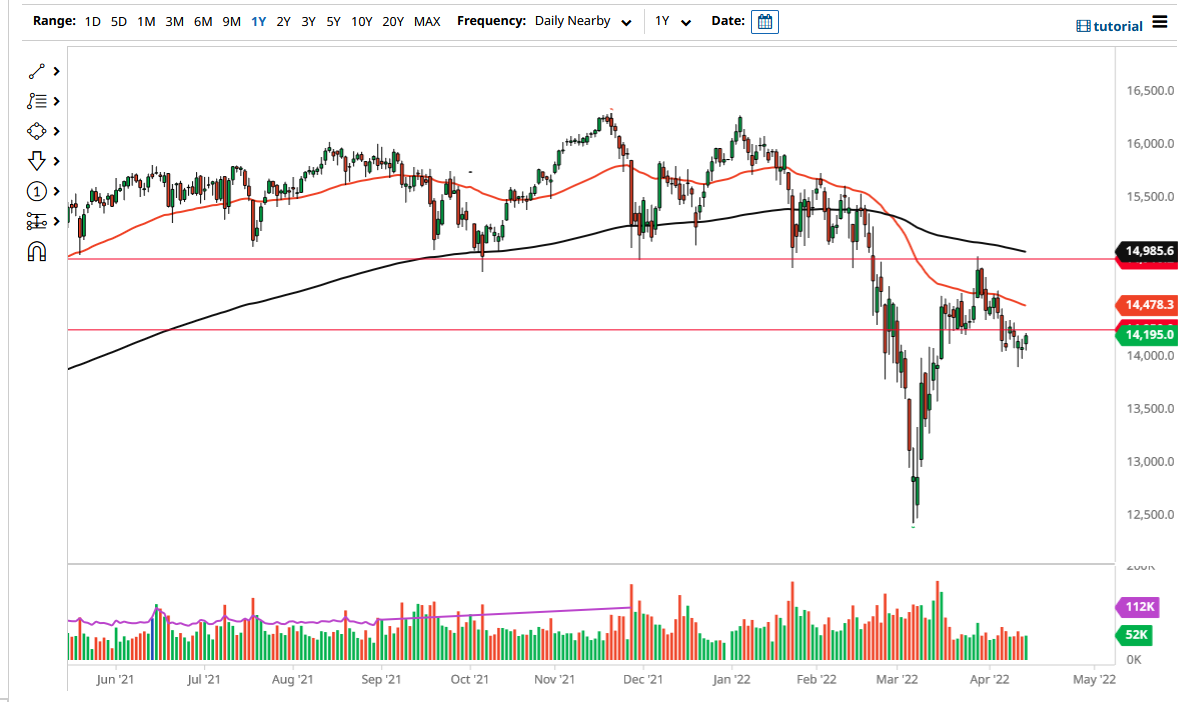

The German index has broken down a bit during the trading session on Monday, only to find buyers near the 15,800 level, an area that I had previously mentioned as significant resistance and potential support. The way we have pulled back and bounce again to turn around and form a hammer suggests that we are in fact going to continue to go higher. To the upside, the market is likely to go to the all-time highs, perhaps even breaking above there. At this point time, the 16,000 level of course would cause a certain amount of headline risk.

Hanging on to the 15,800 level is of course a good sign, but even if we were to break down below there it is likely that the 50 day EMA would come back into the picture to offer support near the 15,600 level. The 50 day EMA of course does attract a lot of attention in the DAX, so therefore I think that would be your intermediate “floor the market.” It is starting to tilt higher, so it is only a matter of time before the buyers would come back as we are still decidedly in an uptrend, assuming that we even break down towards that area.

Clearing the all-time high that we made on Friday allows for even more momentum to come back into the marketplace, perhaps sending the DAX to the 16,250 level. The market had been consolidating for quite some time between 15,000 underneath and the 15,800 level above. That measures for an 800 point move to the upside, which suggests that we are going to go to 16,600. The DAX has been very sensitive to global risk appetite, and of course the idea of exports coming out of Germany in a very healthy situation.

It is not until we break down below the 50 day EMA that I would be concerned about the market for a bigger move, but even then, I think that there would be a massive “floor the market” near the 15,000 level, so that is where I define the trend, therefore it is not until we break down below there that I would consider shorting the DAX. It is worth noting that the 200 day EMA is reaching towards that level again, so I think it will be very difficult to get below.