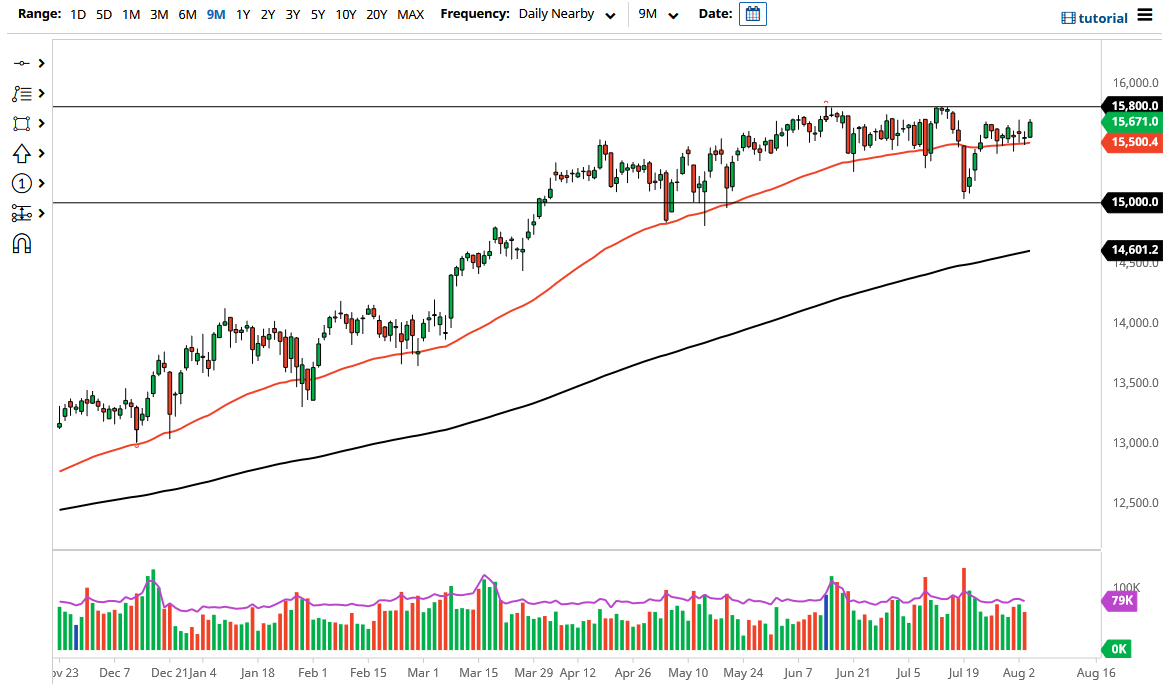

The DAX Index rallied a bit during the trading session on Wednesday as the 50-day EMA continues to offer a significant amount of support. The 50-day EMA now sits at the 15,500 level, which is a “mid-century mark” that a lot of people will pay close attention to. On the other hand, when you look at this market you can see that we have been consolidating for a while, with the 15,000 level underneath offering support. To the upside, the 15,800 level would be resistance, and the market continues to look at that as a potential target, but if we were to break above there then it is possible that we could have a bigger move to the upside.

The DAX is the first place that money goes flowing to if they are trading in the European Union stock markets. The DAX represents Germany, which is the main engine for the European Union, so you can think of it more or less as a “blue-chip index” for the region. We are closing towards the top of the candlestick for the trading session on Wednesday, which suggests that we could very well have some follow-through. That does not necessarily mean that we are going to slice through the 15,800 level, at least not right away.

If we were to turn around and break down below the 50-day EMA, then it is possible that we could go looking towards the 15,250 level, followed by the 15,000 level after that. I do not necessarily think that will happen easily, but it is possible that we could get some type of major “risk off move” when it comes to global indices. The market has been noisy for a while and I think that will continue as the world seems to be a bit confused about where we are going to go as far as inflation or deflation is concerned. I do not necessarily want to short this market, but I do think that if we break down it should be a nice buying opportunity based upon value more than anything else. Breaking above the 15,800 level for me is a signal to start buying and holding. The 16,000 level would be the initial target, but after that we could go much higher.