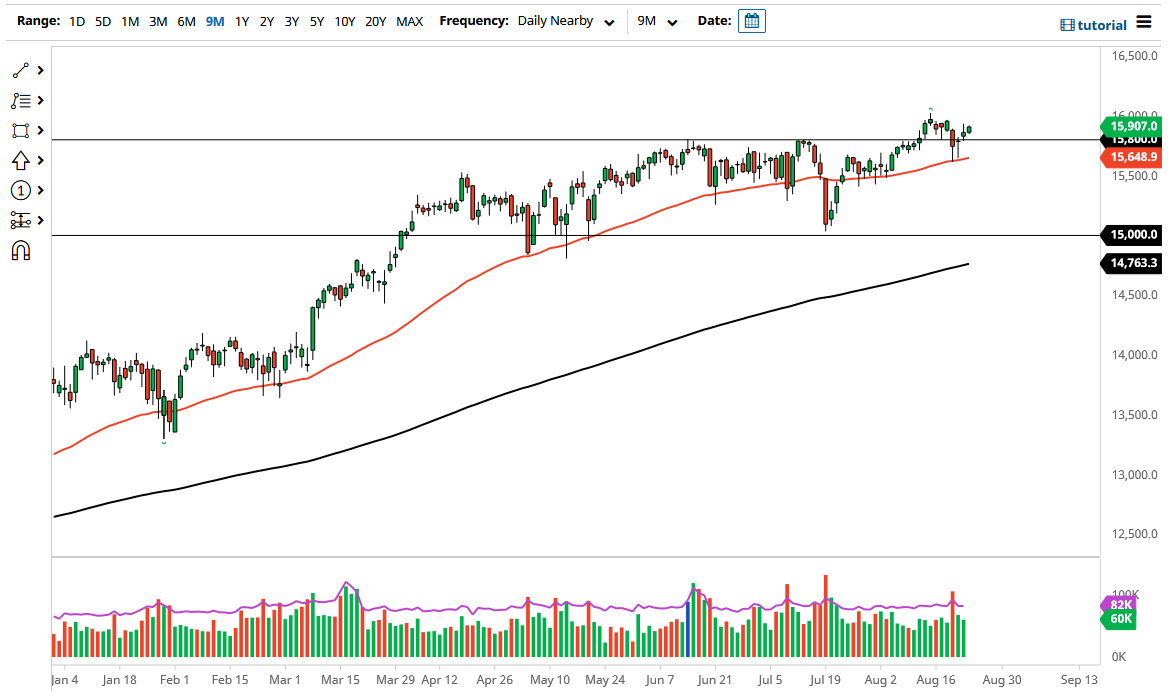

The DAX rallied again on Tuesday to show signs of continuation to the upside. The market has recently bounced from the 50-day EMA, and it makes sense that we will continue to go higher over the longer term. If we can break out above the 16,000 level, then it would be a very bullish sign and could send the DAX towards the 16,500 level.

To the downside, the 15,650 level is an area that I think would be supportive, based upon the recent bounce and the fact that we have the 50-day EMA sitting there. In that scenario, it looks like we continue to pick up a “buy on the dip” scenario, and the DAX will favor the long positions more than anything else. Central banks around the world continue to offer liquidity for the markets to digest, meaning that a lot of money will go looking towards the stock markets to keep a significant amount of wealth preservation if nothing else. After all, there are no real returns when it comes to anything paid with interest, so with that being the case there is nothing else you can do.

The central banks around the world, including the ECB, have forced people into the equity markets, and the DAX shows this. Furthermore, if we continue to see a bit of a reopening trade continue to play out, then it makes sense that the DAX will be an area where we would see traders try to take advantage of the exports that make up such a huge part of the DAX, as Germany is such a major exporter of industrials. Ultimately, I think that we will see the DAX go higher, perhaps looking towards the 16,500 level over the longer term, but it is going to take a while to get there. In the short term, the 50-day EMA continues offer plenty of support, but if we break down below there then we could drop as much as 15,000 underneath where the 200-day EMA is currently racing towards. Because of this, I think that this remains a bullish market that will continue to go higher as far as I can tell for the time being.