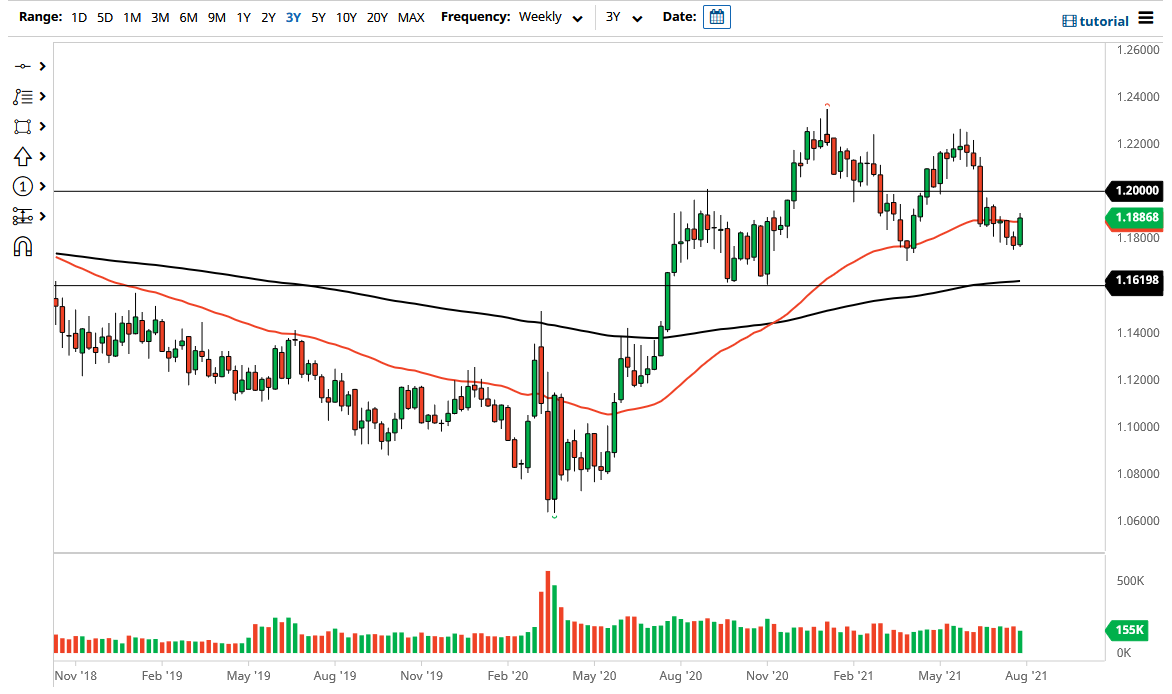

The euro was all over the place during the month of July, but as you can see, the last week was rather positive. That being said, I do anticipate that we are probably going to jump around between 1.18 and 1.20 over the next several weeks. Ultimately, this is a market that I think will continue to pay close attention to the interest rate differential between Germany and the United States. As things stand right now, that does favor the United States, but there are also some other things to pay close attention to as well.

The European recovery has picked up a bit, and now Europe could give the United States a little bit of a run for its money, but we still see much more strength in the USA then we do in other major economies, the EU included. The market breaking above the 1.20 level would be a very bullish sign, but at this point I think you are going to have a very choppy month of August.

If we were to break down below the lows of July, then it will almost certainly open up a move towards the 1.16 level underneath. That is an area that has been support more than once which the market has respected multiple times, so I think that support zone between 1.15 and 1.16 will hold. If we do break down below that zone, it would be a massive “risk off event”, and right now the biggest reason we may see that scenario is perhaps the Delta variant picking up and closing down economies. That being said, I do not necessarily think that is very likely, but it is something that we will need to keep in the back of our minds as we could see a lot of potential problems.

To the upside, if the euro breaks the 1.20 handle, then it is likely that we go looking towards the 1.22 level. That being said, we would need to see a major “risk on” attitude as well. Ultimately though, August generally tends to be very choppy and indecisive as most big traders are going to be away at holiday. With that being the case, it is likely that the market will remain in its range-bound behavior that we have seen so many times in this market.