The euro continues to lose against the US dollar as the Tuesday session was a simple continuation of what we have seen over the last several days. As interest rates in the United States continue to rise and the interest rate differential between America and Germany also widen, it makes sense that the euro will continue to suffer at the hands of the greenback, which is showing strength against everything.

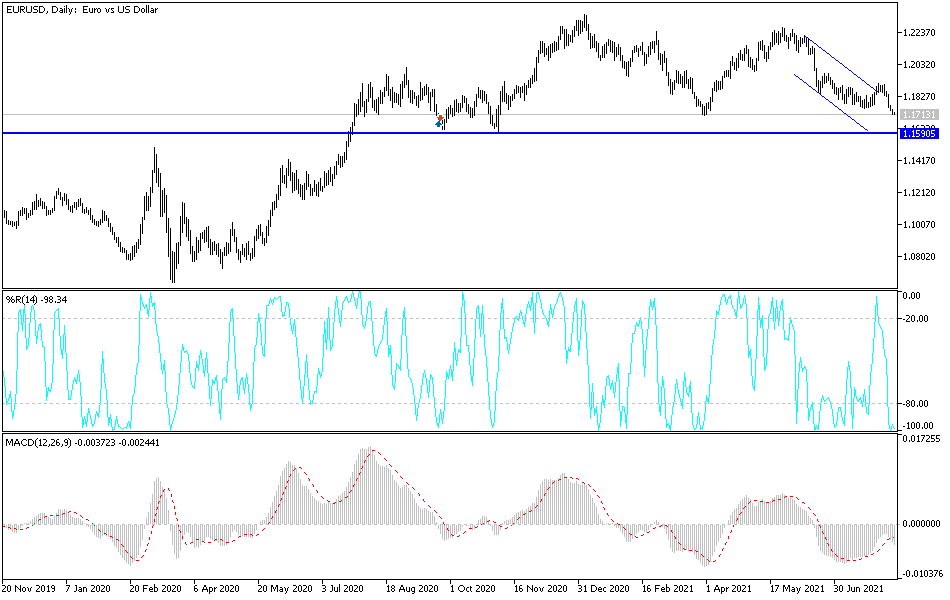

When you look at this chart, you can see that the “death cross” has offered a significant amount of resistance above, and now it looks as if longer-term traders are starting to get involved as well. This is a market that I think will continue to sell rallies unless the CPI number coming out on Wednesday is a huge disappointment. Inflationary numbers are expected to be hot in the United States, which means that the Federal Reserve will have to come into the picture and tighten monetary policy, something that does tend to strengthen a currency, especially as interest rates rise.

I do think that the euro is going to go looking towards the lows again, at the 1.16 level. The 1.16 level is the beginning of a significant support level that is more or less a “zone” that people will pay close attention to. I believe it extends down to the 1.15 level, so it is not until we break down below there that we will go much further. I believe that the market will continue to bounce around as we are going to wait to see whether or not we are going to continue to see US dollar strength. If this market does rally, it is only a matter of time before we would have exhaustion come into the picture that we could start selling.

As far as buying is concerned, is not until we break above the 200-day EMA that I would be a buyer. I do not trust the uro at the moment, and I think that will continue to be a major problem here. As long as interest rates in America continue to show signs of strengthening, there is just no possible way that this pair is going to rally for anything that is remotely sustainable.