The euro fluctuated on Tuesday as we have given back early gains in order to show signs of exhaustion. If we break down below the bottom of the candlestick, then it is likely that we will drop towards the 1.17 level underneath. Ultimately, this is a market that will have to make a decision later on this week, as the Jackson Hole Symposium will have all of the attention right now, due to the fact that the markets will pay close attention to what Jerome Powell says as far as tapering is concerned.

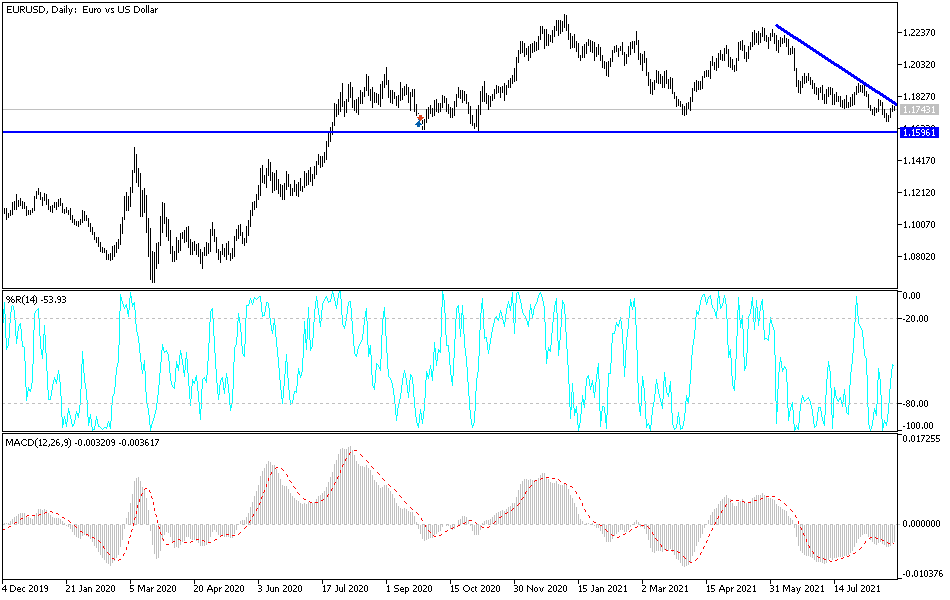

The market turned around quite drastically during the course of the session as we start to question whether or not there will be tapering. Originally, the US dollar sold off quite drastically due to the fact that a lot of people are banking on Jerome Powell pushing back the tapering. However, we have run out of steam, and it looks as if the momentum is starting to hear questions about whether or not they will say enough to kill off the dollar. At this point, it looks as if we have tested the top of the falling wedge, so if we can break out above the top of the candlestick for the trading session on Tuesday then I think it would be a very bullish sign. However, I do not know exactly how far we will go, because the next resistance area is sitting just above at the 1.18 handle, and then we have the 50-day EMA at the 1.1833 level.

If we break down below the bottom of the candlestick for the trading session on Tuesday, then it is likely we will continue to go much lower, perhaps reaching down to the 1.17 level. After that, then we could go looking towards the 1.16 level afterwards, which is much more based upon the longer-term charts. The 1.16 level has offered quite a bit of support previously, so it will most certainly be interesting to see what happens in that general vicinity. At this point, it looks like we are continuing to “fade the rallies”, at least based upon the price action that we have seen during the trading session on Tuesday. I think we have a lot of choppy behavior ahead more than anything else.