The euro broke higher on Friday as it looks like we are ready to continue pushing to the upside. The 1.18 level certainly is being threatened, and if we can break above the 50-day EMA, which is only 25 pips above, then we could see this market turn around and go looking towards the 1.19 level. At that point, we then start looking towards the 1.20 handle.

Keep in mind that a lot of this comes down to Jerome Powell suggesting that we are going to see the Federal Reserve be very cautious about raising interest rates, even if they do taper a bit later on down the year. Ultimately, this is a market that looks as if it is ready to continue going higher based upon the candlestick, but we need to clear the 1.18 level rather handily, and then the 50-day EMA. On the other hand, we may just simply chop back and forth in order to show signs of confusion yet again.

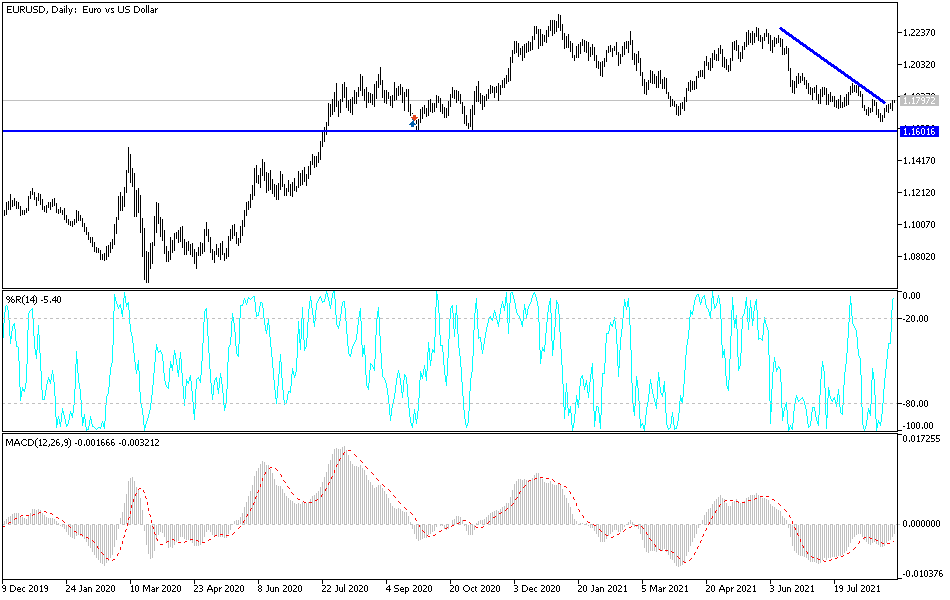

Underneath, if we were to break down below the lows of the Friday candlestick, then it is likely that the euro could go looking towards the 1.17 level, which would be a major turn of events and could continue the market selling off towards the bottom. The 1.17 level underneath has been important in the past, so if we were to get past that level then it is likely we would go looking towards the 1.16 level. The 1.16 level then could come into the picture where we would see a significant support level come back into play, which has caused a major bounce. At this juncture, I believe that breaking down below there would be catastrophic for the euro, because it would be such a huge change in attitude over the last couple of weeks. It would also open up the possibility of a 400-point drop, but it looks as if the Federal Reserve was just dovish enough on Friday to make that not happen, which is good for risk appetite in general. The size of the candlestick is somewhat impressive, so I would anticipate that we could see a little bit of follow-through, but it may take a little bit of effort to get above the short-term resistance.