The euro initially tried to rally during the trading session on Friday but gave back early gains to show signs of weakness again. This is a market that may have gotten ahead of itself so it should not be surprising at all to see a bit of a pullback. We had been in a falling wedge but broke out of it over the last couple of days. At this point, we also have to take a look at a handful of issues that could drive this pair going forward.

The first thing will be the interest rate differential between European bonds and US ones. It still favors the United States, despite the fact that rates have been falling again. Nonetheless, being the world’s reserve currency has its benefits, and as a result, if we continue to see money flying into the bond market, you should keep in mind that money goes to where it's traded best, in this case the United States. However, as yields fall in America, that means that more of those dollars are needed to buy those bonds. It becomes a bit of a feedback loop, so you should keep in mind that the market may simply grind lower because of this.

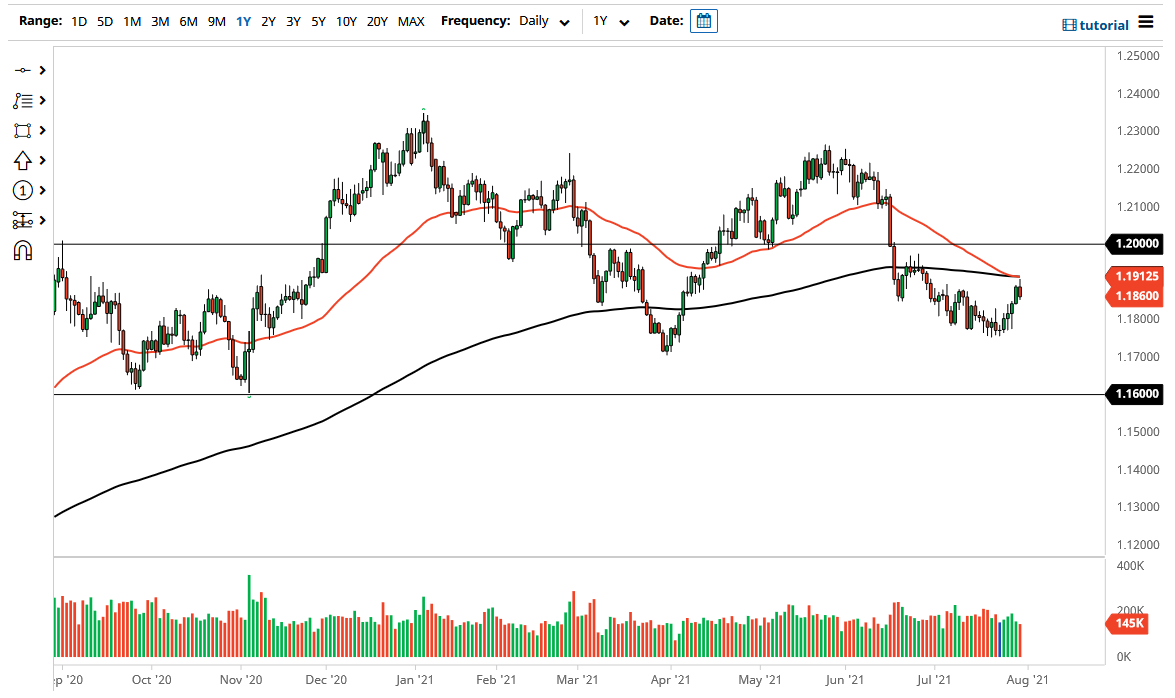

When I look at this chart, it is obvious that there is a significant amount of resistance just above, and more so at the 1.20 handle as it is a large, round, psychologically significant figure. If we were to break above there, then it would change the entire outlook of this pair, perhaps sending the euro towards the 1.2150 level rather quickly. However, I think it is much easier to break down towards the 1.1750 level and then break below there to go lower. At that point, I would anticipate that the market probably will go looking towards the 1.16 handle, which is the beginning of a major support region that extends down to the 1.15 handle.

Regardless of what happens next, I think the one thing you can probably count on is choppy behavior from the euro, because you can almost always count on it. I am not a big fan of the euro as far as trading is concerned anyway, and at this point I think you have to look at it more or less from a longer-term standpoint. If we are starting to struggle globally, that will force this pair lower.