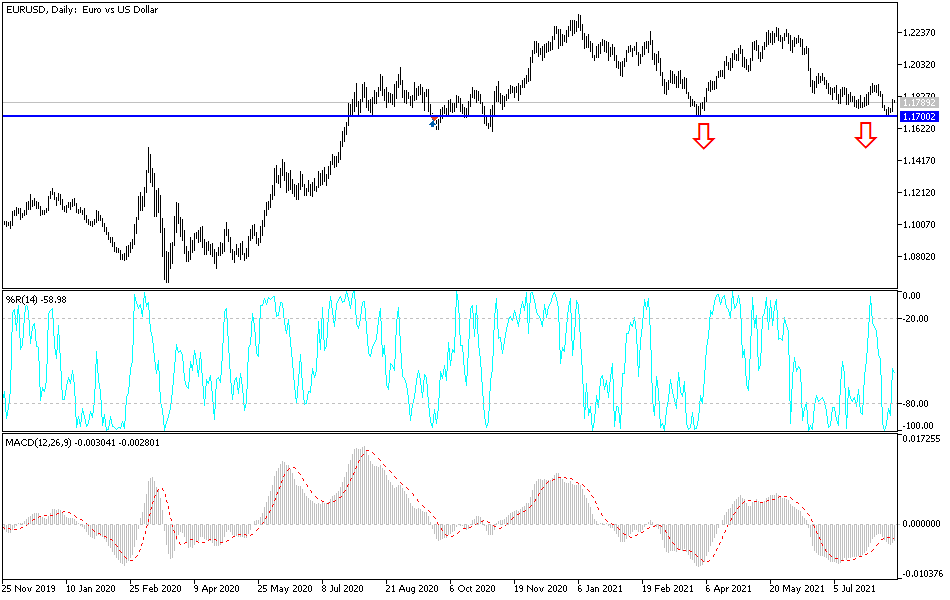

The euro rallied significantly on Friday to reach towards the 1.18 level. This is a large, round, psychologically significant figure, and an area where we had heard a lot of noise previously. Whether or not we can break above here is a completely different question, but I think it will more than likely have a huge influence coming out of the 10-year note, as the interest rate differential between the United States and Germany will have a major influence on what is going to happen next.

The size of the candlestick is fairly strong, which suggests that we could get a little bit of follow-through, but at the very least I think this is going to be a market that is very choppy. After all, we have been in a downward trend as of late, as we have formed a bit of a descending channel. The 50-day EMA is currently sitting at the 1.1870 level, which should offer a certain amount of resistance. We recently formed the so-called “death cross”, which will attract a certain amount of attention in and of itself. Breaking above both of those EMAs would obviously be very bullish, but it certainly seems very unlikely to happen, and more likely than not we will see selling pressure.

If we were to turn around and break down below the bottom of the candlestick for the Friday session, that would obviously be extraordinarily negative, but it should be noted that the 1.17 level underneath is an area where we have seen support previously, so it certainly makes sense that we would continue to see that area attract some buying pressure. Breaking down below there could open up the possibility of the market to drop down towards the 1.16 level underneath, which has a significant amount of support that extends down to the 1.15 handle. In general, I think this is a market that will be very difficult and noisy, and perhaps a “fade the rally” type of move is about to happen, but we may have a little further to go in the process. As we are in the quietest time of the year, it should not be a huge surprise if we continue to be very choppy.