Bullish View

Buy the EUR/USD and add a take-profit at 1.1900.

Add a stop-loss at 1.1750.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1757 and a take-profit at 1.1650.

Add a stop-loss at 1.1850.

The EUR/USD popped on Friday after the relatively dovish statement from Jerome Powell, the Federal Reserve chairman. The pair continued these gains in early trading on Monday. It was trading at 1.1795 on Monday morning, which was substantially above last week’s low of 1.1660.

Dovish Federal Reserve Chair

The main headline in the financial market last week was the virtual Jackson Hole summit. In a statement, Jerome Powell warned about the dangers of tapering the asset purchases too soon.

He also hinted that the bank could start slowing down asset purchases later this year or early 2022 provided that the Delta variant won’t put a substantial strain on the economy. His statement echoed what other central bank officials have said before.

Some of the members who have sounded optimistic about tapering are Mary Daly, Esther George, Eric Rosengreen, and Raphael Bostic.

With the month coming to an end, the key numbers to be released today will likely have no major impact on the EUR/USD. Instead, investors will be focusing on the statement from the Fed chair and the upcoming US non-farm payrolls numbers.

Later on Monday, the key numbers to watch will be the preliminary inflation numbers from Spain, Germany, and Portugal. These numbers are expected to show that consumer prices held steady above the European Central Bank (ECB) target of 2%.

The other key catalyst for the pair will be the consumer and business confidence numbers from the Eurozone. Economists expect these numbers to show that this sentiment weakened slightly in August as companies continued struggling as the COVID pandemic spread. Also, many companies continued facing higher costs as the supply shortages spread.

Meanwhile, in the United States, the statistics agency will publish the latest pending home sales numbers. Last week, data showed that new and existing home sales numbers did well in July.

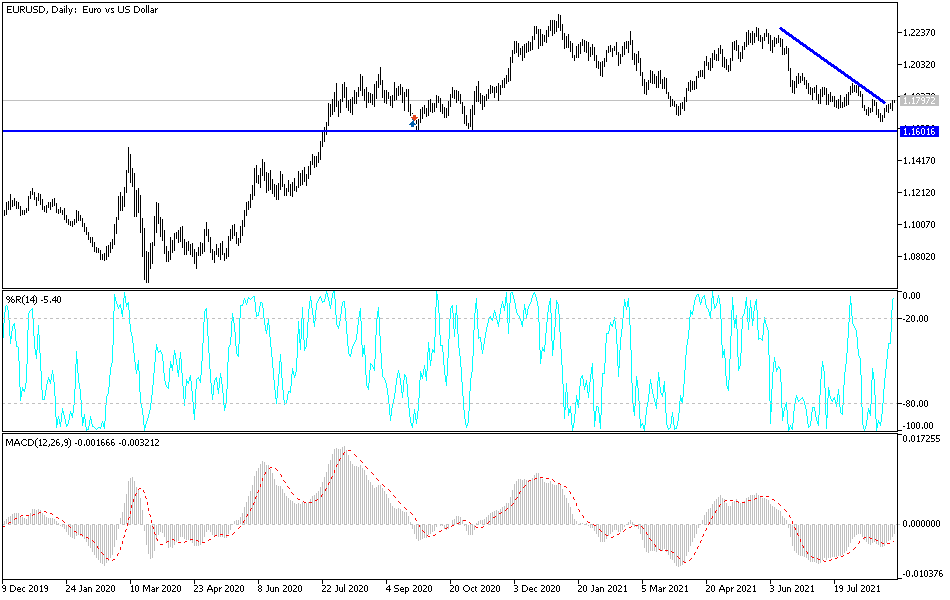

EUR/USD Technical Analysis

The EUR/USD pair rose sharply on Friday after the relatively dovish statement by Jerome Powell. On the four-hour chart, the pair managed to move above the key resistance level at 1.1757, which was the lowest level in July. The price is also slightly below the key 23.6% Fibonacci retracement level.

Additionally, it has moved above the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising as investors target the key resistance level at 1.1850. However, a drop below 1.1750 will invalidate this view.