Bearish View

Set a sell-stop at 1.1755 and add a take profit at 1.1700.

Add a stop-loss at 1.1800.

Timeline: 1 day.

Bullish View

Set a buy-stop at 1.1800 and a take-profit at 1.1900.

Add a stop-loss at 1.1750.

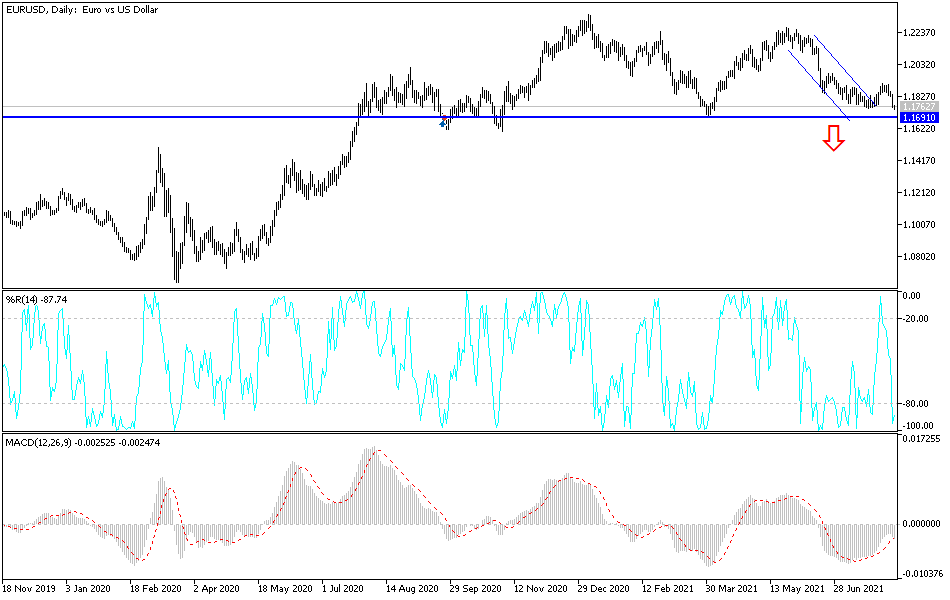

The EUR/USD pair declined to an important support level as the US dollar bounced back following the strong non-farm payrolls numbers. The pair dropped to 1.1755, which was the lowest level since July 23rd.

US NFP Data

The main catalyst for the latest EUR/USD price action was the strong US employment numbers published on Friday. The data revealed that the US labor market continued firing on all cylinders as companies struggled to find workers. In total, the private sector and the government added more than 940k jobs in July, the highest increase since August last year.

All other metrics were strong, with the unemployment rate falling to 5.3% and wages rising to 4.0%. Later this week, the US will publish the latest inflation numbers. The median estimate is that the headline CPI rose by 5.3%, which will be lower than the median estimate of 5.4%. Still, the biggest challenge for the economy is that the Delta variant is spreading, which could put brakes on the overall recovery.

The EUR/USD will today react to the latest German trade numbers that will come in the morning session. Estimates are that the country’s exports rose by 0.4% in June while imports rose by 0.5%. The biggest challenge for Germany is that its biggest companies like Volkswagen and BMW are struggling with a major parts shortage.

The pair will also react mildly to the progress on infrastructure. While the Senate is set to pass the $1 trillion stimulus package, there is a possibility that its impact on the economy will be muted. For one, the $1 trillion spending will be spread in ten years, which is a relatively long period. Further, the economy has already absorbed a stimulus package worth more than $6 trillion in the past 12 months.

EUR/USD Analysis

The EUR/USD pair declined to 1.1755 after the NFP report. As shown below, this was an important level since it was the lowest level in July. It also happened after the pair formed a double-top pattern at around 1.1900. The pair remains below the 25-day and 50-day moving averages. It also moved below the descending pink trendline. Therefore, the pair will likely maintain the bearish trend as investors target the key support at 1.1700. A move above 1.1800 will invalidate the bearish view.