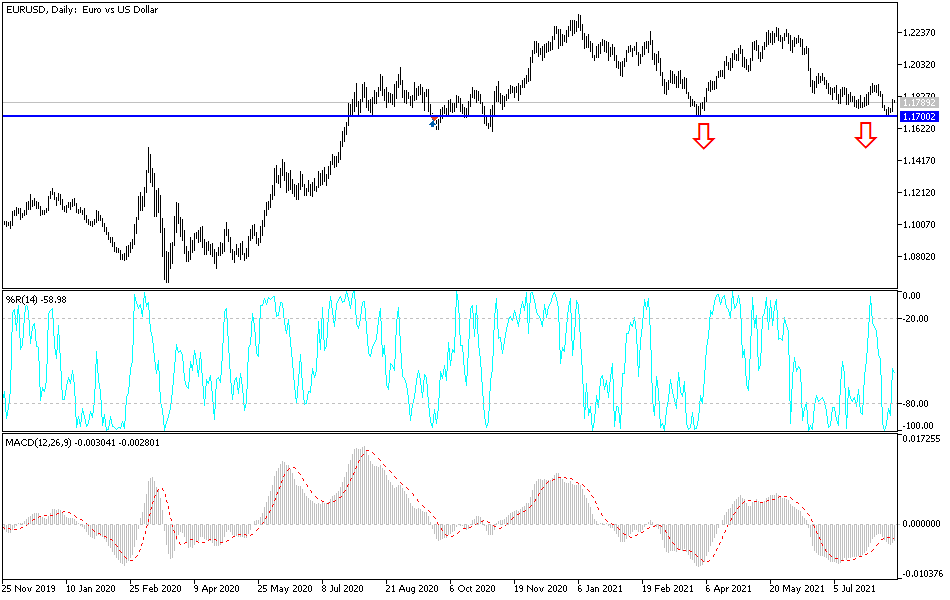

Bearish View

Set a sell-stop at 1.1750 and a take-profit at 1.1650.

Add a stop-loss at 1.1800.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1840 and a take-profit at 1.1900.

Add a stop-loss at 1.1750.

The EUR/USD pair popped on Friday after US data showed that consumers were starting to lose confidence as the Delta variant spreads. The pair is still tilting upwards ahead of key economic data from Europe and the US.

US Retail Sales and FOMC Minutes

The key catalysts for the EUR/USD this week will be the July US retail sales numbers that will come out on Tuesday and the Fed minutes that will be released on Wednesday. Analysts expect that the country’s retail sales declined slightly in July as consumer prices rose. The median estimate among analysts polled by Reuters is that the sales declined by 0.2% in July after rising by 0.6% in June. Retailers like Home Depot, Lowe’s, and Walmart will also publish their quarterly results.

Meanwhile, the Fed minutes will shed more light on the sentiment among Fed officials about the state of the American economy and what they expect to do. Last week, Fed’s Raphael Bostic and Mary Daly said that the Fed will likely start tapering its asset purchases later this year. Analysts expect that hints of this tapering will come out in the September meeting. Jerome Powell, the Federal Reserve chair will have a speech later today.

Other key movers for the pair from the US will be the latest Philadelphia Manufacturing Index, building permits, and initial jobless claims numbers.

The EUR/USD pair will also react mildly to the latest Eurozone GDP and inflation numbers. The final reading of the inflation number will come out on Wednesday. Analysts expect that the Eurozone’s inflation dropped to 2.2% while core CPI retreated to 0.7%. In the past, Eurozone’s CPI data leads to limited volatility for the pair. Eurostat will also publish the latest Eurozone GDP and employment numbers on Tuesday.

EUR/USD Signal

The two-hour chart shows that the EUR/USD pair declined to a low of 1.1706 last week. It then rebounded after the weak US inflation numbers. A closer look shows that the pair was forming an inverted cup and handle pattern, which is usually a bearish sign.

Therefore, there is a possibility that this bounce is part of the formation of the handle section. As such, the pair will likely resume the bearish trend later this week. This prediction will be confirmed if the price moves below the support at 1.1750. If this happens, it will increase the possibility that the pair will drop below 1.1700.