Bullish View

Buy the EUR/USD and set a take-profit at 1.1850.

Add a stop-loss at 1.1667 (last week low).

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1700 and a take-profit at 1.1600.

Add a stop-loss at 1.1800.

The EUR/USD price was little changed on Monday morning as investors waited for the important German sentiment data and US durable goods orders. The pair is trading at 1.1745, which is about 0.70% above the lowest level last week.

German Sentiment Data Ahead

Recent economic data paint the picture of a German economy that is doing relatively well. On Monday, data from Markit revealed that the country’s Manufacturing and Services PMI numbers remained at elevated levels as the country ramps up its vaccination drive.

On Tuesday, data by the country’s statistics agency showed that the German economy rose by 1.6% in the second quarter after it tumbled by1.8% in the previous quarter. This recovery was better than the previous estimate of 1.5%. At the same time, the economy expanded by 9.8% on a year-on-year basis.

Today, a key catalyst for the EUR/USD pair will be the latest German survey data by the ifo Institute. Analysts expect the data to show that the German business expectations inched lower from 101.2 to 100.0. They also expect the numbers to show that the Business Climate Index declined from 100.8 to 100.4 while the current assessment increased from 100.4 to 100.8. These are important numbers because they are flash signals about business spending.

The pair also wavered after the strong US housing data. On Monday, data showed that existing home sales declined from 5.87 million in June to 5.99 million in July. This was a better number than the expected 5.83 million.

And on Tuesday, numbers revealed that new home sales increased from 701k to 708k. These numbers point to a strong housing market. The next key catalyst for the EUR/USD will be the virtual Jackson Hole summit. This is an annual event where central bankers talk about their outlook for the economy.

EUR/USD Analysis

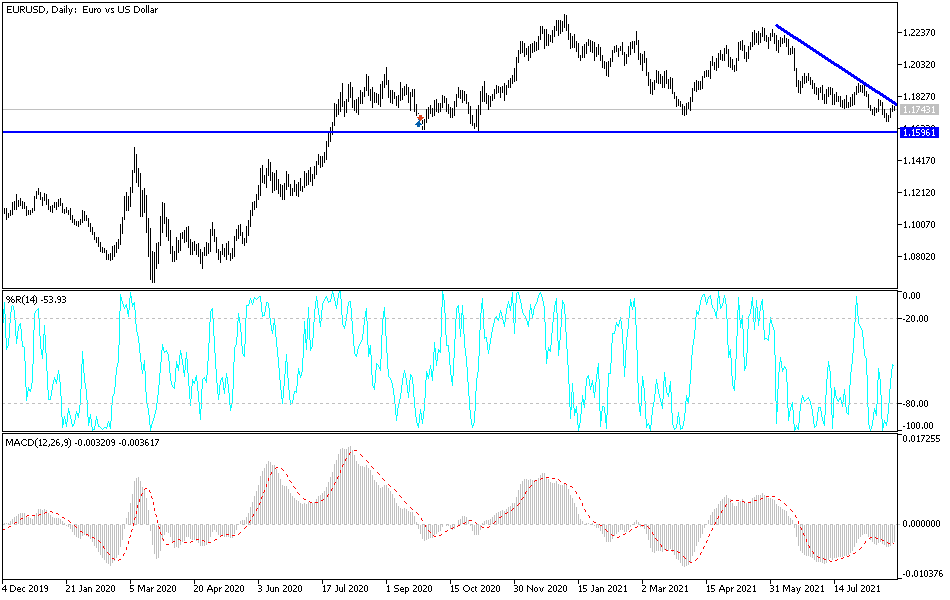

The EUR/USD pair declined to a multi-month low of 1.1667 last week. This was a notable level since it was along the lower line of the descending channel shown in blue. Today, the price has moved above the 20-day and 50-day weighted moving averages while the Stochastic oscillator has moved to the overbought zone. The current level is also important because it was the lowest level in July.

Therefore, the pair’s relief rally will likely continue before the US durable goods orders numbers and the Jackson Hole summit. If this happens, the next key target will be at 1.1850.