Bullish View

Buy the EUR/USD and set a take-profit at 1.1760.

Add a stop-loss at 1.1650.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1670 and a take-profit at 1.1600.

Add a stop-loss at 1.1750.

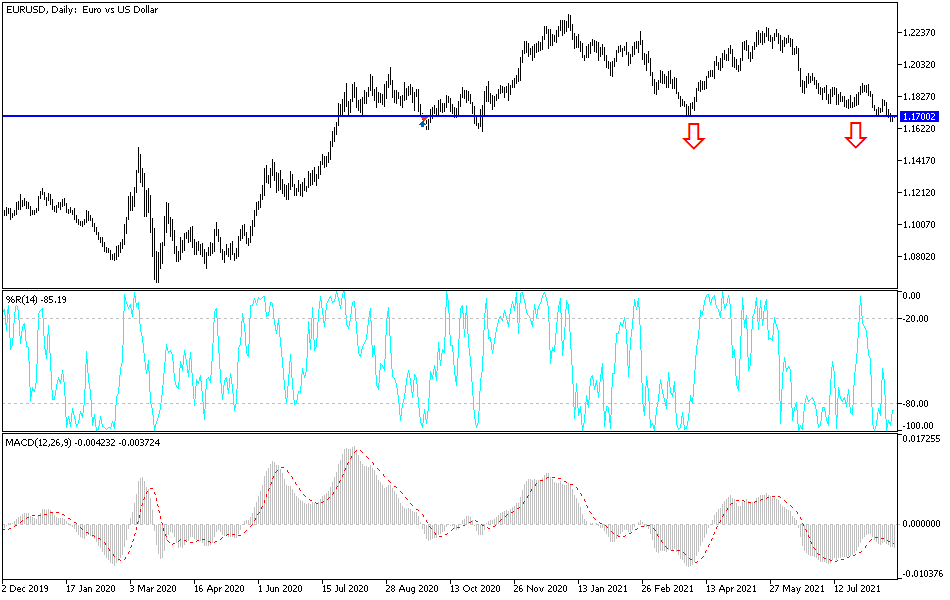

The EUR/USD pair was in a tight range on Monday morning as traders prepared for a relatively busy trading week. The pair is trading at 1.1700, which is slightly above last week’s low of 1.1662.

Flash PMI Numbers Ahead

The main theme for the EUR/USD this week will be the virtual Jackson Hole symposium. This is a summit where global central bankers gather in Wyoming to share ideas about the state of the economy. The summit tends to move key currency pairs because of the speeches from central bank governors and other officials. This year’s summit will be held virtually because of the pandemic.

The key catalyst for the pair on Monday will be the Flash Manufacturing and Services PMI numbers by Markit. These numbers are important because they will provide signals about the state of the European and American economy as they experience a new wave of the pandemic.

In Germany, analysts expect that the Manufacturing PMI declined slightly to 65.0 while the Services PMI declined to 61.0. Still, this will be a sign of expansion considering that a PMI reading of 50 and above is a sign of expansion. Similarly, in France, the Manufacturing and Services PMIs are expected to come in at 57.0 and 57.3, respectively. Across the region, the two PMIs are expected to come in at 59.7 and 62.0.

The EUR/USD will also react to the latest Flash PMI numbers from the US and the existing home sales. Analysts expect the data to show that existing home sales declined from 5.86 million in June to 5.81 million in July. This decline will likely be because of the ongoing shortage of homes in the country. For example, last week, data revealed that housing starts declined by 7% to a three-month low as building costs remained high.

EUR/USD Technical Analysis

Last week, the EUR/USD pair declined to the lowest level since November last year. This decline came as investors rushed to the safety of the US dollar as the number of COVID-19 cases rose. Today, the price is slightly above last week’s low as investors buy the dips.

Still, it remains below the key resistance at 1.1760, which was the lowest level in July. It is also below the 25-day and 50-day EMA. Therefore, there is a possibility that a relief rally will happen today as bulls target the resistance at 1.1760. Still, in the longer term, the overall trend is bearish because of the hawkish Federal Reserve.