Bullish View

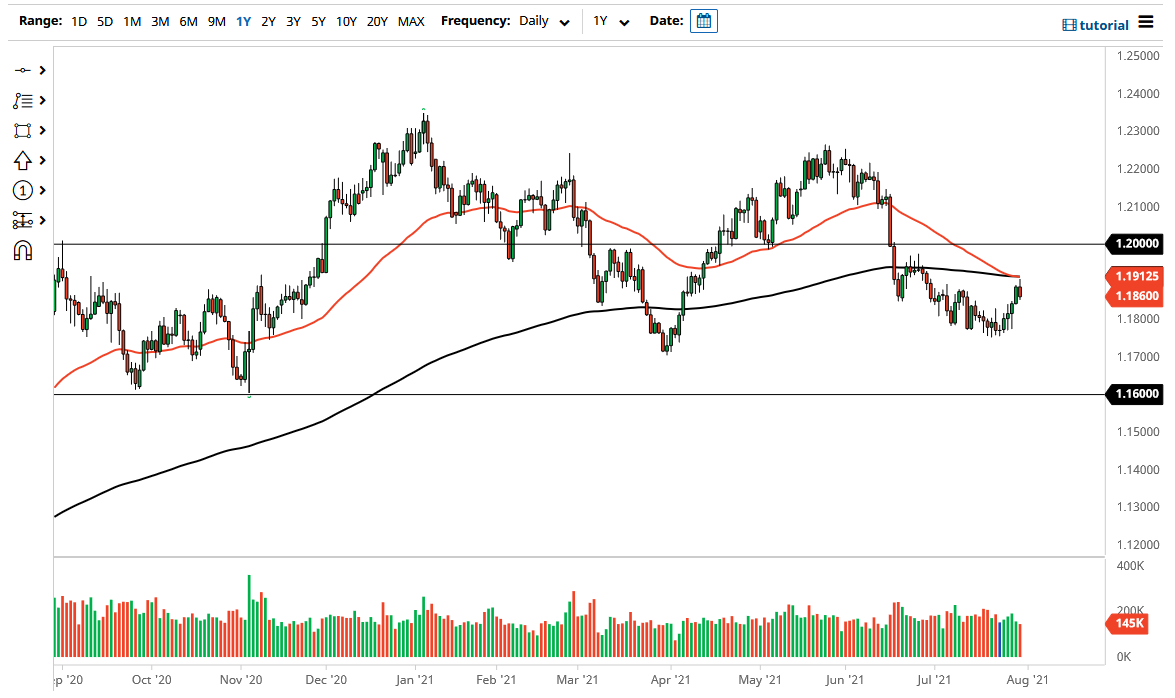

Set a buy-stop at 1.1907 and a take-profit at 1.2000.

Add a stop-loss at 1.1800.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1825 and a take-profit at 1.1750.

Add a stop-loss at 1.1900.

The EUR/USD price retreated slightly as the COVID-19 situation in the US continued to worsen. The pair declined to 1.1868, which was slightly below last week’s high of 1.1900.

Fauci Warning on COVID

The EUR/USD pair declined after the latest warning from Anthony Fauci, Biden’s chief medical advisor. In a statement, the head of the National Institute of Allergy and Infectious Diseases said that the situation will get worse as the number of COVID cases kept rising. This happened as the number of C cases rose by 64.1% last week compared to the previous week. The country reported an average of 66,606 cases per day last week.

Therefore, with infections rising, and with the vaccination rate declining, there is a possibility that the situation will get worse. This could push more states to announce lockdown measures to prevent the situation from getting worse. At the same time, a report published last week showed that three-fourths of people infected in Massachusetts were vaccinated.

The EUR/USD will today react to the latest Manufacturing PMI data from Europe and the United States. Economists expect that data by Markit will show that the US Manufacturing PMI declined to 60 in July. Another data by the Institute of Supply Management (ISM) is expected to show that the PMI increased from 60.6 to 60.9. The PMI numbers from Europe are expected to show a slight weakness.

The pair will also be affected by the latest German retail sales numbers. The overall retail sales are expected to have risen by 2.0% in June after rising by 4.2% in the previous month. On a year-on-year basis, the sales are expected to have declined by 2.2%. Looking ahead, the biggest catalyst for the pair will be the latest non-farm payrolls data scheduled for Friday.

EUR/USD Technical Analysis

The four-hour chart shows that the EUR/USD managed to break above the upper side of the falling wedge pattern last week. The pair then rose to a high of 1.1908. On the four-hour chart, the pair managed to move above the 25-day and 14-day moving averages. The histogram and the two lines of the MACD indicator are above the neutral level. Therefore, the pair will likely resume the upward trend, with the next key resistance being at 1.2000. On the flip side, a drop below 1.1800 will invalidate this view.