The EUR/USD started this week’s trading amid bearish pressure, reaching the 1.1735 support level. The pair stabilized there at the beginning of today’s trading session, ahead of the announcement of the ZEW Index for German economic sentiment. The downward pressure on the currency pair increased after strong signs confirming a renewed recovery in the US economy that may affect Federal Reserve policy in the coming months. The EUR/USD had previously rebounded after the Fed suggested in July that the decision to scale back the bank's quantitative easing program would likely be delayed until the fall months, and after data showed that the Eurozone was growing faster than the US in the last quarter.

But after trying to retest the 1.19 high last Wednesday, the euro suffered several setbacks, one of them being the 1.1700 psychological support. Commenting on the performance, Zach Bundle, currency strategist at Goldman Sach said, “Although we expect the dollar to eventually pull back, the currency may remain supported in the near term in light of strong domestic data, uncertainty about the Fed's tapering schedule, and the outbreak of the contagious delta variable in many parts of the world.” As a result, the analyst expects the price of the EUR/USD to hit 1.20 within three months.

By the end of last week, the US Department of Labor report showed that the US economy succeeded in creating nearly one million jobs for the second month in a row and came strongly in the wake of a new record high in the US service sector reading, both of which point to a renewed acceleration of the economy early in the third quarter and could encourage US monetary policy makers who already see economic conditions merit adjustments to the bank's policy settings.

Overall, the data may drag on the EUR/USD rate for a while, yet it does little to dissuade other FOMC members from joining Fed Vice Chair Richard Clarida, who said in a speech to the Peterson Institute International last Wednesday that if the economy is in line with the Fed's forecast for June, it may need to raise interest rates by late 2022.

Analysts at BofA Global Research expect the euro to fall to 1.16 by the end of September and 1.15 by the end of the year. They see that the EUR/USD is now in agreement with the real return spreads. Furthermore, policy changes from the Federal Reserve and the European Central Bank this fall could determine what comes next.

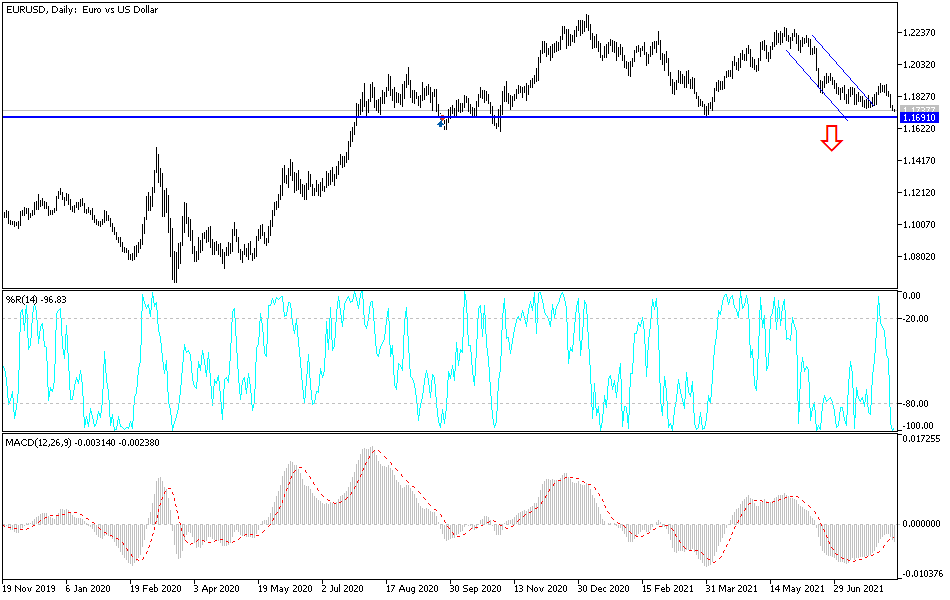

Technical analysis of the pair

On the daily chart, the price of the EUR/USD pair has returned to its bearish channel. The pair failed to move towards the 1.2000 psychological resistance, which is crucial for an upward long-term trend. Currently, the bears are heading towards the psychological support at 1.1700, which in turn will push the EUR/USD to its lowest level of the year. The closest support levels for the bears are currently 1.1685 and 1.1600, according to the performance on this chart. At the same time, it is enough to push the technical indicators to oversold levels.

Today, the euro will be affected by the announcement of the ZEW survey of German economic sentiment, and during the US session, the non-farm productivity rate and the unit labor cost will be announced.