The EUR/USD fell to the 1.1755 support level on Friday, its lowest in nearly three weeks, and closed the week’s trading around the 1.1760 level. The strong decline was a natural reaction, as the US dollar got more momentum from the US jobs numbers. The NFP figures were stronger than all expectations. Undoubtedly, these results support expectations of tightening monetary policy by the US Federal Reserve.

Over the past month, the US economy managed to add a total of 943,000 jobs in the private sector, bringing the US unemployment rate down to 5.4% in another sign that the US economy is recovering with surprising strength from COVID-19. But there is a growing fear that the rapidly spreading Delta variant will hamper recovery. The concern is that the virus could discourage people from going out and spending and lead to another round of closures or other restrictions.

Commenting on the results, Rubella Farooqui, chief US economist at High Frequency Economics said: “This is a definite downside risk...the risk comes from the most cautious consumer, if they do not want to engage in outside activities...you also hear about the big companies delaying the return to work. And that could be something to slow things down.”

The Labor Department collected its data for the report in mid-July before the Centers for Disease Control and Prevention reversed course last week and recommended that even vaccinated people resume wearing masks indoors in places where the alternative would increase infections. However, the July numbers looked good. They beat economists' expectations by more than 860,000 new jobs. Encouraged by their forecast, 261,000 Americans returned to the job market in July. The unemployment rate fell from 5.9% in June.

Moreover, the report found that as customers return and companies scramble to find workers, they are raising wages: average hourly earnings rose 4% last month over the previous year. The Labor Department also adjusted the job numbers for the months of May and June, adding 119,000 jobs. In general, the US economy lost more than 22 million jobs in March and April 2020 in the shadow of the recession as the virus forced companies to close and people to stay in their homes. Since then, the US has regained nearly 17 million jobs, which means it is still 6 million jobs short.

The seven-day average of new daily coronavirus infections has exceeded 100,000 in the United States, returning to levels not seen since the winter surge. The number of cases and hospitalizations has increased dramatically in the past month, driven by the highly contagious Delta variant. The country averaged 11,000 cases per day in late June. Now the number is 107,143.

The virus is spreading rapidly among unvaccinated populations, especially in the Deep South. Hospitals in Florida, Louisiana and Mississippi were full of patients. The US first crossed the average number of 100,000 in November and peaked at around 250,000 in early January before hitting its lowest level in late June.

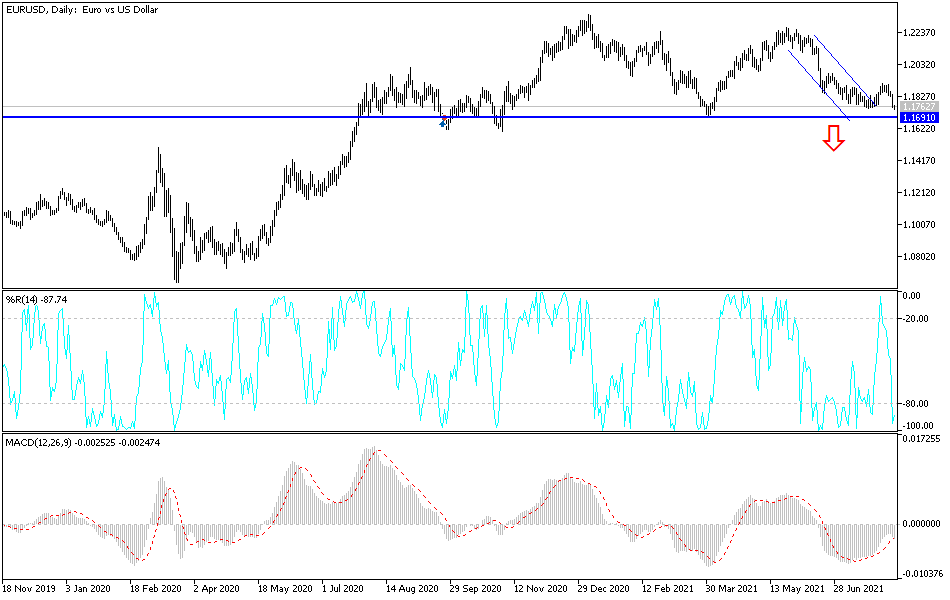

Technical analysis of the pair:

On the daily chart, the price of the EUR/USD broke through the support level of 1.1760, which will bring it back to the bearish channel it succeeded in breaking at the end of last month's trading. More buying of the US dollar after the recent data may push the currency pair towards the next support levels at 1.1710, 1.1655 and 1.1590. The lower two levels are buying levels that may push the technical indicators to strong oversold levels, from which we can wait for a rebound.

On the upside, I still see that the 1.2000 psychological resistance is crucial for bulls, otherwise the bears will have the strongest opportunity to take control.