Fears of the rapid spread of the Corona Delta variable, in addition to the weak results of European releases, contributed to the decline of the currency pair. The final PMI for services in the Eurozone was weaker than expected, which pulled the composite index - which includes the manufacturing and services sector together - below expectations. The overall services PMI stands at 59.8, still strong but not as strong as the initial estimate of 60.4. It was at 58.3 in June. German and French final readings were lower than the initial estimate, while final readings for Italy and Spain were weaker than expected.

On the other hand, the US dollar saw some temporary weakness after the payroll processor ADP released a report that showed US private sector employment increased by a much smaller than expected rate in the month of July. The ADP said that employment in the private sector rose by 330,000 jobs in July after rising by 680,000 downwardly revised jobs in June. Economists had expected the private sector employment rate to rise by 695,000 jobs compared to the jump of 692,000 jobs originally reported for the previous month.

However, the dollar rebounded after a separate report from the Institute of Supply Management showed that service sector activity growth in the US accelerated much more than expected in July. The ISM said that its services PMI jumped to an all-time high of 64.1 in July after slipping to 60.1 in June, and any reading above the 50 level indicates growth in the sector. Economists had expected the index to reach 60.4. Tomorrow, the US Department of Labor will release a more comprehensive jobs report. Economists expect that US employers added 700,000 jobs during July, bringing the US unemployment rate down to 5.7% from 5.9%, according to FactSet.

Currently, concerns are growing about the spread of the COVID-19 delta coronavirus variant in the United States, Europe, and Asia, especially in China, which is on high alert as it faces hundreds of new cases.

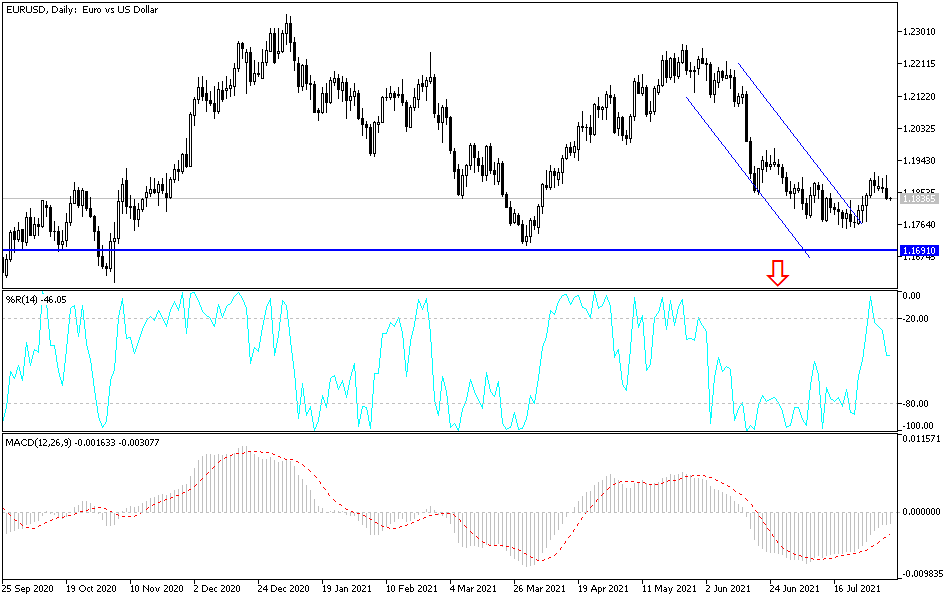

According to the technical analysis of the pair: The bears' strongest control over the performance of the EUR/USD currency pair will be with an important test to break below the 1.1800 level, which may bring the currency pair back within its descending channel range again. Currently, the closest support levels for the pair are 1.1810, 1.1765 and 1.1690, respectively. On the upside, I still see the 1.2000 psychological resistance as the most important for a change in the current downtrend. Those mentioned levels will be clearer on the daily chart.

As for the economic calendar data today: German factory orders, French industrial production and the monthly report from the European Central Bank will be announced, then the number of US jobless claims and the trade balance numbers will be announced.