It has room to retest if it doesn’t recover the 1.19 resistance over the coming days and is currently stabilizing around the 1.1890 level. The US dollar is still facing pressure since the last US Federal Reserve announcement, and on the other hand, the markets are realizing the inflection point on which the Eurozone economy is currently standing.

This came after Eurostat data revealed in mid-month-end trading on Friday that the euro zone economy grew even faster than the US economy when emerging from recession last quarter, more than drawing a line below the -0.3% contraction seen in the early months of the year. Commenting on this, Nikola Dacic, economist at Goldman Sachs said, “Eurozone real GDP rose +2.0% q/q in the second quarter, exceeding consensus expectations among economists, even after subtracting this 0.3% decline earlier. However, the eurozone's GDP growth is still roughly matching the pace of growth seen in the world's largest economy and more, and some economists are suggesting that the best is yet to come from the European continent.

Christian Keeler, head of economic research at Barclays says, “We expect a larger rise (2.8% q/q) in the third quarter in line with the return of real GDP to pre-crisis levels by the fourth quarter. Inflation also surprised the upside in July; We expect risks to our 3.1% YoY forecast. For November, it tends to be bullish.”

Europe's GDP growth has surprised even strongly with manufacturing sectors in major industrial economies like Germany operating at significantly reduced capacity due to supply chain disruptions that have left some companies short on key components and materials.

Demand for vaccines in Italy has increased by as much as 200% in some areas after the government announced the Green Corridor, according to the country's commissioner for vaccination. In France, nearly 5 million got a first dose and more than 6 million got a second dose in the two weeks following French President Emmanuel Macron's announcement that corridors of the virus would be expanded to include restaurants and many other public places. Prior to that, the demand for vaccination had been waning for weeks.

15% of Italians still resist the vaccine: 7% describe themselves as hesitant, and 8% as anti-vaccine, according to a SWG survey. The survey of 800 adults, conducted July 21-23, has a margin of error of plus or minus 3.5 percentage points.

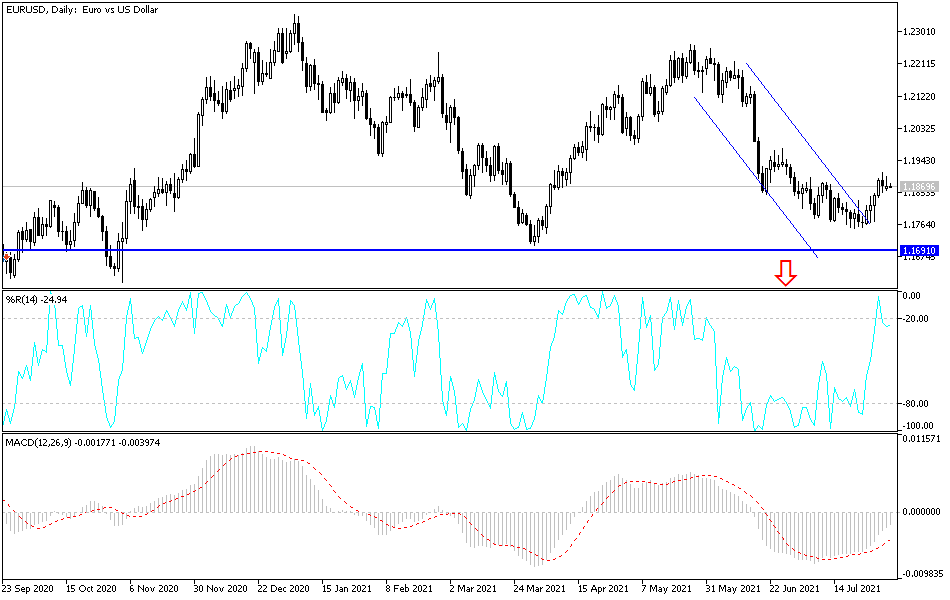

Commenting on the performance of the EUR/USD pair. “This Elliott wave count is still only a correction but we are now allowing a move to the 1.1930/85 range,” says Karen Jones, Head of Currency, Commodities and Bond Technical Analysis at Commerzbank. “You will need to get the 200 day EMA back and retrace 50% at 1.2008/ 15 to reconfirm upside pressure and pay attention to the May high at 1.2266.”

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD currency pair. The stronger control of the bulls depends on moving towards the 1.2000 psychological resistance level. This may happen before the announcement of the most important US employment report for the forex market this week in the event that pressure continues on the dollar Investors’ appetite for risk increased. On the downside, the support level remains at 1.1775, the most important for the current bullish opportunities to expire, and the currency pair is back to move within the clearly bearish channel on the daily chart.

I still prefer to sell the currency pair from every bullish level. Today, the Euro will be affected by the announcement of the Spanish Employment Change and the Producer Price Index in the Eurozone. Then the announcement of US factory orders. Today's trading may be in a narrow range.