Risk appetite contributed to the EUR/USD pair's completion of the upward correction path, with gains that reached the resistance level of 1.1830 as of this writing. The currency pair's recent moves suggest that a trend reversal is in full swing, something that could be reinforced over the coming days by further declines in the dollar's value, although there are hints of a possible change in ECB policy in September that may also support the euro.

Commenting on the performance of the EUR/USD in the Forex market, the Commerzbank team marked the level of 1.1771 as key to confirming the “falling wedge” reversal pattern on the charts, which often indicates the resumption of the previous trend after periods of consolidation and now indicates that the price of the EUR/USD has actually reached the bottom. In their view, “EUR/USD spent most of the past week pushing hard in the short-term downtrend and finally broke higher on Friday. This has completed the descending reversal wedge pattern and we are now looking for gains to 1.1909 July high then 1.1990/1.2005 March high.”

They are now looking for the euro to advance until 1.2005 although the euro must first surpass a group of technical resistance above its opening level for this week including the Fibonacci retracements of 1.1806 and 1.1825 and its 55-day moving average at 1.1831.

The euro and other major currencies gained momentum against the US dollar after the keynote speech by US Federal Reserve Chairman Jerome Powell at the Jackson Hole seminar hosted by the Federal Reserve in Kansas, which appeared to disappoint those who have optimistic views on the dollar. This was when he told the market that if the Fed continues to scale back its quantitative easing program for 2021, the US economy will then have to pass a "different, significantly tougher test" before it raises US interest rates.

“This last point saw investors push lower expectations about the first Fed tightening in late 2022 and was a major factor affecting the dollar,” says Chris Turner, an analyst at ING Bank. The dollar's subsequent collapse follows a months-long rally that left no currency intact, although Turner and the ING team say that if the euro is to maintain an advance beyond 1.1850, a domestic rather than an international catalyst may be needed.

“In the upcoming meetings, whether in September or December, we have to take into account movements in interest rates,” Philip Lane, chief economist at the European Central Bank, said in an interview with Reuters last week. Lane later said that our tolerance for the level of financing terms depends on how strong the inflation dynamics are.

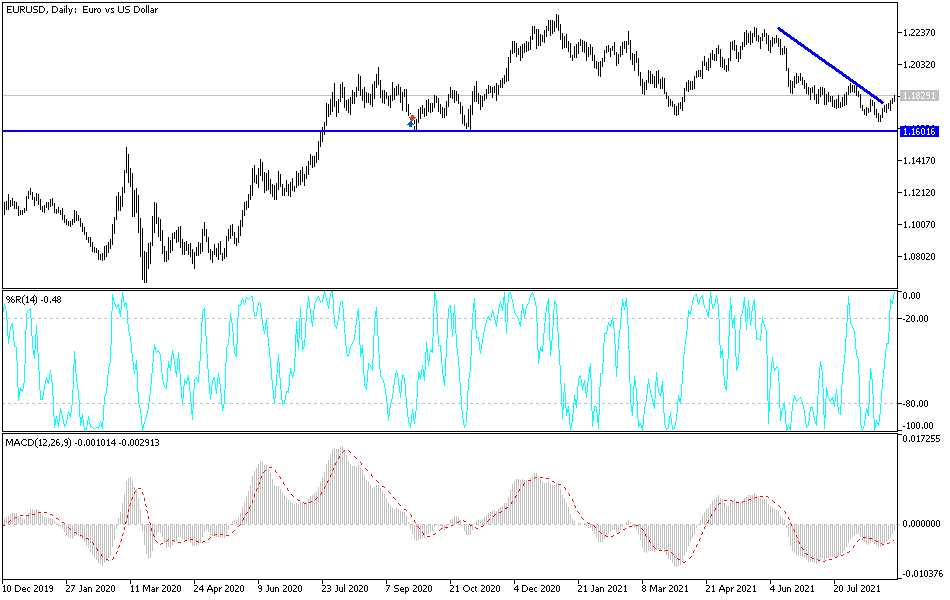

Technical analysis of the pair

On the daily chart, there is no doubt that the breach of the 1.1800 resistance would help the bulls break out of the bearish trend, which pushed it towards its lowest level of 2021. I confirm now that the psychological resistance at 1.2000 is vital to a strong bullish trend. Unless the euro gains momentum from improving European economic data results and a new outbreak of the coronavirus, its gains may be exposed to a quick sell-off.

The nearest support levels which are necessary for completing the general trend are 1.1755 and 1.1680. The euro will be affected today by the announcement of inflation figures in the Eurozone and then the announcement of the US consumer confidence numbers.