The EUR/USD is trying to correct upwards after plunging to the 1.1665 support level, then rebounding to the 1.1774 resistance level before settling around 1.1760 as of this writing. This move comes as the Jackson Hole Symposium organized by the US Federal Reserve approaches, at a time when the markets want to know when there will be a tightening of the bank's policy amid a strong recovery of the US economy from the consequences of the COVID-19 epidemic.

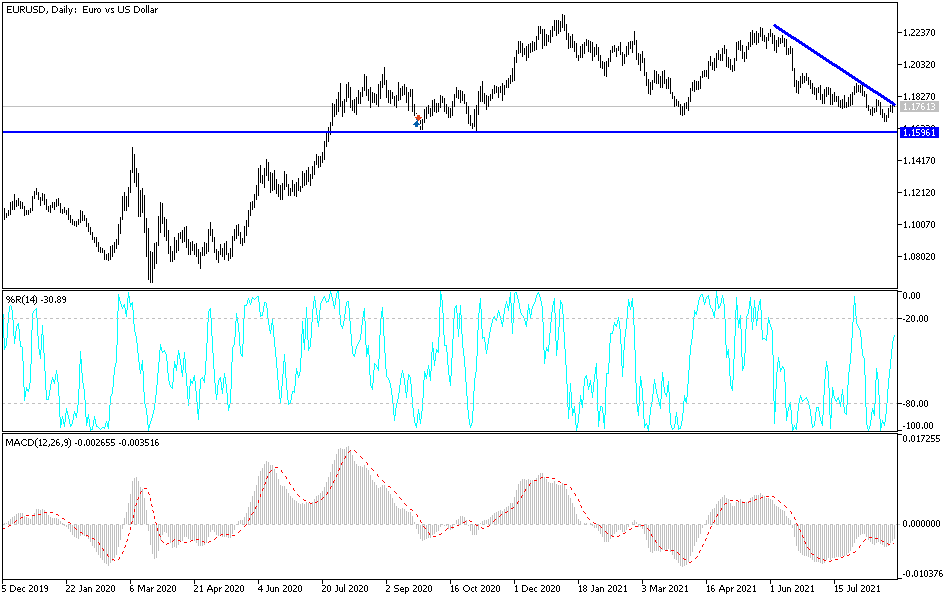

The recovery of the EUR/USD comes with the charts giving reversal signals, indicating that the price action this week may appear to be the end of a prolonged correction from the January highs above 1.23, which is also the euro's highest since early 2018. “Bullish divergence” between EUR/USD and the Relative Strength Index (RSI) is one such indicator and this has resulted in the euro further falling earlier, raising the RSI even as the euro advanced and eventually set new lows for 2021.

Commenting on the performance of the EUR/USD, Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank said, “The EUR/USD low of 1.1665 has not been confirmed by the daily RSI and the market is correcting higher. In fact, this could be a falling wedge reversal pattern.” This is another indication of the possibility of a change of direction after the resilient performance of the EUR/USD in recent weeks.

Accordingly, Jones says, “This will only be confirmed on a close above the downtrend at 1.1780.”

A bullish divergence usually creates a period of neutrality but can also indicate that a trend change is in full swing, while a “falling wedge” often indicates a resumption of the previous trend during periods of neutrality. Accordingly, George Davis, chief technical strategist at RBC Capital Markets, says, “Price action is expected to resolve to the prior uptrend as part of the continuity issue.”

Falling wedge patterns tilt against previous uptrends and reveal themselves in a series of lower lows and lower tops, with the gap between highs and lows narrowing gradually as the pattern develops, according to a glossary of technical analysis terms written by RBC's Davis. The EURUSD's temporary bounce and signals from the charts suggest it may be on the way down, although the recent price action has been largely the result of swings and turns by the dollar and the US currency itself could see a reversal of its own.

Accordingly, John Hardy, foreign exchange analyst at Saxo Bank, says: “A firmer rally towards 1.1800 is needed which sticks after Fed Chairman Powell’s speech on Friday to indicate that we have bottomed out (more on rallies in the US dollar). Until then, 1.1600 and 1.1500 levels are potential targets on the downside."

Technical analysis of the pair

The recent rebound attempts of the EUR/USD have not yet taken it out of the range of its current bearish channel, and an actual reversal of the general trend will not occur without moving above the psychological resistance of 1.2000. Moving below the 1.1690 support again will give the bears more momentum to move further downhill.

The currency pair will be affected today by the announcement of the growth rate of the US economy, the start of the Jackson Hole symposium, and Jerome Powell's statements tomorrow in that symposium.